AG Barr is a thorn in the side of The Coca-Cola Company.

Its core product, IRN-BRU, is known as “Scotland’s second national drink” and it's one of few soft drinks in the world to consistently outsell Coca-Cola in its home market.

And like Coca-Cola, AG Barr has a long and successful history, generating attractive returns on capital and relatively consistent dividend growth.

Of course, none of this is news and AG Barr is already popular among UK dividend investors, but popularity has its downsides; at its current share price of £5.70, the company's dividend yield is a mere 2.1%.

So the question is: Is a 2% yield enough, given AG Barr's growth prospects, or does that low yield simply reflect an unattractive valuation?

To answer that, I'll begin with a review of the company and its future prospects and then try to estimate its fair value.

Table of contents

- AG Barr has been a soft drinks business for more than a century

- A very experienced, narrowly focused, vertically integrated business

- A long track record of consistent and sustainable growth

- Consistently good growth driven by consistently good profitability

- Two durable competitive advantages

- Recent acquisitions have been both large and successful

- Reliance on key brands is a potential risk

- The UK soft drinks market is stable and expected to continue growing

- There is some potential for expansion into closely related adjacent markets

- AG Barr has survived dozens of recessions and the next one should be no different

- Estimating AG Barr's future dividends

- Estimating AG Barr's fair value

- Is there a sufficient margin of safety between price and fair value?

- Selling AG Barr as it's close to my fair value estimate

AG Barr has been a soft drinks business for more than a century

Robert Barr first produced “aerated drinks” in 1873 at Burnfoot Lane, Falkirk, when the introduction of bottles with screw lids began to undermine the Barr family’s existing corking business.

In 1887, Robert’s son started a second Barr soft drinks business in Glasgow. In 1903, that business was incorporated as A.G. BARR & Co. Ltd.

Various Barr family members remained as chairman until 2009 and over the 100 years and more since the company was founded, AG Barr has done little else but develop, manufacture and sell branded soft drinks.

A very experienced, narrowly focused, vertically integrated business

Like most branded consumer goods companies, AG Barr has five main tasks:

- Develop products (drinks in this case) that people love

- Build brands around those products that people know, like and trust

- Manufacture and distribute those branded products efficiently

- Sell them at a slight premium to generate attractive profits

- Expand into closely related adjacent markets

Brands are clearly at the heart of this business and in addition to IRN-BRU, AG Barr has a variety of supporting brands. Most are owned by the company but some are licensed brands that it manufactures and sells on behalf of third parties.

In order of sales as a percentage of total revenue, the company’s brands in 2022 were:

- 45%: IRN-BRU (Scotland’s #1 soft drink)

- 20%: Rubicon (one of the UK’s leading exotic fruit-flavoured drinks)

- 13%: Funkin (the UK’s #1 ready-to-drink cocktail)

- 12%: Barr Flavours (a value-focused range of new & classic soft drinks)

- 10%: KA, Strathmore, Simply, Tizer & others

Revenues and profits from mature soft drink brands like IRN-BRU tend to be very stable and reliable, but they also tend to grow quite slowly. That's why expansion into closely related adjacent markets is a key part of the company's strategy.

For example, in recent years, AG Barr used some of its strongest brands to create spin-off brands in the fast-growing energy drink market, with newly developed drinks such as IRN-BRU Energy and Rubicon RAW.

These new brands and products were then plugged into the company’s marketing machine, leveraging existing customer awareness of the IRN-BRU and Rubicon brands and AG Barr’s existing knowledge of the energy drink market built through its (recently lost) licence to sell Rockstar Energy.

When a retailer places an order, the drinks are manufactured in the company’s super-efficient facilities in Scotland or Milton Keynes, where more than £130 million has been invested over the last decade. Many of these drinks are then distributed to customers using the company’s own fleet of more than 70 trucks.

This vertical integration of design, marketing, manufacturing and distribution gives AG Barr a relatively high degree of control over the entire process, and it allows the company to profit from each step rather than having to give away profits to third parties.

