For obvious reasons, markets were volatile this week and many UK stocks saw their share price absolutely crater.

To be frank, it was pretty shocking.

The FTSE 100 held up well and was only down about 9% from its recent high, mostly thanks to its large exposure to defence, mining, utilities and international stocks.

The more UK-focused FTSE 250 didn't fare so well and officially entered bear market territory this week, having fallen slightly more than 20% from its recent all-time high.

Table of Contents

- Don't Panic!

- This bear market has almost made the FTSE 250 cheap

- Those who cannot remember the past are condemned to repeat it

Don't Panic!

The most important thing for investors to do when they're greeted by collapsing share prices is to not panic.

You have to remember that the share price simply reflects the price at which you could buy or sell a company's shares if you chose to do so.

They do not necessarily reflect the intrinsic value of the company, i.e. the present value of its future cash returns to investors (typically in the form of dividends).

For example, one of my investments, ITV, fell an incredible 28% when it announced its recent annual results last Thursday, even though those results were quite upbeat.

Does that mean ITV's dividends are now going to be 28% lower than they were before?

Possibly, but let's look at how accurately the market priced ITV in the past:

- In 2009 you could buy ITV shares for 20p each

- In 2015 you had to pay 280p

- In 2020 you could snap them up for 60p

- And a couple of weeks ago they cost 125p and now they're 75p

Clearly, the market only has the very vaguest idea of what this company should be worth.

The same is true for all companies, to varying degrees.

So don't rely on Mr Market (or even Mrs Market) to tell you what a company is worth. You have to ignore the market price and come to your own conclusions about the intrinsic value of a company, or even a whole index like the FTSE 250.

And if the share price falls off a cliff, but your assessment of intrinsic or fair value remains broadly the same, the lower price could simply be an excellent opportunity to buy more shares at a lower price and with a higher dividend yield.

Does that mean I dived in and topped up my ITV position? Not yet, but if I find some pennies behind the sofa I might do.

ITV's board members obviously have more pennies knocking around than I do, because after the price decline the CFO bought £50k of shares and the Chair and CEO each bought about £100k of shares.

This bear market has almost made the FTSE 250 cheap

The UK stock market has been out of favour with investors since Brexit reared its head, and arguably it's been out of favour with UK investors since the UK's property bubble made buy-to-let the go-to investment for so many people.

Because of this general aversion to UK stocks, the FTSE 250 wasn't expensive even before this bear market, at least according to its cyclically adjusted PE or CAPE ratio.

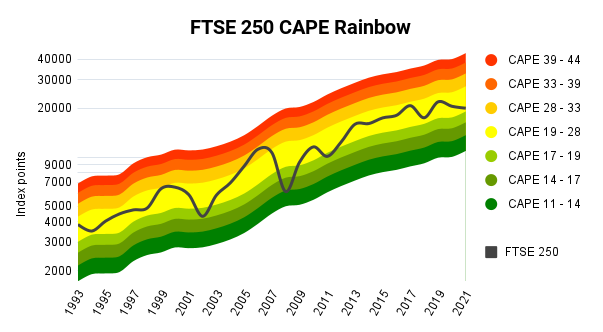

The chart above shows where the FTSE 250 currently sits in its valuation cycle. If you're not familiar with these charts, here's how it works:

- Red (very expensive) is where the FTSE 250 would be if it was trading close to double its long-run average CAPE of 22

- Yellow (fair value) is where the FTSE 250 would be if it was trading close to its long-term average CAPE

- Green (very cheap) is where the FTSE 250 would be if it was trading close to half its long-term CAPE

After its recent 20% fall, the FTSE 250's price is close to 20,000 and that gives it a CAPE ratio of 20.

That's slightly below its long-term average, which means that according to the CAPE ratio, the mid-cap index is trading slightly below fair value.

However, its valuation is only slightly below average, so it's still in the yellow zone in the above chart. From my point of view, that means it's still trading at fair value.

Given that the FTSE 250 is trading close to fair value, we should expect historically average returns, which means something like high-single-digit annualised returns over the medium to long term.

Those who cannot remember the past are condemned to repeat it

If you're nervous about this mini-crash, just look back to the past.

Investors (including my younger self) sold out during the dot-com bust as the FTSE 100 fell by 50%. The FTSE 100 briefly touched 3,300 at the moment of peak fear, and then more than doubled over the next four years.

In 2009, investors left, right and centre sold out in a panic. The FTSE 250 fell by 50% but within three years it had gained 100%, probably leaving most of those who sold in the dust.

And the same thing happened in 2020. The market crashed, lots of investors bailed out to escape the pain of seeing the "value" of their investments fall. And today we're about 40% up from those 2020 lows.

So bail out if you have to for practical reasons, or because the company you're invested in really is going down the pan, but try not to bail out for emotional reasons.

The UK Dividend Stocks Newsletter

Helping UK investors build high-yield portfolios of quality dividend stocks since 2011:

- ✔ Follow along with the UK Dividend Stocks Portfolio

- ✔ Read detailed reviews of buy and sell decisions

- ✔ Quarterly, interim and annual updates for all holdings

- ✔ Quality Dividend Watchlist and Stock Screen

Subscribe now and start your 30-DAY FREE TRIAL

UK Dividend Stocks Blog & FREE Checklist

Get future blog posts in (at most) one email per week and download a FREE dividend investing checklist:

- ✔ Detailed reviews of UK dividend stocks

- ✔ Updates on the UK Dividend Stocks Portfolio

- ✔ UK stock market valuations

- ✔ Dividend investing strategy tips and more

- ✔ FREE 20+ page Company Review Checklist

No spam. Unsubscribe anytime.