Senior PLC is a FTSE 250 engineering firm that primarily designs and manufactures complex fluid and thermal conveyance systems for cars, trucks, nuclear power stations and (almost) everything in between.

It has a separate business which manufactures large structural components for commercial and military aircraft, but that business is being sold off, so fluid and thermal conveyance systems is really the core business.

Senior first joined the UK Dividend Stocks Portfolio in 2016. It had an attractive combination of strong growth and profitability, and the share price seemed to offer good value. Within a couple of years the share price had gone up by more than 50%, so I sold and locked in a quick profit.

Believe it or not, that is how investments often panned out in those happy pre-pandemic days.

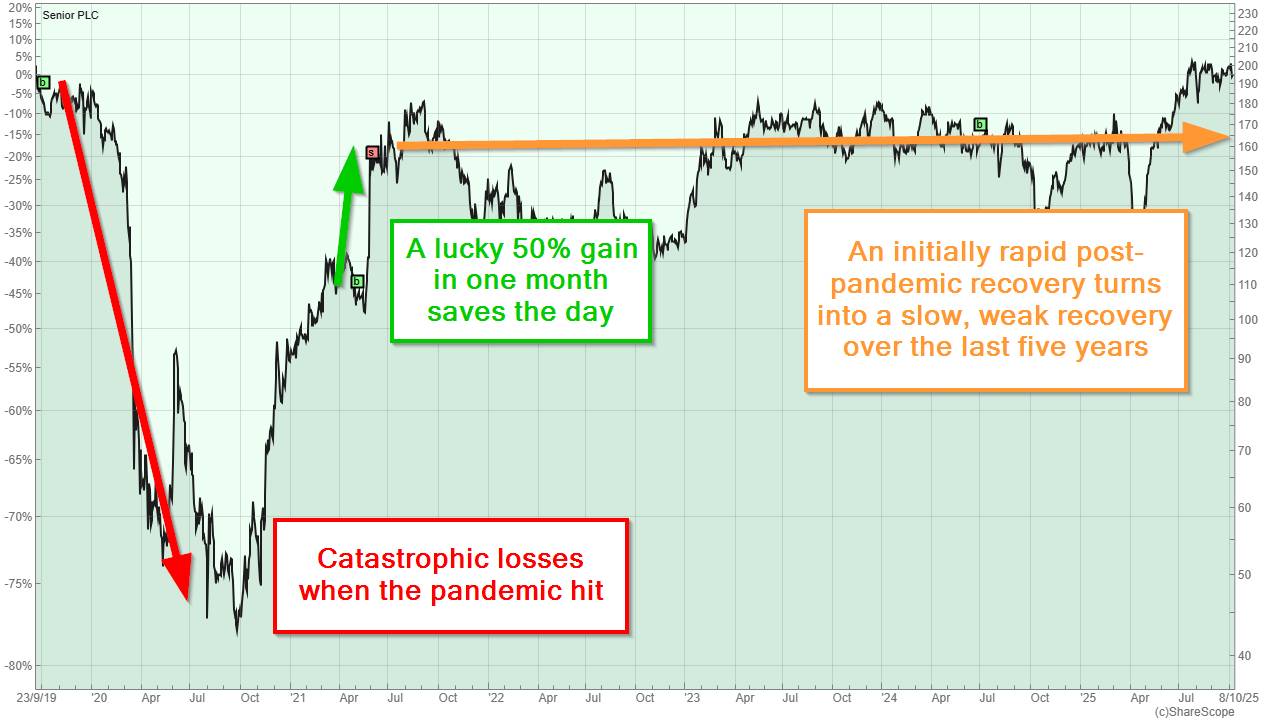

A year later, in 2019, Senior's share price had fallen by more than 40% as investors were worried about problems at Boeing, Senior’s then-largest customer. Boeing was reducing its aircraft production rate after two crashes, but I thought the impact on Senior would be short-lived, so I purchased the company's shares for a second time.

Unfortunately, Covid reared its head a few months later and the aviation industry was plunged into a downturn that it has yet to fully recover from. Supply chains were severely disrupted, Senior’s profits turned into losses and the dividend was suspended for two years.