A long track record of consistent and sustainable growth

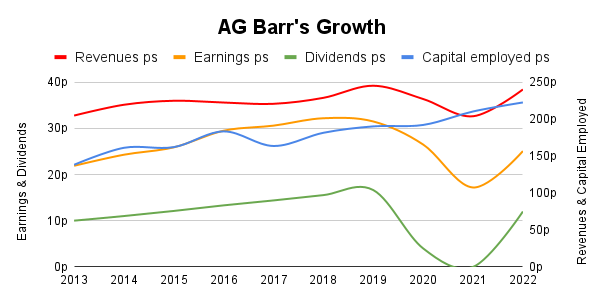

Before the pandemic, the combination of experience, focus, strong brands and vertical integration helped AG Barr produce a long history of relatively stable inflation-beating growth.

For most of the last decade, capital employed was growing by 4.5% per year, revenues by 3%, earnings by 6% and dividends by almost 9%. Growing the dividend faster than earnings isn't sustainable, so realistically a more sustainable dividend growth rate would have been something around 5% per year, given the growth rate of both capital employed (capital tied up in factories, warehouses, machinery, stock and so on) and earnings.

That capital employed growth rate was definitely sustainable because it was funded almost entirely with retained earnings rather than unsustainably by taking on ever more debt. Some debt was used to acquire Rubicon for £60 million in 2009, but all of that debt was paid back within a few years.

The only potential blot on AG Barr’s scorecard is its decision to suspend dividend payments to protect the business during the pandemic.

To be honest, I was surprised when management made this decision because, even without hindsight, it seemed obvious that AG Barr would probably sail through the pandemic relatively unscathed. And that's exactly what it did.

So why did management act in such an extremely conservative manner?

I think the answer lies in AG Barr’s long history as a multi-generation family business.

If you’re the head of a large business that has been handed down through generations and is a significant local employer, it is your responsibility to do your best to see the business survive and thrive for generations to come. If that were me, I’d be inclined to suspend the dividend for a while, even if it really wasn’t necessary, just to be on the safe side.

And even though the current CEO and Chairman aren’t members of the Barr family, I think the family-business mindset still runs through this company and its management.

Consistently good growth driven by consistently good profitability

Like many branded consumer goods companies, AG Barr has been consistently and highly profitable for a long time.

For example, over the last ten years, which obviously includes the pandemic, net returns on capital employed averaged 15% while net returns on sales (profit margins) averaged 12%.

Both of those figures are comfortably above what most companies can achieve and, as the pandemic fades into history, AG Barr’s profitability has already started to recover towards the company's pre-pandemic norms.

Such consistently good profitability is a sign that AG Barr may have some enduring competitive advantages.

Two durable competitive advantages

AG Barr’s above-average profitability comes from its ability to charge a premium price for its products thanks to their well-known and trusted brands.

For example, if you pop into a convenience store to buy a drink, are you going to buy a can of IRN-BRU (assuming you’re a fan) for £1.10 or are you going to buy a can of something that looks very similar and is priced at £1 but has a brand name you’ve never heard of?

Most people who like IRN-BRU are going to ignore the unknown alternative and just pay the extra 10p to get their favourite fluorescent orange drink. That all adds up to millions of pounds of additional revenues, some of which will be reinvested into marketing to further strengthen the IRN-BRU brand, some of which will be reinvested for growth and some of which will be returned to shareholders as dividends.

And while the idea of a brand that is known, liked and trusted by millions is simple, actually building one is incredibly hard. In fact, the best brands tend to have a history stretching back decades or even centuries, deeply ingraining them into a given culture. And that’s something competitors cannot easily replicate.

I also think AG Barr’s culture and history as a multi-generation family business is a valuable and hard-to-replicate competitive advantage.

Successful, multi-generation family businesses tend to focus far more on the long term than most other companies. They don't bet the farm just to achieve short-term performance goals, but they are willing to invest in new products or markets that are vital for the company's long-term success, even if those investments might not produce meaningful profits for a decade or more.

And perhaps most important of all, they tend to grow their own leaders, developing the brightest talent within the company through long and varied careers which may eventually lead to a seat on the board.

