To be honest, as a dividend-focused investor, mining stocks are not the sort of thing I usually go for. But Ferrexpo is currently one of the highest-ranked stocks on my FTSE All-Share stock screen, so at the very least it deserves a fair crack of the whip.

If you’re not familiar with the business, Ferrexpo is one of the world’s largest and lowest-cost producers of iron ore pellets, which are used in the steel industry.

The company can trace its roots back to 1960 when mining operations commenced in Poltava, Ukraine. The operations were eventually moved from state to private ownership and today Ferrexpo still mines exclusively in Ukraine.

So immediately two alarm bells are ringing in my brain:

- Ferrexpo is a mining business focused solely on iron ore pellets, so its fortunes are very likely to be tied to global iron ore prices which are probably quite volatile

- Its mines are in Ukraine, which at first glance seems to be a high-risk country to operate in

Putting those concerns to one side for now, let’s put Ferrexpo under the microscope using my Company Review Checklist, but with a twist: I’ve re-ordered the checklist into a SWOT analysis for quality dividend stocks.

Table of Contents

- Strengths: Does Ferrexpo have enduring strengths?

- Weaknesses: Does Ferrexpo have any significant internal weaknesses?

- External Opportunities: Ferrexpo has limited options for growth

- External Threats: Ferrexpo operates in a high-risk environment

- A high-quality company operating in a high-risk environment

- Valuing Ferrexpo using a discounted dividend model

Strengths: Does Ferrexpo have enduring strengths?

What I want from an investment is progressive dividend growth over many years, so the obvious thing to look for is companies that have already produced progressive dividend growth over many years and preferably decades.

I can do that easily by going to SharePad, downloading ten years of financial data for Ferrexpo and then loading it into my Company Review Spreadsheet.

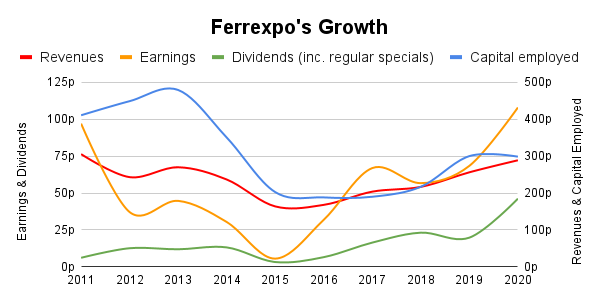

As you can see from the chart, Ferrexpo’s track record is a bit up and down, although to be fair, that’s exactly what you should expect from a business whose revenues are derived from a single commodity.

The chart above shows a period of decline from 2011 to 2015, followed by a recovery from 2015 to 2020, so let’s see how well that correlates with global iron ore prices.

Somewhat unsurprisingly, the chart above from Business Insider shows iron ore prices falling from 2011 to 2015 and then recovering through to 2021. That's exactly what I'd expect to see and it pretty much confirms that Ferrexpo's fortunes are strongly tied to iron ore prices.

There isn’t anything intrinsically wrong with that, but since iron ore prices are volatile we have to assume that Ferrexpo’s results will be just as volatile in the future as they have been in the past.

To understand whether Ferrexpo is growing underneath all that volatility, we can filter out the influence of iron ore prices by looking at the company’s production volumes. More specifically, we can look at total pellet production from its mines, in terms of millions of tonnes.

This gives us a much clearer picture of the company’s underlying growth. Thanks to the expansion of its mines and technological improvements, production capacity has grown by around 2% per year on average.

However, despite this steady increase in production levels, Ferrexpo’s overall results are massively impacted by iron ore price volatility, so I would definitely classify it as a “highly cyclical” stock, and that has implications for how much I’d be willing to invest.

A brief detour into target position sizes

Some dividend investors would immediately put Ferrexpo into the “too volatile” pile and move on to another company. That's very sensible, but personally, I’m willing to invest in highly cyclical dividend payers if the share price is extremely attractive.

Having said that, the more cyclical a company is, the less I’m willing to invest. So given that my personal portfolio and model portfolio each hold the same 20 to 30 companies:

- My default position size for defensive companies is 4%

- My default position size for cyclical companies is 3%, and

- My default position size for highly cyclical companies is 2%

These default sizes are then adjusted up and down depending on the stock’s valuation to give a target position size. Very simply, the cheaper the price, the larger the target size and vice versa.

Ferrexpo’s default position size is just 2%, so for it to have a position size worth bothering with (say, 3%) it would have to be really, really cheap.

I’ll cover how cheap I think Ferrexpo might be at the end of this article, but first, let’s finish off looking at its strengths.

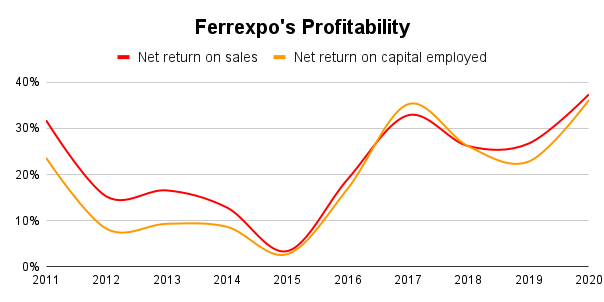

Ferrexpo’s profitability has been high when averaged across the cycle

Companies that produce consistently high returns on capital over long periods of time are usually high-quality businesses capable of fending off whatever the competition can throw at them. Of course, Ferrexpo’s profitability has been up and down over the last decade, but it’s still quite impressive.