All of that was understandable given the circumstances, but we are now several years past the pandemic and Senior’s slow and weak recovery has undermined its credentials as a quality dividend stock.

Also, I'm in the process of reducing the number of holdings in the portfolio from my current target of 25 to a new, more manageable target of 20, and Senior is the most obvious candidate for the chopping block.

The rest of this review is taken more or less directly from the October issue of The UK Dividend Stocks Newsletter. If you're interested, you can download the original PDF purchase and sale reviews for Senior using the links below:

Table of contents

- Part 1: Financial Track Record

- Part 2: Business Quality

- Part 3: Growth Prospects

- Part 4: Dividend Yield and Valuation

- Part 5: Final Results

Part 1: Financial Track Record

Does Senior have a long track record of progressive dividend growth?

NO - When Senior first joined the portfolio in 2016, it did have an impressive track record of steady double-digit growth, but that came to an end with the problems at Boeing, and then the pandemic. This is understandable as the aerospace industry was severely impacted, so a dividend cut or suspension was inevitable. But we are now almost six years past the start of the pandemic, and Senior’s dividend is still two-thirds below pre-pandemic levels.

Has its growth over the last ten years been good, okay or bad?

BAD - Senior’s inability to rebuild its dividend reflects a wider inability to generate pre-pandemic levels of revenue and profit.

Senior’s Growth Rate for the last ten years comes in at -5%, which of course isn’t great. This is mostly due to its Aerostructures division, which manufactures large aircraft structures based on blueprints from Boeing, Airbus and others. That business has struggled to compete against newer, lower-cost peers, and Senior recently did the right thing by selling it off.

Has its profitability been good, okay or bad?

BAD - Senior’s weak recovery is mostly due to its profitability, which has been unacceptably low since the pandemic first hit almost six years ago. In fact, Senior’s profitability was already weak before the pandemic, as the company struggled with multiple headwinds.

First, there was the end of the commodity super-cycle around 2015, when the manic pace of city-building in China began to slow. That hit Senior’s heavy-duty truck components business. Second, Boeing reduced and then suspended production of the 737 MAX around 2018, after two planes crashed, killing hundreds of people. Boeing was Senior’s largest customer at the time, so this was another blow. And third, we had a global pandemic.

So this has been a very tough period for Senior, but excuses can only get you so far. All companies face headwinds on a regular basis, and an unusually severe series of headwinds is still no excuse for more than a decade of low returns on capital and weak profit margins.

The table above shows how Senior’s Net ROC has slowly decayed, from a barely acceptable 11% a decade ago to a mere 5% today, which is not a fair compensation for the risks involved.

Most of this is due to the decline of the Aerostructures division, which no longer makes any profit at all and has recently been sold. The remaining fluid and thermal conveyance businesses are more profitable, but Senior doesn’t disclose detailed divisional figures.

Has its balance sheet strength been good, okay or bad?

BAD - When Senior joined the portfolio, its Debt Ratio (the ratio of borrowings to 10-year average earnings) was a very reasonable 3.2. However, the company’s woeful performance over the last five years has completely changed that picture.

Although its debt has only increased by about 10% since 2019, consistently weak post-pandemic profits have dramatically reduced the ten-year average earnings figure, pushing the Debt Ratio far above my preferred limit of 6.0. The graph above shows Senior’s Debt Ratio using today’s much-reduced 10-year average earnings, so with the benefit of hindsight, the historical debt level was not as prudent as it appeared in 2019.

The good news is that Senior’s debts should be reduced by at least £100 million (about 30%) following the sale of the Aerostructures businesses. If that happens then Senior would most likely pass my debt tests, but even if its debt was reduced to zero, that wouldn’t be enough to keep it in the portfolio.

Has its cash conversion been good, okay or bad?

BAD - As always, my main concern with cash conversion is capital expenses, as these reduce cash flow without immediately reducing earnings. Because of this unintuitive accounting feature, capital-intensive businesses often generate much less free cash than profit, which isn’t great for the sustainability of their dividends.