These are all things that listed companies can do, but they tend not to. Most institutional shareholders are obsessed with the short-term because that's what their clients are focused on. They look for anything to boost the share price in the next six months or less, so CEOs are pressured to perform in the short term, which is often at odds with what needs to be done to build a high-quality business that can endure for decades and perhaps even centuries.

Of course, from the outside, it’s incredibly hard to be sure about this sort of thing, but as far as I can tell, AG Barr still has something of the "family business" feel about it, with more than a century of Barr family chairmen and a CEO who has been in place for almost 20 years.

Recent acquisitions have been both large and successful

While most of AG Barr’s growth has been organic, quite a lot of that organic growth was built upon earlier acquisitions.

For example, it acquired Rubicon for £60 million in 2008 when Rubicon’s revenues were less than £30 million.

The Rubicon acquisition made a lot of sense because Rubicon and AG Barr had already worked together for 20 years, with AG Barr manufacturing Rubicon’s fizzy drinks. Rubicon had a strong footprint in London and the South East, while AG Barr sold drinks mostly in Scotland and the North, so buying Rubicon would allow AG Barr to cross-sell IRN-BRU into the South and Rubicon into the North.

14 years after the acquisition, AG Barr’s continued organic investment in Rubicon has almost doubled the brand’s revenues.

Another successful acquisition came in 2015 when AG Barr acquired Funkin Cocktails for around £20 million.

As with Rubicon, Funkin was another drinks company operating in a closely related adjacent market that AG Barr was looking to enter. In this case, it was the fast-growing cocktail market. And also as with Rubicon, the acquisition has proven successful, with Funkin’s revenues more than quadrupling from £9 million in 2014 to £37 million in 2022.

Of course, whether AG Barr can continue to grow by bolting on other drinks companies is impossible to know, especially when it only has two major successes to shout about. But at least its track record with recent acquisitions is good, which is more than you can say for most companies.

Reliance on key brands is a potential risk

AG Barr has a very concentrated portfolio of brands, with IRN-BRU generating 45% of the company’s revenues, Rubicon 20% and Funkin 13%. That’s almost 80% coming from three brands.

I’m not especially worried about IRN-BRU as it really is like Coca-Cola. It’s been around for more than 100 years, has been Scotland’s #1 soft drink for decades and is deeply ingrained into the culture of Scotland.

But that isn’t the case with Rubicon and Funkin. They’re popular drinks, but so was Tizer in the 1980s and that brand now makes up less than 1% of the company’s sales.

I’m not saying Rubicon and Funkin will fall to that level, but the only AG Barr brand I really trust is IRN-BRU.