Both return on capital and return on sales (profit margin) have averaged around 20% over the last decade, which is much better than most companies, although as with revenues and earnings, profitability has closely followed iron ore prices up and down.

Ferrexpo has a durable cost advantage over most of its competitors

To generate above-average returns over many years, you need something that most companies don’t have, which is a durable competitive advantage.

In Ferrexpo’s case, it has a durable cost advantage thanks to the unique nature of its mines.

When it comes to mining, I'm no expert, but it seems to me that there are three key factors that drive cost competitiveness:

- Scale: Bigger is generally better as it provides economies of scale

- Extraction: The easier it is to get a specific grade of iron ore out of the ground, the cheaper it will be to extract (so factors like proximity to the surface and hardness of the rock are important)

- Distribution: You could have a huge mine with iron ore that is easy to extract, but if it’s halfway up Mount Everest it’s going to cost a fortune to get that iron ore processed and into the hands of customers. It’s much better to have a mine that is easily accessible by road, rail and sea and close to very large customers.

Ferrexpo’s Ukranian mines seem to tick all these boxes, being large (Ferrexpo is the world’s third-largest exporter of iron ore pellets even though it only has two mines in operation), easy to extract (its reserves are good quality and relatively close to the surface) and easy to distribute (its mines are close to rail, river and sea, enabling easy distribution to Europe and the rest of the world).

Together this makes Ferrexpo one of the world’s lowest-cost producers of iron ore pellets.

Normally a competitor would try to copy a market leader's products or services, but low-cost sources of raw materials are unique, so they can’t be copied, and that makes them durable. There is a risk that someone could discover a new Saudi Arabia of iron, but that seems pretty unlikely anytime soon.

Deep expertise from a long focus on mining iron ore

The last strength I look for is deep expertise that has been developed from decades of focusing on a narrow core business.

In this case, the original Ukrainian mining operations started out as a state-run organisation in the 1960s. It was privatised in 1992 and in 1996 it became Ferrexpo. So Ferrexpo's mining operations have worked the same mine for more than 60 years and everything else the business does (iron ore processing, distribution and sales) is built around those mining operations.

On that basis, I would say that Ferrexpo does appear to have deep expertise in a narrow core business.

Weaknesses: Does Ferrexpo have any significant internal weaknesses?

Two key weaknesses that many companies suffer from are (a) excessive debts and (b) poorly integrated operations due to excessive growth or too many acquisitions.

Ferrexpo doesn’t have much debt and it wasn’t built by a series of recent acquisitions, so it doesn't suffer from either of those weaknesses.

There are some potential issues though, mostly involving concentration risk.

For example, Ferrexpo has a single source of iron ore. Yes, that source is many kilometres long and has an expected lifespan of significantly more than 50 years at current extraction rates, but it’s a single source nonetheless and it will eventually run out. This is a clear risk to the company's very long-term prospects, but it can also be factored into any estimates of the company's fair value.

Another form of concentration risk is concentrated ownership. In this case, Ferrexpo’s largest shareholder and ex-CEO owns just over 50% of its shares, so the company is effectively under his control.

Significant founder ownership can often be a good thing as they tend to have a longer-term outlook than institutional shareholders. But in this case, the majority shareholder didn't build the business from scratch, so it's harder to say what his long-term intentions are.

Also, there have been some issues around the majority shareholder, including the failure of a Ukrainian bank which he also owned, and the possible loss of money that was paid by Ferrexpo to a charity with links to that shareholder.

This isn't necessarily a major problem, but it is a negative factor.

External Opportunities: Ferrexpo has limited options for growth

Let’s move on and look at the influence of the outside world, starting with external opportunities.

The main route to growth for Ferrexpo is to increase production from its existing mines and to open new mines where it has development rights.

This plan is well-established and it’s how the company intends to keep producing iron ore pellets for at least the next 50 years.

The problem, of course, is that iron ore deposits are finite, and once you’ve dug them all up, they’re gone.

To get around this, the company could buy additional mines or iron ore deposits on the open market. But in a competitive market, the purchase price would be pushed up until returns are barely better than average, so the return from buying mines or resources would probably not be great.

That leaves Ferrexpo with the option of increasing production from its existing Ukrainian resources while also increasing efficiency to improve profit margins.

Historically the company has grown production at 2% per year, on average, so that’s probably a reasonable guess at production growth in the future. Management thinks they can grow production capacity from 12 million tonnes per year today to 20 million.

At a 2% growth rate that would take two to three decades, which seems realistic. However, mining is a bit like drinking through a straw. You can buy a fatter straw and suck the drink up faster, but the faster you drink the drink the faster it runs out.

So almost doubling production will increase profits, but it will also shorten the lifespan of the company's only productive assets.

External Threats: Ferrexpo operates in a high-risk environment

As an iron ore mining business, Ferrexpo operates in a market where prices and therefore revenues and profits are highly volatile.

