The UK Dividend Stocks Portfolio

This portfolio is the centrepiece of the UK Dividend Stocks Newsletter.

A High-Yield Portfolio of Quality Dividend Stocks

The UK Dividend Stocks Portfolio aims to generate a high and rising income by investing in a diverse group of high-quality UK dividend stocks.

Most of its holdings are in the FTSE 100 or FTSE 250, with the rest being members of the FTSE Small Cap, FTSE Fledgling or AIM UK-50 indices. Most holdings have long records of consistent dividend growth, typically extending back at least 20 years.

This is a virtual portfolio, but it accounts for all real-world expenses, including trading fees, stamp duty and the cost of an annual subscription to The UK Dividend Stocks Newsletter.

A Systematic Investing Strategy

The portfolio follows an updated version of the strategy from the 2016 book, The Defensive Value Investor, and you can find a detailed overview of the strategy in the Company Review Checklist.

Performance Goals

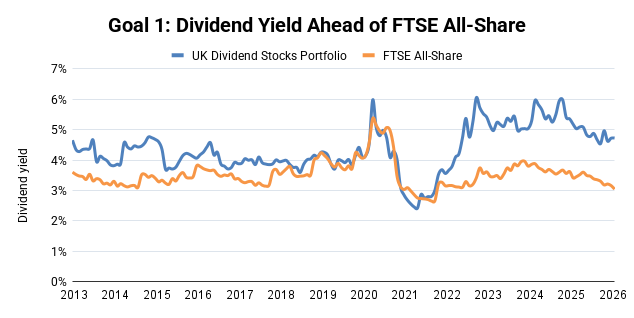

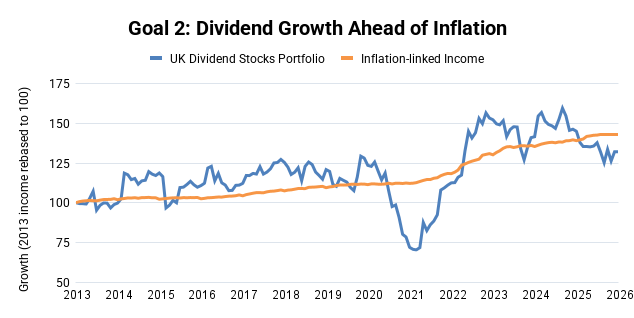

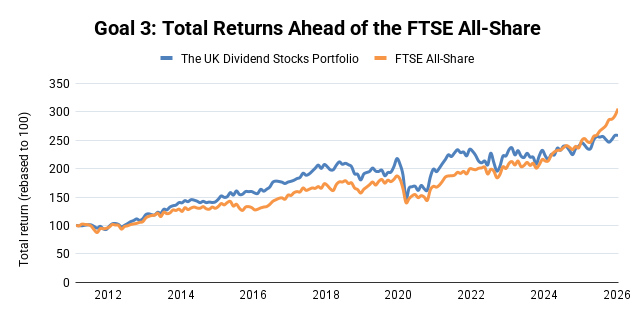

The portfolio has three performance goals which, in order of importance, are:

- Dividend Yield higher than the FTSE All-Share's at all times

- Dividend Growth ahead of UK CPI (inflation) over ten years

- Total Return higher than the FTSE All-Share's over ten years

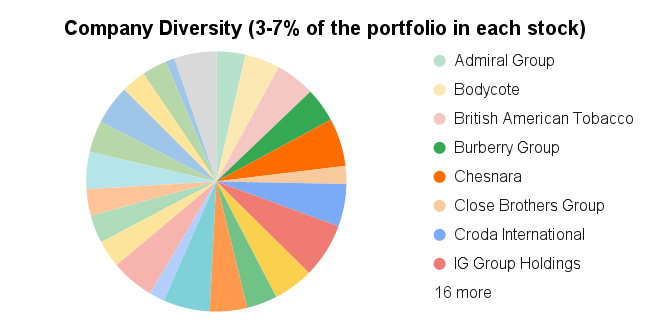

Portfolio Diversification

To reduce risk, the portfolio is broadly diversified by company, sector and country:

- Around 20 holdings, approximately equally weighted

- Default position size of 5%

- Trim holdings that grow beyond 7%

- Top-up or sell holdings that fall below 3%

- Up to two holdings from the same sector

- Up to 50% of the portfolio's total revenues from the UK

Interim and Annual Portfolio Reviews

The portfolio is reviewed twice each year, with the review covering performance, recent changes to the portfolio's holdings and other relevant news:

- UK Dividend Stocks Portfolio: 2024 Annual Review

- UK Dividend Stocks Portfolio: 2024 Interim Review

- UK Dividend Stocks Portfolio: 2023 Annual Review

- UK Dividend Stocks Portfolio: 2023 Interim Review

- UK Dividend Stocks Portfolio: 2022 Annual Review

- UK Dividend Stocks Portfolio: 2022 Interim Review

- UK Dividend Stocks Portfolio: 2021 Annual Review

- UK Dividend Stocks Portfolio: 2021 Interim Review

The portfolio was launched in 2011 and you can find a full archive of earlier reviews at UKValueInvestor.com below:

Buy and Sell Reviews for Past Holdings

The portfolio follows a long-term investing strategy, so there is relatively little in the way of trading activity on a day-to-day basis.

In a typical month, there might be one new holding added to the portfolio, or one existing holding removed. With around 25 holdings, each holding usually remains in the portfolio for at least several years.

When companies join or leave the portfolio, a detailed review (typically around ten pages) is published in the UK Dividend Stocks Newsletter. You can download these reviews for all past holdings below.

Buy and sell reviews for companies sold in 2026

Buy and sell reviews for companies sold in 2025

Buy and sell reviews for companies sold in 2024

Buy and sell reviews for companies sold in 2023

Buy and sell reviews for companies sold in 2022

Buy and sell reviews for companies sold in 2021

Buy and sell reviews for companies sold in 2020

Buy and sell reviews for companies sold in 2019

Buy and sell reviews for companies sold in 2018

Buy and sell reviews for companies sold in 2017

Buy and sell reviews for companies sold in 2016

Buy and sell reviews for companies sold in 2015

Buy and sell reviews for companies sold in 2014

Buy and sell reviews for companies sold in 2013

Buy and sell reviews for companies sold in 2012

This website provides information, education and tools for investors. It does not provide financial advice or recommendations to buy or sell any specific investment. If you're not sure if an investment is right for you, you should speak to a regulated financial adviser. Please read the disclaimer for more details.