The UK soft drinks market is stable and expected to continue growing

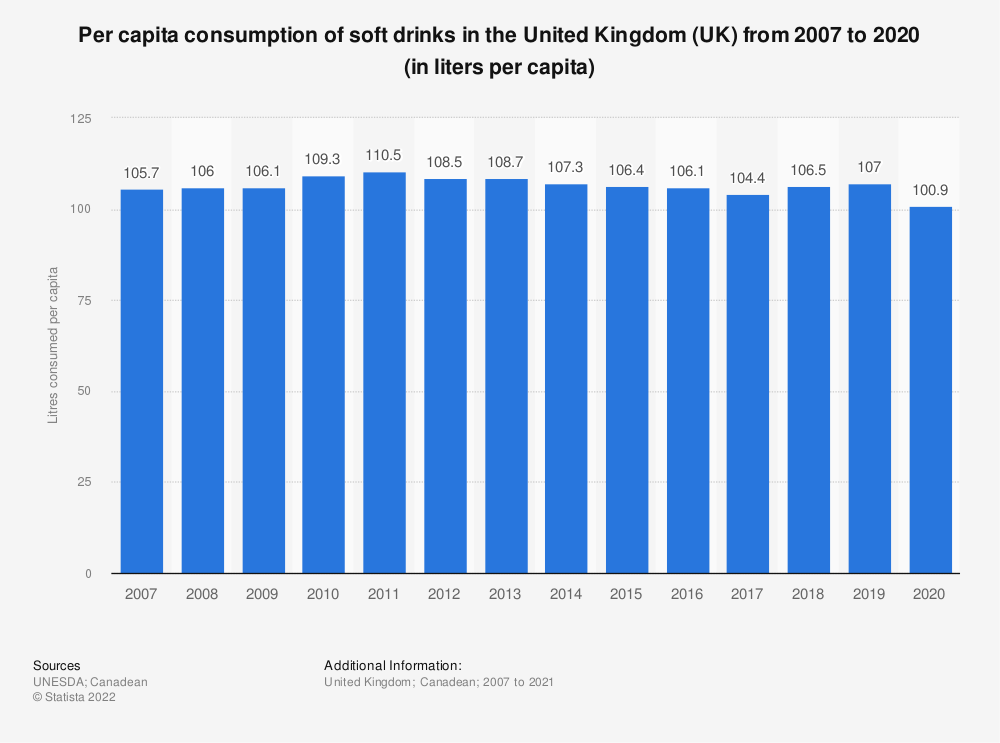

The soft drinks market is about as stable a market as you’ll find anywhere, perhaps other than toothpaste and toilet paper. This is one of the main reasons why AG Barr’s results have been so consistent for so long.

(Source: statistica.com)

This stability is likely to continue, so growth in the UK market is likely to come from a combination of (a) population growth, (b) inflation and (c) wage growth ahead of inflation (real wage growth would allow people to buy more expensive “active ingredient” drinks like energy drinks).

Taking each in turn:

Population growth

The UK's population is expected to grow by 3.2% by 2030. That’s 3.2% over the entire period, not per year, so population growth per year is expected to be just 0.2% which (perhaps thankfully) isn’t very much.

A simple (and perhaps optimistic) assumption is that longer-term inflation stays at the Bank of England’s 2% target.

Inflation and wage growth

As for real (after inflation) wage growth, UK wages have doubled since 2000 but in real terms, they’ve only gone up by 28%. That’s a real growth rate of just over 1% per year.

Adding those factors together, we get an estimated future growth rate for the UK soft drinks market of 3.2% per year.

There is some potential for expansion into closely related adjacent markets

In addition to the UK soft drinks market, AG Barr has access to several closely related adjacent markets that could allow it to consistently and sustainably outgrow its core market.

The first is the international soft drinks market, where the company already generates 4% of its revenues. However, 4% isn't very much and its international business isn't especially fast-growing, so although I think international sales could help it outperform the UK market, I think the effect will be relatively minor over the next decade.

It also has access to the alcoholic beverage market, which it successfully entered through the acquisition of Funkin, the UK's #1 cocktail brand. This has materially boosted the company's growth over the last decade, but again, it's very hard to say how much Funkin will continue to boost growth in the future.

Another option is to expand into markets beyond drinks. AG Barr took its first step in that direction with its recent acquisition of MOMA Foods, a popular brand of oat-based products such as oat milk and ready-to-eat porridge.

AG Barr has survived dozens of recessions and the next one should be no different

In the near-term future, it's very likely that the UK will enter another recession and quite possibly a period of stagflation, so it's worth thinking about how AG Barr would cope with that situation.

The good news is that, as the owner of loved and trusted consumer brands, AG Barr is about as defensive a company as you’ll find. It primarily operates in a structurally defensive market, it has wide margins to absorb input cost inflation and sales declines and it has a strong balance sheet.

If there is a recession in the UK, even a stagflationary one, I would expect AG Barr to sail through it relatively well as most people are far more likely to cut spending on holidays and cars rather than cut back on relatively cheap fizzy drinks.

In an extreme recession, the dividend could be suspended, as it was in the pandemic, but I would expect it to be reinstated quickly, as it was after the pandemic.

Estimating AG Barr's future dividends

To summarise all of the above, I would say that AG Barr is a classic example of a quality dividend growth stock, generating consistent profits and growth from market-leading consumer brands. This is exactly the sort of company I like to invest in, so the next step is to decide whether the yield and valuation are sufficiently attractive.