In Senior’s case, it has to invest in engineering facilities, machinery and equipment, much of which is large and expensive. Over the last ten years its capex has remained broadly flat, but Senior’s weak profits over the last few years have increased its Capex Ratio (the 10-year ratio of capex to earnings) from a middling 64% in 2019 to an unacceptably high 130% today.

In simple terms, Senior spent more on capex over the last ten years than it made in profit. This is another consequence of weak profitability, it poses a significant headwind to dividend growth and it’s another reason why Senior is no longer a suitable holding for the portfolio.

Has the level of acquisitions been good, okay or bad?

BAD - Senior’s Acquisition Ratio currently stands at 50%, so it spent the equivalent of half its earnings acquiring other businesses over the last ten years. This isn’t entirely surprising, as Senior was largely built through acquisitions in the 1980s and 1990s, but I’d still rather see its acquisitiveness taken down a notch or two.

That’s because highly acquisitive companies are inherently more difficult to manage, and the impending disposal of Senior’s aerostructures businesses is proof that getting acquisitions right is no easy task.

Part 2: Business Quality

Does it have a focused core business?

NO - It takes a lot of focus to be the best, so I like my holdings to be highly focused businesses, with at least two-thirds of their revenues coming from a narrow set of closely related activities.

In Senior’s case, it carries out a wide variety of engineering design and manufacturing work across about two dozen (mostly acquired) subsidiaries, so there are various ways to define and categorise what Senior does. In my opinion, its capabilities fall into two largely independent groups: fluid and thermal conveyance, and aerostructures.

You can think of fluid and thermal conveyance as advanced plumbing, which manages things like lubrication in jet engines or cooling in nuclear power stations. Aerostructures, on the other hand, is the manufacture of large aircraft structures designed by Airbus and others.

There is relatively little overlap between these two activities and they are, in fact, carried out by entirely separate subsidiaries (Senior owns more than 20 semi-autonomous firms).

Before the pandemic, Senior’s revenues were split about 60/40 between fluid/thermal conveyance and aerostructures, so neither activity dominated. That is a problem, because I like companies to be highly focused and a 60/40 split between two very different engineering activities is not focused.

The pandemic devastated the aviation industry, so the aerostructures business has struggled in recent years and its share of overall revenues has fallen to less than 30%. From a focus point of view that’s good, because Senior has become more focused around its world-leading fluid and thermal conveyance systems. Even better, that focus will increase to 100% when the aerostructures businesses are sold.

This is a positive development, but I don’t think Senior is making this decision because it values focus. Instead, the aerostructures businesses are being sold because they’re a ball and chain around the group’s ankles. If the aerostructures businesses were performing better, I think Senior would have carried on as a relatively unfocused business of two halves, and that is another black mark against its name.

Has it had the same core business for at least 20 years?

YES - Although Senior was founded in 1933, most of its subsidiaries were acquired during the 1990s. That’s long enough ago to pass this test, but the fact that Senior was built largely through acquisitions just three decades ago is still a negative factor.

The problem is that it’s very easy to grow by acquisition, at least for a while, but it’s very hard to turn acquisition-driven growth into sustainable long-term organic growth. Just look at Senior’s aerostructures businesses. When they were acquired they added to revenues, profits and growth for the overall group, but over the years it has become clear that they don’t have durable competitive advantages. They have become an expensive distraction and a drain on resources, so what was acquired amid much optimism must now be sold amid much pessimism.

I don’t want to be too negative here, because Senior has been a fairly stable business since the 1990s, but it certainly isn’t a bastion of organic growth like PageGroup or Admiral (two of the portfolio's other holdings).

Has it had broadly the same growth strategy for at least 10 years?

YES - Senior has had broadly the same business model and growth strategy since it exited its acquisition-driven phase in the 1990s.

Its business model is to be a trusted supplier of critical components in industries such as aerospace and energy, where supply chains are long and complex and where mistakes are expensive and potentially life-threatening. This is an area that rewards suppliers who have a proven track record of reliability and stability over decades, and most of Senior’s subsidiaries have that kind of track record.

As for the company’s growth strategy, although acquisitions do continue to play a role, the strategy has been more focused on organic growth for at least the last ten years. There are a lot of moving parts to this business, but I would simplify the strategy into three main activities.

