For most companies, recessions cause a short-term dip in earnings and perhaps even dividends, but recessions are also an opportunity for the strong to take market share from the weak.

That’s because recessions cause more damage to weak companies, with many of them failing during the recession or shortly after, at which point their customers switch to a stronger competitor.

Fashion brands and retailers are very economically sensitive, so Next, BHS, Debenhams, Topman and Topshop have all been good examples of this dynamic over the last decade or so.

On the one hand, Next (which is in my personal portfolio and the UK Dividend Stocks Portfolio) is an example of an exceptionally well-run business, combining a robust balance sheet with a long-term outlook focused on adapting to a changing world. This combination of robustness and adaptability has helped Next sail through recent recessions and downturns while successfully transitioning from a leading store-based retailer to a leading online retailer.

On the other hand, BHS, Debenhams, Topman and Topshop all suffered from owners that were interested in extracting as much cash as possible as quickly as possible, and in the process these companies were saddled with huge debts, demotivated staff and outdated infrastructure.

Each of these poorly-run businesses has struggled since the 2008-2009 financial crisis and the pandemic finished them off. Their failure benefitted Next as it was able to hoover up customers who had been let down by these underinvested and unsatisfactory businesses.

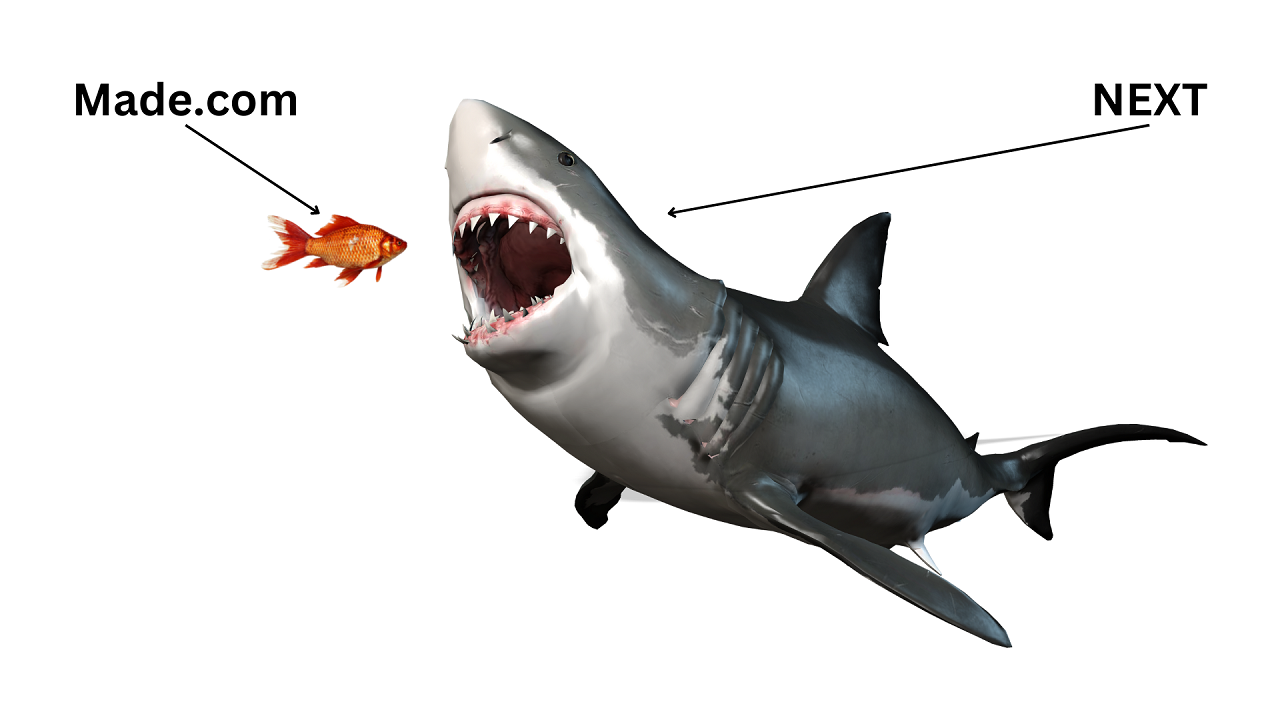

A similar story played out in November with the demise of Made.com, a once-leading homewares retailer.

Made.com was valued at £775 million in mid-2021, but strategic errors during the pandemic led to its collapse in November. Shortly after Made.com went bust, Next hoovered up the brand for £3.4 million and will probably hoover up many of its customers as well.

As one somewhat unsavoury saying puts it: The weak are meat and the strong do eat.

The UK Dividend Stocks Newsletter

Helping UK investors build high-yield portfolios of quality dividend stocks since 2011:

- ✔ Follow along with the UK Dividend Stocks Portfolio

- ✔ Read detailed reviews of buy and sell decisions

- ✔ Quarterly, interim and annual updates for all holdings

- ✔ Quality Dividend Watchlist and Stock Screen

Subscribe now and start your 30-DAY FREE TRIAL

UK Dividend Stocks Blog & FREE Checklist

Get future blog posts in (at most) one email per week and download a FREE dividend investing checklist:

- ✔ Detailed reviews of UK dividend stocks

- ✔ Updates on the UK Dividend Stocks Portfolio

- ✔ UK stock market valuations

- ✔ Dividend investing strategy tips and more

- ✔ FREE 20+ page Company Review Checklist

No spam. Unsubscribe anytime.