Personally, I value companies based on an estimate of their future dividends, because a financial asset like a company is only worth the cash you can get out of it.

This means we need to come up with a scenario for the company's future dividends which is both realistic and conservative, as this builds in a margin of safety in case reality turns out to be worse than you expect.

My starting point for this scenario is the UK soft drinks market, which as we've already seen, is expected to grow by around 3% over both the medium and long term.

Given the strength of AG Barr's competitive advantages and its proven ability to acquire its way into adjacent markets, I think it's reasonable and conservative to assume that the company could grow faster than the UK soft drinks market, at least over the next decade or so.

However, over the last decade, AG Barr's capital employed, revenues and earnings were growing by mid-single-digits at best, so I wouldn't expect it to massively outperform the market.

On that basis, I think an annual growth rate of around 4% to 5% for AG Barr over the next decade is a reasonable expectation.

Of course, trees don't grow to the sky, so looking beyond the next ten years it's sensible to assume a lower growth rate that is more in line with population growth plus inflation. Given the strength of AG Barr's business and its existing (but small) exposure to international markets, I don't think it's unreasonable to expect a long-term growth rate slightly above 3%. Let's say 3.5% to be conservative.

In this scenario then, AG Barr grows by 4.5% per year to 2031 and by 3.5% per year thereafter.

That sounds reasonable, but is it feasible?

In other words, growth doesn't appear out of thin air. For it to grow, AG Barr will need to build new manufacturing facilities, buy more trucks and invest in other productive assets. Those things need to be funded by retaining some of the company's earnings, but if earnings need to be retained to fund growth, how much can be paid out as dividends?

To answer that we can build a simplistic model of the business, taking into account:

- its existing capital employed (effectively money tied up in factories, machinery and so on);

- its expected return on that capital (how much it earns) and

- the amount of earnings that must be retained to fund the expected growth rate

If we put all of that into a dividend model it will tell us, in broad terms, what sort of dividend the company could pay while still retaining enough earnings to grow at the rate outlined in the scenario.

Here is a snapshot of that model (which I built using my investment spreadsheet):

In the dividend model above, I assume that AG Barr will continue to earn returns on capital similar to its longer-term mid-teen average. I also assume that it retains enough earnings to fund the scenario growth rate of 4.5% to 2031, followed by a "perpetual" growth rate of 3.5%.

Under those conditions, AG Barr's dividend would start at 21p in 2023 and grow to 30p by 2031.

However, AG Barr's current dividend is 12p, so why am I assuming the dividend will almost double to 21p by next year?

The first thing to note is that the current 12p dividend is probably too low and reflects a cautious post-pandemic reinstatement of the dividend rather than the company's true dividend-paying potential. After all, the dividend almost reached 17p pre-pandemic and I think 17p would still be easily affordable today, given that its EPS this year was 25p.

The second thing to note is that AG Barr has historically returned cash to shareholders through buybacks as well as dividends, and in 2019 it paid dividends and buybacks totalling 25p per share.

To simplify things, my model assumes all future buybacks would be paid as dividends instead, and on that basis paying a 21p dividend next year would be no bigger than previous payouts.

And lastly, this is a scenario, not a forecast of what I think will actually happen. The truth is that I have no idea what will actually happen, and neither does anyone else.

However, we can come up with scenarios that are realistic and conservative and, given that this model estimates dividend payouts in line with historical norms, I do think it's realistic and conservative.

Estimating AG Barr's fair value

Having done the hard work of analysing the company and building a realistic and conservative scenario for its future dividends, now comes the easy bit.

We can estimate the company's "fair value" by discounting those estimated future dividends by a fair rate of return, which for me is the UK's long-term return from equities of 7%.

We can also estimate a target price or "good value" price by discounting those dividends by our target or hurdle rate of return, which for me is 10%.

