Direct Line is due to be acquired by Aviva at some point during the summer. When that happens, shareholders will be forced to exchange their shares for a combination of Aviva shares and cash.

As a Direct Line shareholder, I had no intention of becoming an Aviva shareholder (as it doesn't meet my investment criteria) and with Direct Line’s share price now almost equal to the expected takeover value, there seemed to be little point in holding on for a few more weeks. And so, on that basis, I decided to sell my Direct Line shares last week in order to reinvest the proceeds sooner rather than later.

When I invested in Direct Line in 2022, I thought it looked like an attractive turnaround and I still think I was right. But turnarounds are hard work and they often don’t work. In this case, management mistakes led to a suspended dividend and, although Direct Line's turnaround is now back on track, the company is being taken over before that turnaround has had time to complete.

In the end, this investment was a bumpy ride to nowhere and it’s one of the main reasons why I no longer invest in turnarounds.

The rest of this post-sale review is taken from the June issue of the UK Dividend Stocks Newsletter and, if you're interested, you can download the original purchase and sale reviews:

Some people find my review format slightly clunky as it's based on my dividend investing checklist, but I'm a dyed-in-the-wool checklist investor so there isn't much I can do about that. And for context, my buy and sell reviews use the same checklist and the same format, because both decisions need to assess a company's past, present and future, as well as its valuation.

Table of contents

- Part 1: Financial track record

- Part 2: Business quality

- Part 3: Growth prospects

- Part 4: Yield and valuation

- Part 5: Final results

Part 1: Financial track record

1. Does Direct Line have a long track record of progressive dividend growth?

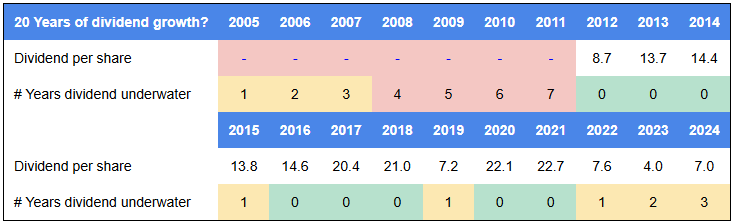

NO - When Direct Line joined the UK Dividend Stocks Portfolio (and my personal portfolio) in 2022, I had a rule that all new holdings had to have a near-perfect 10-year dividend record, and Direct Line passed that test because it had paid a dividend every year since joining the stock exchange in 2012. However, more recently I’ve extended this rule to 20 years, partly in response to problems at Direct Line, and Direct Line obviously doesn’t meet this higher standard.

Just to clarify, the table shows red for any missing dividends or where the dividend was underwater (zero or below a previous high) for more than three consecutive years.

2. Has its growth over the last ten years been good, okay or bad?

BAD - Like most companies, Direct Line has had a difficult time over the last five years, but its weak results stretch back much further than that, going all the way back to the middle of the last decade.

As you can see from the chart above, Direct Line’s equity, assets, earnings and dividends have all gone nowhere over the last ten years, giving the business a negative overall Growth Rate.

As for Growth Quality (a measure of growth consistency), the yo-yo nature of its year-to-year results leave it at a very uninspiring 53%, which is far below the 66% needed for an Okay rating.

Note: If you're not familiar with metrics like Growth Rate or Growth Quality, or my definitions of Good, Okay and Bad, they're all defined in my dividend investing checklist.

3. Has its profitability been good, okay or bad?

BAD - Direct Line’s margins and returns on capital have also been weak, although this is largely due to the enormous loss it sustained in 2022.

As a reminder, 2022 was the year of double-digit inflation, where used car prices and repair costs skyrocketed, leaving insurers with claim costs that exceeded the premiums they’d charged. The inevitable result was large losses across the industry.

Before the pandemic, Direct Line had average profit margins and returns on capital of 7% and 10% respectively, which fall into the Okay range. However, if we include the post-pandemic period, then margins and returns on capital are unacceptably low, at 4% and 8% respectively.

Also, if we look at the rolling ten-year average return on capital then the picture looks even bleaker, at it only exceeded 10% once in the companies entire post-IPO history.

As with the company’s weak growth, I was aware of its weak profitability when I added it to the portfolio in 2022, so why did I invest when it clearly didn’t meet my quality standards?

To put it bluntly, I invested in Direct Line because I thought it was a competitively advantaged business that was nearing the end of a long turnaround, and I still think that assessment was correct. But turnarounds are hard to pull off, and they often involve a lot of unpleasant activities like layoffs and suspended dividends, so as a general rule I no longer invest in turnarounds (unless the company does meet all of my quality criteria).