(1) Prune to grow

Senior built most of its size through acquisitions in the 1980s and 1990s, but like most roll-ups, eating too many companies too quickly eventually led to indigestion. Senior found itself with a mish-mash of ho-hum businesses, so for more than a decade “prune to grow” has been a key pillar of its strategy. This essentially means disposing of previously acquired companies that are either underperforming, non-core or, in most cases, both.

The largest and most obvious example of this is the impending disposal of the aerostructures businesses. This sale will remove about a third of Senior’s operations, but there has also been a steady drip-drip of smaller disposals over the years.

I’m a big fan of focused businesses, so this “prune to grow” approach makes sense, but it would be better if Senior had been more disciplined when acquiring businesses in the first place.

(2) Maintain or grow market share in existing growth markets

The easiest way for most companies to grow is to operate in growing markets and then simply keep pace with the market as it grows. This is most obvious in Senior’s core aerospace market where the number of aircraft and the amount of miles flown continues to increase in line with its historical trend, at around 3-4% per year.

However, Senior also has a significant foot in the oil and gas industry, where long-term growth is far less likely. To avoid declining with that industry, Senior needs to be adaptable enough to switch to alternative industries, and that is exactly what it’s doing.

(3) Expand into closely related growth markets

As the world moves from a fossil fuel energy system to one based on electricity from renewables and nuclear power, Senior is changing with it.

Senior’s existing exposure to the nuclear power industry should make the transition away from the oil and gas extraction industry easier, but transport is where most of the interesting changes have occurred.

Somewhat impressively, the company is in the middle of a successful pivot away from thermal and fluid conveyance systems for internal combustion engines, and towards meeting similar demands for battery and hydrogen electric vehicles. This transition has at least another 10 years to go, but it’s good to see Senior already making progress in that direction.

Looking beyond the transition to net zero, Senior has also expanded (to a small degree) into other growth markets, designing thermal and fluid conveyance systems for semiconductor manufacturing equipment, medical devices and the fast-growing space industry.

Is it free from significant stakeholder risk?

YES - Senior has no single customer that generates more than 10% of its revenues.

Does it gain a durable advantage from market dominance?

NO - After the aerostructures businesses have been sold, Senior will be the world’s leading pure-play fluid and thermal conveyance systems business. That’s great, but the addition of the phrase “pure-play” is a concern. It means there could be larger fluid and thermal conveyance firms out there, but they also do other things as well, so they aren’t pure-play.

Having looked at the competition, it seems that fluid and thermal conveyance isn’t something large engineering companies tend to specialise in. Instead, it tends to be one string to their bow, so being the pure-play market leader isn’t necessarily an advantage. Also, Senior’s consistently weak profitability and lack of growth are signs that it doesn’t dominate its market.

Does it gain a durable advantage from hard-to-copy assets?

YES - Senior’s business model is to be a trusted supplier of critical components for products where the cost of failure is huge, including aircraft, satellites and medical devices.

To be a trusted supplier, you need to build up your reputation and brand by proving that you’re a reliable supplier of quality components. That takes a lot of time. For established suppliers like Senior, a reputation built up over many decades is a valuable asset, because it’s impossible for younger competitors to copy overnight.

Of course, no competitive advantage is insurmountable. For example, Senior’s aerostructures businesses make life-critical components, like moveable wing-tips for commercial aircraft, so being a trusted supplier is still essential. However, those structural components are not technically demanding. That made it easier for new competitors in low-cost countries to build up their experience and reputations, and they’re now trusted by Boeing and others.

With the aerostructures businesses being sold, the remaining fluid and thermal businesses are in a stronger position. These products are more technically demanding. They require a significant amount of engineering design expertise, rather than just manufacturing know-how, so the expectation is that Senior’s reputation in fluid and thermal conveyance is more durable.

Does it gain a durable advantage from its business model?

NO - Although Senior’s competitive advantage stems from its business model as a trusted supplier of critical components, the model itself doesn’t differentiate it from its peers, who are also trying to build or maintain trusted reputations.