If we do that (using an investment spreadsheet), we get the following estimates of fair value and good value:

- Fair value estimate: £6.14

- Good value estimate: £3.27

In other words, if we paid £6.14 to buy AG Barr's shares, and if the company actually paid out dividends exactly in line with the previous scenario, we would achieve an annualised total return of 7% per year.

And if we paid the good value price of £3.27, we'd get a 10% annualised return because the dividend yield would be higher.

Of course, these valuations are just estimates and they're based on my model. If your opinion of AG Barr differs from mine then your scenario and dividend model would be different, and therefore your estimates of good and fair value would be different.

But these valuations are mine and I think they're reasonable.

Is there a sufficient margin of safety between price and fair value?

Margin of safety is a central concept in any endeavour that involves risk, whether that's investing or building a bridge.

If you build a bridge then you want to build in a margin of safety, just in case trucks are heavier in the future than you ever thought they would be, or the wind blows harder than you ever thought it could.

Or, perhaps AG Barr's future will turn out to be worse than in my scenario, in which case my fair value and good value estimates will be too high.

Hopefully, that won't be the case because those estimates already have a built-in margin of safety in the form of conservative assumptions about returns on capital and growth prospects, but we can build in a further margin of safety by purchasing companies at prices that are comfortably below our good and fair value estimates.

In this case, AG Barr's share price is £5.70 at the time of writing. That's just 7% below my fair value estimate and, as margins of safety go, that's tiny.

If reality turns out to be even slightly worse than my scenario then £5.70 will end up being above the company's true fair value, and paying more than fair value is an almost guaranteed way to lose money.

To put some numbers on this, I measure the margin of safety in terms of where the share price is in relation to my good and fair value estimates.

It works on a sliding scale, for example:

- If the share price is equal to my good value estimate, the margin of safety is 100%

- If the share price is halfway between my good and fair value estimates, the margin of safety is 50%

- If the share price is equal to my fair value estimate, the margin of safety is zero

At £5.70, AG Bar has a margin of safety of 16%, which is nowhere near enough for me to want to invest in this admittedly high-quality business.

In fact, if it was already in my portfolio then I might be looking to sell. I could move the cash into other more attractively valued holdings and that's exactly what I've done.

Selling AG Barr as it's close to my fair value estimate

(Source: SharePad)

AG Barr joined the UK Dividend Stocks Portfolio and my personal portfolio back in September 2020, at a price of £4.51.

Unfortunately, that was more than I'd originally planned to pay. The week before, the shares were trading closer to £3.75 (fairly close to my "good value" estimate), but by the time I'd finished my analysis, they'd jumped up to £4.51.

If I'd bought the company at £3.75 the total return would have been 49% over 18 months, or almost 32% annualised, which of course is very good.

But in the end, I paid £4.51 per share, leaving me with a total return of 23% and annualised returns of 15% which is still above my 10% target.

Missing out on the lower purchase price was annoying, but these things happen and I'm not going to cry over a 15% annualised return.

However, AG Barr's share price has now almost reached my fair value estimate so it's time to sell up and move on. I sold the company at the beginning of May and the proceeds have been partially reinvested into other holdings with higher yields and significantly wider (estimated) margins of safety.

If you'd like to see the original purchase review, I've included it below along with the sale review originally published in the UK Dividend Stocks Newsletter:

The UK Dividend Stocks Newsletter

Helping UK investors build high-yield portfolios of quality dividend stocks since 2011:

- ✔ Follow along with the UK Dividend Stocks Portfolio

- ✔ Read detailed reviews of buy and sell decisions

- ✔ Quarterly, interim and annual updates for all holdings

- ✔ Quality Dividend Watchlist and Stock Screen

Subscribe now and start your 30-DAY FREE TRIAL

UK Dividend Stocks Blog & FREE Checklist

Get future blog posts in (at most) one email per week and download a FREE dividend investing checklist:

- ✔ Detailed reviews of UK dividend stocks

- ✔ Updates on the UK Dividend Stocks Portfolio

- ✔ UK stock market valuations

- ✔ Dividend investing strategy tips and more

- ✔ FREE 20+ page Company Review Checklist

No spam. Unsubscribe anytime.