RM is a FTSE Fledgling stock with a share price of 38p and a dividend yield of more than 12%. The company paid a dividend in every one of the last ten years, it's a market leader and it has an above average track record of profitability.

Of course, a 12% dividend yield could be a sign of risk rather than opportunity, so is the market right to offer RM's shares at such a deep discount, or is a double-digit dividend yield always too good to be true?

We can begin to answer that by reviewing RM's business model.

RM is a market-leading supplier of educational products and IT services

RM's business is divided into three divisions:

RM Resources (about 55% of group revenue) is a bit like Amazon but for schools and nurseries. It operates through two subsidiaries: TTS designs and sells educational toys and other equipment, whereas Consortium is purely a supplier, supplying a broad range of more than 30,000 products to nurseries, primary schools and secondary schools.

RM Resources is the leading supplier in the UK and this division generates a small but not insignificant amount of revenue overseas.

RM Technology (about 30% of group revenue) provides strategic IT services, support and software to UK schools. In practical terms, it helps schools choose and set up computers, networks and other technology for teachers and pupils, and it provides ongoing support. It also supplies software to help schools with day-to-day management, network security, internet filtering and similar tasks.

RM Assessment (about 15% of group revenue) provides software and related services that enable exams to be created, taken and marked online, and for the results to be analysed online. As online assessment is still a relatively immature market, this division has perhaps the greatest potential for growth.

Looking at those three divisions, the first thing that strikes me is that RM seems to be two quite separate businesses. RM Resources is a designer and supplier of education toys and other physical products, while RM Technology and RM Assessment are IT services and software businesses. It isn’t entirely obvious to me why they should be part of the same group.

Perhaps this setup made more sense in the past.

Historically, RM (originally called Research Machines) designed, manufactured and sold computers and other IT hardware to educational institutions.

This was still the case in 2004, when RM acquired TTS. Both RM and TTS designed and sold physical products to schools, so I can (just about) see the logic in lumping them together. Consortium was then acquired in 2017, making RM Resources the UK's leading supplier of educational toys and equipment.

However, RM stopped producing computers in 2013 and since then, the IT side of the business (RM Technology and RM Assessment) has focused on IT services and software. This has left RM with a near 50/50 split between two very different businesses: Designing and supplying educational toys and equipment on the one hand and supplying IT services, software and support on the other.

In my experience, quality companies are usually highly focused companies, so RM's split personality is a yellow flag that breaks one of my rules of thumb:

- Rule of thumb: The core business should generate at least two-thirds of all revenue and profit

For me, the fact that RM owns two similar sized but very different businesses is a problem, because it suggests that management are either unaware of the focus required to build a high-quality business, or they're not looking to build a high-quality business. Either way, it isn't a good look.

Much of RM was acquired fairly recently

As I’ve already mentioned, RM acquired TTS in 2004 to expand into non-IT products, and that was followed by the acquisition of Consortium in 2017. The Consortium acquisition grew the non-IT part of RM from about 33% of revenues in 2016 to more than 50% today. As a result, the majority of RM's revenues now come from companies that were acquired within the last 20 years, with a significant chunk acquired within the last five years.

This is another yellow flag because it breaks another one of my rules of thumb:

- Rule of thumb: The core business should have been the core business for at least ten years

The problem is that RM's largest division wasn't built from scratch, from the ground up, using little more than blood, sweat and tears. This is a problem because building things from scratch is how real expertise and reputation are built.

Companies that are cobbled together from acquisitions usually suffer from poorly integrated systems, processes, cultures and pretty much anything else you can think of. They usually struggle along for a number of years before reaching an existential crisis, after which the acquired businesses are either fully integrated or separated.

An example of this would be GSK, which recently split into two highly focused businesses after struggling along for more than 20 years as a poorly thought-out pharmaceutical and consumer healthcare conglomerate (here's my post-split review of GSK).

In RM's case, it's still in the process of fully integrating TTS and Consortium through two major projects:

- Project Vanilla is a multi-year project to centralise the logistic operations of TTS and Consortium, from five warehouses to a single automated distribution centre. The new centre is up and running, but systems and processes are still being fine-tuned.

- Project Evolution involves rolling out a new IT platform for the whole business, in order to simplify and standardise procedures and processes and to benefit from economies of scale. Perhaps unsurprisingly, this major IT project is costing more and taking longer than expected.