Does it gain a durable advantage from long-term leadership?

NO - Compared to most listed companies, Senior has a good track record of long-term leadership. The current CEO has been in the hot seat since 2015, the previous CEO had the job for seven years and the CEO before that led the company for eight years. In my book, retaining a CEO for five years is the absolute minimum, so Senior has consistently ticked that box.

However, two of those CEOs were external hires, so they hadn’t worked their way up through the business and had no direct experience within the firm. This is common, but it’s still a negative as the best companies tend to hire CEOs from within. This forces them to build a robust pipeline of CEO candidates, which means hiring good people and training and retaining them over many years, all of which helps to build a workforce of happy, talented, experienced people.

Does it gain a durable advantage from network effects?

NO - Unlike Facebook, the size of Senior’s user/customer network doesn’t directly increase the utility of its products.

Does it gain a durable advantage from switching costs?

YES - This doesn’t apply to all of Senior’s components and systems, but it applies to enough that I think it ticks this particular box.

As a specific example, when Senior wins a contract to supply components on, say, the F-35 military jet, that contract will last many years. That’s because (a) the aircraft’s mechanical components are unlikely to change for years and perhaps decades, and (b) switching from one supplier to another is an expensive, time-consuming and not risk-free task. It is far easier for the customer to stick with a supplier until the contract comes up for renewal, even if that supplier turns out to be worse than expected (although not so bad as to break any contractual terms).

Part 3: Growth Prospects

Is it free from serious short-term problems?

YES - I would definitely describe the pandemic as a near-death experience for Senior and many firms within the aerospace industry. Fortunately, that’s all in the past and although the operating environment remains weak, there has been a slow but steady recovery across the industry over the last few post-pandemic years, and Senior is no longer facing serious short-term problems.

Is the core market likely to grow over the next ten years?

YES - Senior’s fluid and thermal conveyance business has three core markets: aerospace, land vehicles and power & energy. Each of these will be materially impacted by the expected transition to a net zero global economy over the next 50 or so years, and Senior will have a lot of adapting to do.

In terms of growth, the aerospace industry is expected to continue to grow for decades, with the vast majority of commercial aircraft still powered by combustion engines running on sustainable aviation fuels, with relatively unchanged needs for fluid and thermal conveyance.

In land vehicles, there will be a much more significant shift towards battery electric vehicles. Senior is confident that these vehicles need as many fluid and thermal components as fossil fuel vehicles, and it has already won several contracts to supply EV battery cooling systems.

As for power & energy, it appears that the oil and gas industry’s decades are numbered. Solar power deployment is soaring as the cost of solar panels declines, and that virtuous circle will only become more powerful.

Unfortunately, solar panels don’t require much in the way of fluid and thermal conveyance, so Senior is pinning its hopes on a resurgence of nuclear power, where fluid and thermal management is critical, but I have my doubts. The small modular reactor revolution hasn’t even begun, whereas wind and solar are proven and increasingly cost-effective solutions.

Fortunately, the power & energy market only generates around 15% of Senior’s revenues, so on balance, I think Senior should be able to grow in line with the global economy for many years and perhaps many decades to come.

Does it have a proven ability to grow into adjacent markets?

YES - Although most of Senior’s growth has come through acquisitions, it has also been able to expand organically into adjacent markets. A few examples that spring to mind are its expansion into markets for commercial space satellites, semiconductor manufacturing equipment and electric vehicle battery packs, all of which require highly engineered fluid and thermal conveyance systems.

Having said that, I certainly don’t see Senior as a “land and expand” business, constantly growing by moving into one new market after another (like Amazon or Nike). But it does have a proven ability to move into new markets, and that is still a useful feature.

Part 4: Dividend Yield and Valuation

Is the dividend yield good, okay or bad?

BAD - Senior currently has a dividend yield of 1.2%, which is of course terrible from a dividend investor’s point of view. The dividend is growing at more than 10% per year as it’s still recovering from its post-pandemic suspension, but even if the dividend doubled tomorrow, the yield would still be below my 3% minimum.

Are the PE10 and PD10 ratios good, okay or bad?