This is a threat in the same way that a rough and stormy sea is a threat to a ship; it makes the task of sailing from A to B much more difficult, so anything less than a robust ship and a talented and experienced crew could spell disaster.

This is obviously a negative factor and it’s why my default position size for companies like Ferrexpo is a measly 2%. I’m happy to invest in them at the right price, but they certainly wouldn’t make up a big chunk of my portfolio.

Another more serious threat comes from the Russo-Ukrainian War which has been ongoing, to varying degrees, since 2014.

So far there has been no material impact on the company’s mines or their production rates, but throughout 2021 there has been a huge build-up of military assets from Russian, Ukraine and NATO.

I realise that war is a potential threat anywhere in the world, but I'm not overly keen on investing in a company that has all its productive assets in a country that is already involved in a fairly significant war.

A high-quality company operating in a high-risk environment

Here’s a quick review of my position on Ferrexpo:

- Strengths: It has an established and narrowly focused core business with enduring cost advantages from its unique iron ore resources

- Weaknesses: It sells a single commodity which it extracts from a single region and the company is majority-owned by a single person

- Opportunities: It has limited opportunities for growth and in the longer term the company is likely to decline unless it can cost-effectively buy additional mines or resources

- Threats: Its revenues, earnings and dividends depend heavily on iron ore prices which are volatile and unpredictable. It also operates in a single country that is currently at war with Russia.

I’m not exactly chomping at the bit to invest in Ferrexpo, but I don’t think it’s a complete no-go either. If the outlook for Ukraine became more positive, then there’s a chance I might make a small investment in Ferrexpo at the right price, because I do like its world-class mining operations.

On that basis, I will add Ferrexpo to my Blacklist (i.e. companies I’m not actively thinking about investing in) with a review date of 2023, at which point I’ll have another look at the situation in Ukraine.

Valuing Ferrexpo using a discounted dividend model

Seeing as I won’t even think about investing in Ferrexpo before 2023, it doesn’t make much sense to spend time building a detailed valuation model.

However, you might find it useful to see a back-of-an-envelope valuation using the following assumptions:

- Ferrexpo had capital employed per share valued at 298 US cents in 2020

- If that capital produces historically average returns on capital of 17.7%, then 2021 earnings would be 53 cents (actual 2021 earnings are much higher because of abnormally high iron prices, but that won’t affect the model’s output much so with a simple model like this I’ll ignore it)

- Ferrexpo’s average dividend over the last decade was 15.9 US cents, so given the growth of its production capacity, I think a sustainable starting dividend is 17.6 cents

- The rest of the company’s earnings are reinvested to drive production growth in its mines towards its 20 million tonnes per year target

- Return on capital gradually decreases as excess cash is held on the balance sheet to enable the company to pay a steadily increasing dividend

- Dividend cover decreases from 3.0 today to 2.2 by 2029 because more earnings are paid out as dividends as the opportunity to reinvest earnings to expand production capacity diminishes

- This combination of factors leads to a doubling of the sustainable dividend, from 17.6 cents to 36.1 cents in 2029

- Long-term growth in 2030 and beyond is zero as production capacity reaches its peak and as older mines begin to go into decline

Here’s a snapshot of the dividend model taken from my Company Review Spreadsheet:

This model gives us a ballpark estimate of good value and fair value prices for Ferrexpo.

The current share price is £2.95, so it’s somewhere between the good value estimate (£2.34) and the fair value estimate (£3.44).

In fact, the Margin of Safety in the table above tells us that the gap between the current price and fair value is 44% as big as the gap between good value and fair value. So it's not quite halfway to good value.

The combination of a mediocre margin of safety and a highly cyclical business model means that at its current price, my target position size for Ferrexpo would be 1.9%.

That's far too small for me to bother with, and it’s another reason why I wouldn’t want to invest in Ferrexpo today.

For me to invest, Ferrexpo's share price would have to be at or below that good value estimate of £2.34.

That's about 21% below the current price and it would give Ferrexpo a target position size of 3%, which is still small. It would also give the company a sustainable dividend yield of 5.7% (based on my assumption of a 17.6 cent sustainable dividend) which is pretty good.

But regardless of price, I would want the situation in Ukraine to be a little less uncertain.

The UK Dividend Stocks Newsletter

Helping UK investors build high-yield portfolios of quality dividend stocks since 2011:

- ✔ Follow along with the UK Dividend Stocks Portfolio

- ✔ Read detailed reviews of buy and sell decisions

- ✔ Quarterly, interim and annual updates for all holdings

- ✔ Quality Dividend Watchlist and Stock Screen

Subscribe now and start your 30-DAY FREE TRIAL

UK Dividend Stocks Blog & FREE Checklist

Get future blog posts in (at most) one email per week and download a FREE dividend investing checklist:

- ✔ Detailed reviews of UK dividend stocks

- ✔ Updates on the UK Dividend Stocks Portfolio

- ✔ UK stock market valuations

- ✔ Dividend investing strategy tips and more

- ✔ FREE 20+ page Company Review Checklist

No spam. Unsubscribe anytime.