4. Has its balance sheet strength been good, okay or bad?

BAD - There are many ways to measure the strength of an insurance company’s balance sheet, but one simple way is to focus on regulatory capital coverage. In other words, how much capital (shareholder equity plus specific types of unsecured debt) does an insurer have compared to how much the regulator says it must have?

Regulators insist on a minimum level of capital because capital acts as a buffer that can absorb losses and protects policyholders. When an insurer records a loss, the loss will reduce the company’s capital (by reducing shareholder equity), but if the capital buffer is sufficient, the company will still be able to cover the cost of all valid claims.

My rule of thumb is that an insurer’s capital coverage ratio (the ratio of actual capital to required capital) should be at least 150%, which I define as Okay, and ideally it should be more than 175%, which I define as Good.

As the chart above shows, Direct Line’s capital cover was mostly in the Okay range (150-175%) before the pandemic. It then spiked to more than 190% in 2020 before collapsing to less than 150% in 2022, at which point the company suspended its dividend and the CEO resigned.

That dividend suspension was a huge disappointment for shareholders, so it’s worth unpacking this series of events as it contains some important lessons.

Lockdowns lead to windfall profits and share buybacks

The story begins in 2020, when Direct Line’s capital dramatically increased thanks to lockdowns. As you’ll no doubt remember, lockdowns banned people from travelling, so the number of road accidents collapsed. Because of that, there were far fewer claims than expected, so Direct Line and other insurers made record profits. These windfall profits ended up on the balance sheet as shareholder equity, and as equity is a component of capital, the capital coverage ratio increased dramatically.

In fact, Direct Line’s management thought the business had too much capital, so it used some of that excess capital to buy back shares, with the aim of returning the coverage ratio to 160%.

Covid leads to supply chain disruption and double-digit inflation

But the pandemic wasn’t over, and by 2021 it was massively disrupting supply chains across the world. Car manufacturers were struggling to get the parts to build new cars, so the price of used cars shot up. And because parts were hard to get, it was also taking longer to repair damaged cars, so the cost of repairing or replacing a car went up by 20-40% or more.

This was a major problem for insurers, because they set premiums at a level that will hopefully cover the expected cost of future claims, plus a small profit margin. If actual claims costs turn out to be more than they’d expected, then the insurer will record an underwriting loss, and that is exactly what happened in 2022 and 2023.

Simple maths tells us that if claim costs go up, premiums must go up, but if you’re the first insurer to raise your premiums, you’ll lose customers and revenue to competitors who keep their premiums low. So keeping premiums unsustainably low can make sense, but only for very brief periods. If an insurer keeps its premiums too low for too long, it will soon learn why this practice is known as suicide bidding.

Direct Line is too slow to raise its premiums in response to rapidly rising costs

As for Direct Line, it kept its premiums far too low for far too long, which is a clear sign of weak management and/or weak processes. Eventually, it did respond with premium increases of 20-40%, but by then it had written millions of policies where the premiums were nowhere near enough to cover the eventual cost of claims. That was a big mistake, and it was compounded by the decision to buy back shares.

Remember, the company’s capital coverage ratio was sky high in 2020 at almost 200%, thanks to lockdown-driven windfall profits. If management had decided to keep the ratio abnormally high by not buying back shares, there’s a good chance the extra capital could have absorbed the losses of 2022 without the need for a dividend suspension, but we’ll never know for sure.

That, in a nutshell, is why I would rate Direct Line’s balance sheet track record as Bad.

Today, however, its balance sheet is in rude health. When the company’s CEO “resigned” after the dividend suspension, an insider was promoted to the role and he did a very good job of steadying the ship and filling the £500 million black hole the company had dug for itself.

Most of the damage was repaired by selling NIG, the company’s broker-based commercial insurance business, for around £500 million. This worked like a charm and enabled the dividend to return much sooner than I’d expected. It also leaves Direct Line with a very healthy capital coverage ratio of around 200%.

The key lesson from this debacle is that a mature insurer should have a proven commitment to profitable pricing. In other words, it should raise premiums when costs are rising, even if others are keeping theirs unsustainably low. Admiral talks about this all the time, and it walks the talk.

5. Has its cash conversion been good, okay or bad?

GOOD - The conversion of profit into cash is negatively affected by capital expenditures (into long-lived assets like property or machinery) as they reduce cash today while only reducing profits in the future (through depreciation). The good news here is that like most insurers, Direct Line doesn’t have to make large capital investments into machinery or factories.