BAD - Senior’s share price has recovered strongly in recent months, to the point where its PE10 and PD10 ratios are both unattractive. The price has also risen above my 2019 purchase price, so the stock is in profit and that makes selling a little easier, psychologically speaking.

Is there a sufficient discount between price and fair value?

NO - As Senior’s post-pandemic recovery has continued to disappoint, I have repeatedly made my dividend model more pessimistic. Because of that, my estimate of fair value has fallen while its share price has risen. As things stand, Senior’s share price of £1.99 is above my fair value estimate of £1.84. However, there are two issues with that estimate.

First, Senior has just sold its aerostructures businesses. This will have an impact on its capital base, as the proceeds will be turned into buybacks for shareholders and debt repayments for lenders. It will also impact profitability, which is expected to increase after the underperforming division has gone. This makes any estimate of the future even more difficult.

Second, my model has Senior raising its dividend from 2.4p last year to 5.8p next year, which is more in line with the past (dividends peaked at 7.4p in 2018). Given Senior’s slow recovery, this seems somewhat optimistic, so I’m inclined to think my estimate is on the high side.

In summary, Senior has a low dividend yield, a price which is above my fair value estimate and it doesn’t meet my criteria for quality. On that basis, I will be removing Senior from the portfolio a few days after this issue goes out, and the proceeds will be reinvested over the coming months.

Part 5: Final Results

Although Senior and its share price haven't performed as I'd initially hoped, the investment was far from a disaster.

Although my reactions were too slow to take full advantage of the initial Covid crash in 2020, I did manage to add a significant number of shares in 2021 at a 40% discount to my initial 2019 purchase price. Just one month later those shares had increased in price by around 50%, so I sold all of them and locked in most of the investments gains in a single month.

The speed of that gain was entirely luck, but the fact that I bought more shares at a lower price and sold at a higher price had nothing to do with luck. It was just good old fashioned value investing.

And so, thanks to that one joyous month, this investments final results were middling rather than terrible:

- Holding period: 6 years, zero months

- Capital return: 16.4%

- Dividend return: 2.2%

- Total return: 18.6%

- Annualised return: 6.6%

Note: There's an error in the PDF version of this review where I said the annualised return was 3.8%. It was actually a much better 6.6% due to the fairly sizeable realised return in 2021, when I sold a block of shares for a quick 50% capital gain.

Lessons from investing in Senior

I don't think there are any huge lessons to draw from this investment. Senior was and is a fundamentally sound business, but its post-pandemic performance have shown it to be merely good, or perhaps okay, rather than great, and I only want to invest in great businesses ("great" as defined in Good to Great and The Defensive Value Investor).

If I had to put my finger on one key lesson, it would be to avoid roll-ups (companies built mostly through acquisition), as they have been a recurring theme in some of my less-than-spectacular investments.

Building a great business through acquisition can be done, but it is extremely difficult and rare, and Senior is another case in point.

As for the proceeds of this sale, they've pushed the portfolio's cash balance above 10%, which is far too much. Because of that, I will be spending a month or three reinvesting some of that cash back into existing holdings, before asking another holding to walk the plank several months from now. At that sort of pace, I expect the UK Dividend Stocks Portfolio to reach its new, lower target of 20 holdings somewhere around mid-2026.

The UK Dividend Stocks Newsletter

Helping UK investors build high-yield portfolios of quality dividend stocks since 2011:

- ✔ Follow along with the UK Dividend Stocks Portfolio

- ✔ Read detailed reviews of buy and sell decisions

- ✔ Quarterly, interim and annual updates for all holdings

- ✔ Quality Dividend Watchlist and Stock Screen

Subscribe now and start your 30-DAY FREE TRIAL

UK Dividend Stocks Blog & FREE Checklist

Get future blog posts in (at most) one email per week and download a FREE dividend investing checklist:

- ✔ Detailed reviews of UK dividend stocks

- ✔ Updates on the UK Dividend Stocks Portfolio

- ✔ UK stock market valuations

- ✔ Dividend investing strategy tips and more

- ✔ FREE 20+ page Company Review Checklist

No spam. Unsubscribe anytime.