RM has a lot of debt

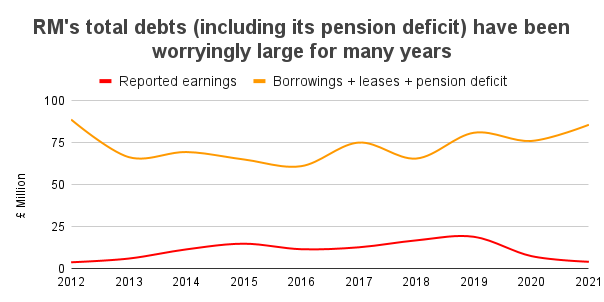

As recently as 2016, RM had a clean balance sheet with a few lease liabilities and no borrowings, but since then, its debts have increased almost every year. In the last two years, debts have approximately doubled, largely to fund Project Vanilla and Project Evolution.

In RM’s 2022 half-year results, the balance sheet showed borrowings and lease liabilities totalling £64 million. If we compare those debts to RM's ten-year average earnings of £11 million, we get a debt-to-earnings ratio of 5.9.

This is another yellow flag because it breaks another rule of thumb:

- Rule of thumb: Avoid companies where the debt to average earnings ratio is above four (or five for very defensive companies)

Breaking this rule is a problem because debt obligations are fixed while the earnings that pay for them are not. If RM's earnings go down while its interest payments go up, that could force the company to suspend its dividend, which is something that I and other dividend investors obviously want to avoid.

RM has a massive pension

Unfortunately, RM has an even bigger financial obligation in the form of a massive defined benefit pension scheme.

RM's pension obligations are currently valued at just over £300 million. That's almost 30-times its average earnings. For me, this is a red flag that completely obliterates one of my rules of thumb:

- Rule of thumb: Avoid companies where pension obligations are more than ten-times average earnings

This huge pension scheme is a problem because RM is legally obliged to pay enough cash into the pension to reduce any pension deficit to zero.

Over the last ten years, the deficit has varied from about £40 million to about £50 million. That is effectively another form of debt, so RM has been pumping about £5 million per year into the pension to close that deficit. Remember that RM earns about £11 million per year on average, so a £5 million deficit reduction payment, every year for a decade, is huge.

The actuarial pension deficit is now down to £22 million, but if we add the pension deficit to RM's £64 million debt pile, the company's total debts increase to £86 million.

That gives RM a total debt-to-earnings ratio of almost eight, compared to my cut-off point of four (or perhaps five at the very most).

That is a second red flag and as a result, I'm going to end the review there.

RM is not a high-quality dividend stock

To summarise all of the above, I wouldn't call RM a quality dividend stock because it has too many problems:

- Yellow Flag #1: RM is unfocused, with revenues split almost 50/50 between two very different businesses

- Yellow Flag #2: RM's largest division (RM Resources) was built from companies that were acquired fairly recently

- Yellow Flag #3: RM has a debt-earnings ratio of almost six compared to my preferred maximum of four

- Red Flag #1: RM has massive pension obligations totalling almost 30-times its average earnings

- Red Flag #2: Including its pension deficit, RM's total debt-earnings ratio is almost eight, which is almost double my preferred limit of four

Unfortunately, the combination of high debts, ongoing pension deficit reduction payments and the cost and disruption of integration projects has led to a cash crunch and RM's dividend was suspended at its half-year results in August.

Management intends to review the dividend at year-end, but I think reinstating it would be a mistake.

In my opinion (which I'm sure management doesn't care about), RM should:

- Sell off the non-IT-focused RM Resources business (it's the UK market leader so it should fetch a reasonable price)

- Use the proceeds to remove the actuarial pension deficit and pay down debt

- Fully de-risk the pension by selling it to a life insurer or pensions consolidator

- Complete the IT integration project for the remaining RM Technology and RM Assessment divisions

- Only reinstate the dividend once debts have been reduced to sensible levels

Perhaps at some distant point in the future I would be willing to invest in RM, but for now, it's more suited to investors who are looking for deep value turnarounds.

That isn't me, so I will be adding RM to my Blacklist and I won't be reviewing it again for at least five years. Until then, I wish RM, and all who sail in her, the very best of luck.

The UK Dividend Stocks Newsletter

Helping UK investors build high-yield portfolios of quality dividend stocks since 2011:

- ✔ Follow along with the UK Dividend Stocks Portfolio

- ✔ Read detailed reviews of buy and sell decisions

- ✔ Quarterly, interim and annual updates for all holdings

- ✔ Quality Dividend Watchlist and Stock Screen

Subscribe now and start your 30-DAY FREE TRIAL

UK Dividend Stocks Blog & FREE Checklist

Get future blog posts in (at most) one email per week and download a FREE dividend investing checklist:

- ✔ Detailed reviews of UK dividend stocks

- ✔ Updates on the UK Dividend Stocks Portfolio

- ✔ UK stock market valuations

- ✔ Dividend investing strategy tips and more

- ✔ FREE 20+ page Company Review Checklist

No spam. Unsubscribe anytime.