6. Has the level of acquisitions been good, okay or bad?

GOOD - Direct Line hasn’t made any material acquisitions in the last ten years.

Part 2: Business quality

7. Does it have a focused core business?

YES - Direct Line mostly writes motor and home insurance, but it also writes commercial insurance policies for landlords, tradespeople, professionals and other small business owners. Given that these are all very similar types of insurance, and that all of its insurance is “direct” (i.e. not sold through brokers), I do think Direct Line has a focused core business.

Interestingly, it also owns more than 20 auto-repair centres as well as Green Flag, one of the UK’s leading breakdown recovery businesses. Although vehicle recovery and repair are very different from insurance, these businesses are an important part of the company’s vertically integrated business model, which I’ll cover in more detail soon.

8. Has it had the same core business for at least twenty years?

YES - Direct line was founded in 1985 as the UK’s first direct motor insurer, where direct means acquiring customers directly through adverts, rather than the then-usual route of using brokers. In 1988 it became a subsidiary of the Royal Bank of Scotland (RBS), and although it offered savings products at one point, its core business has always been motor and home insurance.

9. Has it had broadly the same growth strategy for at least ten years?

YES - When Direct Line suspended its dividend in 2023, the CEO left and, after a lengthy delay, a new CEO was poached from Aviva. As is usually the case, this new CEO announced a new strategy, but to my eyes, it was just a minor evolution of the existing strategy, with only one significant change. In summary, Direct Line’s strategy since 2012 has had two pillars:

(1) Move away from white-label insurance towards own-brand insurance

Direct Line has always written a lot of white-label motor and home insurance, sold by and under the names of banks and supermarkets. This was an easy way to gain scale, and when the company left RBS in 2012, more than two-thirds of its 19 million policies were white-label.

However, these policies also had wafer thin profit margins and weak returns on capital, so Direct Line has spent the last 13 years slowly reducing its white-label policy count. At the same time, it has invested in growing its own-brand policy count (sold under owned brands including Direct Line, Churchill and Privilege), so that today almost two-thirds of its policies are own-brand.

That's why the company’s return on capital increased between 2012 and 2018, although much of that good work was undone by mistakes made during the pandemic.

(2) Build a competitive technology platform

When RBS was bailed out during the financial crisis, it was told in no uncertain terms that it had to sell off its non-core businesses as soon as possible in order to rebuild its capital buffers.

For Direct Line to be sold, it had to have its own technology platform that was separate from RBS’s, and given the rushed nature of the sale, the platform had to be cobbled together in a very compressed timeframe. This gave it a tech platform that was functional, but uncompetitive, and that platform has been the bane of the company’s life ever since.

There was an attempt to upgrade the platform around 2015, but it soon became clear that further investment into a fundamentally poor system was a waste of money, so plans were drawn up to build a new platform worthy of Direct Line’s position in the industry. Unfortunately, it took the business the thick end of eight years to build and deploy this platform, but the work is now complete, and this is the main reason why I think the turnaround is also virtually complete.

With the new platform in place, the company has some spare capacity to do other things, so the new CEO has announced a long-overdue strategic shift:

(3) Put the Direct Line brand onto price comparison websites

Almost from the very beginning, the Direct Line brand has always been positioned as the insurer that wasn’t on price comparison websites. In theory, this helped it compete on factors other than price (such as speed of repair or customer service) while cutting out middleman costs. In practice, the brand eventually found itself competing for a rapidly shrinking pool of customers, as the vast majority of people now buy insurance through price comparison websites like MoneySuperMarket (owned by Mony Group, which is currently a holding in the UK Dividend Stocks Portfolio and my personal portfolio).

Hanging onto a business model from the 1980s was a terrible mistake, so the new CEO has put the Direct Line brand onto price comparison websites, alongside the company’s other major brands, Churchill and Privilege, which have already been on them for years. This isn’t a huge change or a silver bullet, but it is a very necessary step in the right direction.

13. Is the company free from significant stakeholder risk?

YES - Until fairly recently, Direct Line had large white-label insurance contracts with banks and supermarkets. That was a material risk, because if a contract wasn’t renewed, it could have a significant impact on revenues and profits, and that’s exactly what happened in 2016. Sainsbury’s and Nationwide didn’t renew their contracts and, because of that, Direct Line lost 8% of its policies. Today this risk is much reduced, as white-label insurance is a much smaller part of its business.

14. Does it gain a durable advantage from market dominance?

NO - By my definition, a business has dominant scale when it’s twice as large as its nearest competitor, and although Direct Line was once the UK’s largest motor insurer, those days are long gone.

Over the last ten years it has consistently shrunk, partly due to (a) its (correct) decision to exit white-label insurance, (b) its (incorrect) decision to exclude the Direct Line brand from price comparison websites, and (c) its uncompetitive technology platform. The net result is that Direct Line is no longer the market leader, let alone a dominant market leader.

15. Does it gain a durable advantage from hard-to-copy assets?

YES - Direct Line isn’t the market leader in terms of size, but it does have the two most recognised insurance brands in the UK: Direct Line and Churchill. That’s an important advantage when you’re selling a heavily commoditised product, where one insurance policy is essentially identical to another in all aspects other than price.

A lot of people will pay a higher price to buy products and services from trusted brands, so this does give Direct Line a small amount of pricing power over its less well-known peers, both on and off of price comparison websites.

16. Does it gain a durable advantage from its business model?

YES - Although Direct Line’s results have been unimpressive since its IPO, the company does have some enduring advantages. Its brands are its most important and durable advantage, but it also gains an advantage from a market-leading degree of vertical integration.

For example, if you’re a Direct Line policyholder and you crash your car, there’s a good chance you’ll be rescued by Green Flag, which is owned by Direct Line. And when your car is repaired, there’s a good chance it will be repaired by DLG Auto Services. That business is also owned by Direct Line and it’s the biggest insurer-owned garage network in the UK.

This is an advantage for two reasons: (1) it reduces costs, because Direct Line doesn’t have to fund the profits of external breakdown and repair suppliers; (2) it gives Direct Line more control over the quality of those breakdown and repair services, which can lead to happier customers.

Of course, Aviva and Admiral could build their own vertically integrated businesses, and at various points in their histories they have (Aviva does own repair centres and Admiral used to own the confused.com price comparison website), so this isn’t an insurmountable advantage. But it is somewhat durable, given the scale of both Green Flag and DLG Auto Services.

17. Does it gain a durable advantage from long-term leadership?

NO - My favourite companies have long track records of long-tenure CEOs who already worked in the business for many years before becoming CEO. Sadly, that isn’t the case at Direct Line.

Its first CEO (at the 2012 IPO) had previously been the head of RBS’s retail banking division, so he was an outsider to Direct Line and not a dyed-in-the-wool insurance person. He was replaced in 2019 by the CFO, who joined the company two years earlier from a life insurer. She left in 2023 when the dividend was suspended, and was replaced by another outsider (from Aviva).

On that basis, it’s clear that Direct Line has no cultural tradition of developing CEOs from within, so it doesn’t benefit from leaders with deep company knowledge and a long-term mindset.

18. Does it gain a durable advantage from network effects?

NO - There are no network effects in general insurance.

19. Does it gain a durable advantage from switching costs?

NO - Customers have to renew their policies each year, and it’s very easy to switch from one insurer to another.

20. Is it free from serious short-term problems?

YES - Having had something of a near-death experience in 2023, Direct Line’s current position is surprisingly strong. The cash raised by suspending the dividend and selling NIG has left it with a very robust 200% capital coverage ratio, and as no pandemic-scale disruptions appear to be on the horizon, I don’t think the business is facing any major short-term issues.

Part 3: Growth prospects

21. Is the core market likely to grow over the next ten years?

YES - Direct Line’s core business is UK home, motor and SME commercial insurance, and these are all very stable and very mature markets. Each is projected to grow by about 4% per year through to 2030 (and most likely beyond), which is broadly in line with expected inflation plus population and economic growth.

22. Does it have a proven ability to grow into adjacent markets?

NO - During Direct Line’s 40-year history, it has expanded beyond its UK motor insurance origins into home, travel and pet insurance, it has expanded into Europe and into savings and other non-insurance products. Unfortunately, most of these expansions were ultimately unsuccessful.

The European and non-insurance businesses were sold or closed more than a decade ago and the travel and pet businesses are currently being wound up or sold. This leaves Direct Line more or less back at square one, with only its successful (and very easy) expansion into home and small-business insurance left sitting alongside its original motor insurance business.

That isn’t necessarily a bad thing, but it does limit the company’s growth potential.

Part 4: Yield and valuation

23. Is the dividend yield good, okay or bad?

BAD - Although the dividend was reinstated fairly quickly after the errors of 2022/2023, it remains significantly below previous levels. For example, in 2021 the dividend reached its zenith at 22.7p, which would give a nice 7.6% yield at today’s share price. Today, the dividend sits at a lowly 7p, giving the stock a less-than-inspiring 2.3% yield (with the share price at £2.99).

In an ideal world, Direct Line would complete its turnaround over the next year or two and then fully reinstate its dividend back to 2021 levels, which would almost certainly produce a materially upward re-rating of the share price. Alas, with the takeover looming, if that does happen, it will only benefit Aviva’s shareholders.

24. Are the PE10 and PD10 ratios good, okay or bad?

GOOD - With the share price at £2.99, the PE10 ratio is 15 (which is at the bottom of the Okay range of 15 to 25) and the PD10 ratio is 21 (which is in the Good range of below 30). Overall, I would classify these valuation ratios as Good.

25. Is there a sufficient discount between price and fair value?

NO - Of course, everything I’ve said in this review up to this point is somewhat moot because, sadly, Direct Line is about to be taken over by Aviva. I say “sadly” because it would have been nice if shareholders could have directly benefitted from the long-overdue completion of Direct Line’s turnaround, which began in 2012 and looks set to complete at some point in the next few years. Instead, the spoils will go to Aviva and there isn’t much we can do about that.

When Direct Line is taken over, shareholders will receive 129.7p and 0.2867 Aviva shares for each Direct Line share, so there is the option of holding onto those Aviva shares and perhaps buying more with the 129.7p per share. I won’t be doing that, because Aviva has red flags in five of my stock screen's seven core metrics (three valuation metrics - Yield, PE10, PD10 - and four quality metrics - Growth Rate, Growth Quality, Net ROC, Debt Ratio), and it only ranks 87th on my stock screen. On that basis, I don’t think Aviva is a suitable holding for my portfolio.

As for the question of fair value, there are two options: I can either estimate Direct Line's fair value using a discounted dividend model, or I can assume its fair value is equal to the expected return from the takeover. I’ll start with the takeover valuation.

Aviva’s share price as I write is £6.11, so 0.2867 of that plus 129.7p is £3.05, and that is more or less what Direct Line's shareholders can expect to get if they hang on until the mid-year takeover. Unsurprisingly, Direct Line’s share price is very close to that, at £2.99, with the small difference reflecting the time value of money and a tiny amount of uncertainty around whether the takeover will happen.

To estimate Direct Line's fair value using a dividend model, here’s the model I built when I reviewed Direct Line’s latest annual results, which I still think is a realistic and conservative model of the company's future prospects as a stand-alone business.

Note: In the table above, FV Yield is the dividend yield today if the shares were trading at their fair value estimate of £3.21.

I won’t delve into all of the model’s assumptions, suffice to say that the returns on capital and dividend cover are conservative relative to pre-pandemic norms, and perhaps a little too conservative. Even so, the resulting fair value estimate of £3.21 is still slightly above the £3.05 takeover valuation.

Either way, the actual share price of £2.99 was very close to the estimated fair value, so I sold all of my Direct Line shares a few days ago. I will begin the process of reinvesting the proceeds next month and I will, as usual, share all of the details through my newsletter first and, later, through the blog.

Part 5: Final results

Although the total return from this investment wasn't terrible, it wasn't great either, especially as the stock was down more than 50% at one point. Having sold the shares last week, the final tally was as follows:

- Total return = 6.6% over 3.4 years

- Annualised return = 2.2%

If you look at the drawdown in the chart below, I'm sure you'll agree that the investment's very small gain wasn't worth the pain of enduring a 50% paper loss in early 2023.

(Chart by ShareScope)

Having said that, it's important to remember that Direct Line was just one stock in a portfolio of around 25 stocks, so the 50% drawdown wasn't really that stressful. Even so, this was an investment I'd rather not repeat, and that's why I've internalised some of the lessons through concrete repeatable rules, such as my new rule to only invest in "dividend hero stocks" that have a near-perfect 20-year dividend track record.

The UK Dividend Stocks Newsletter

Helping UK investors build high-yield portfolios of quality dividend stocks since 2011:

- ✔ Follow along with the UK Dividend Stocks Portfolio

- ✔ Read detailed reviews of buy and sell decisions

- ✔ Quarterly, interim and annual updates for all holdings

- ✔ Quality Dividend Watchlist and Stock Screen

Subscribe now and start your 30-DAY FREE TRIAL

UK Dividend Stocks Blog & FREE Checklist

Get future blog posts in (at most) one email per week and download a FREE dividend investing checklist:

- ✔ Detailed reviews of UK dividend stocks

- ✔ Updates on the UK Dividend Stocks Portfolio

- ✔ UK stock market valuations

- ✔ Dividend investing strategy tips and more

- ✔ FREE 20+ page Company Review Checklist

No spam. Unsubscribe anytime.