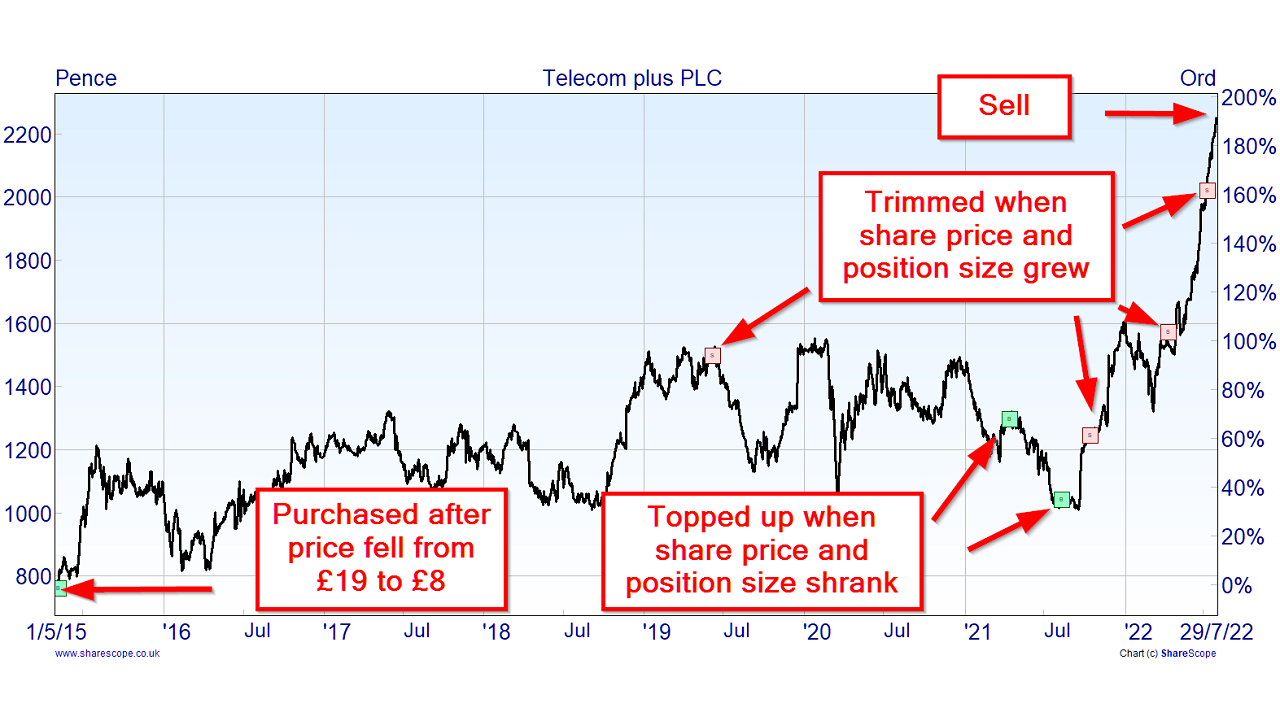

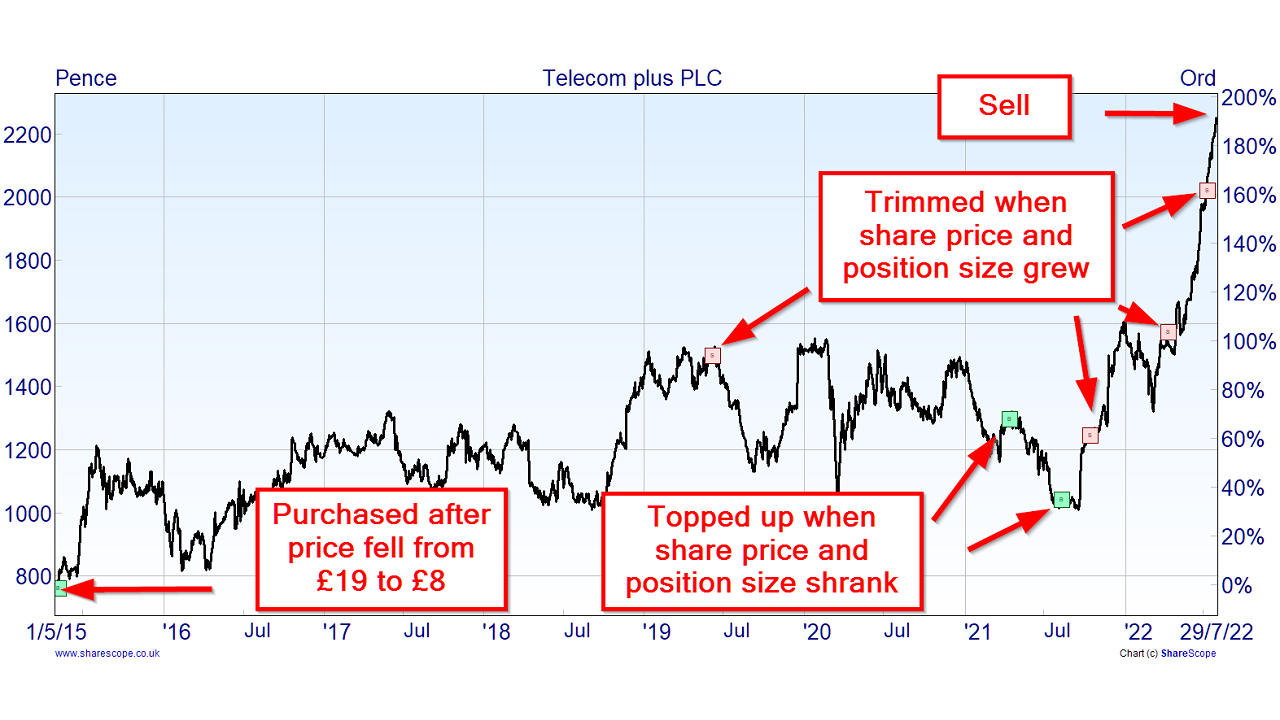

I bought my first Telecom Plus shares in May 2015, shortly after the share price had plunged from £19 to £8.

It was impossible to know exactly why the share price had fallen that far, but the company’s growth was slowing, and it had just announced a write-down on its gas supply business.

After that share price collapse, Telecom Plus had a dividend yield of 4.6% and (in my opinion) still healthy growth prospects, so I added it to my personal portfolio and the UK Dividend Stocks Portfolio at £7.61 per share.

That was seven years ago, and since then, the company has grown its customer base by 25%, revenues by 33% and dividends by 42%, and today its growth prospects seem better than ever.

The market has finally recognised this, and over the last year, Telecom Plus's share price has increased by more than 100%, taking it all the way up to £22.50. That's a gain of more than 200% over seven years, which is extremely good for what is essentially a very defensive dividend stock.

However, despite all this good news, I've decided to sell Telecom Plus.

To many investors, that will sound counterintuitive, so in this post-sale review, I want to explain (a) why I still think Telecom Plus is a quality dividend stock, (b) why I decided to sell and (c) what the share price would need to be for me to switch from selling to buying.

Note: If you prefer reading PDFs, here's the original Telecom Plus Sale Review, extracted from the August issue of the UK Dividend Stocks Newsletter.

Table of contents

- Is Telecom Plus a quality business?

- A multi-service utility provider with a focused core business

- A business model that is unique among UK utility companies

- A track record of consistent and sustainable growth over many years

- A track record of consistently good profitability

- A valuable, rare and hard-to-replicate competitive advantage

- Switching costs are both a benefit and an obstacle

- Is Telecom Plus a defensive business?

- Are Telecom Plus shares good value?

The first thing I look for in a quality business is focus, so let's start there.

A multi-service utility provider with a focused core business

Telecom Plus started life in the 1990s, selling widgets that automatically routed your phone calls to whoever's network was cheaper than BT. It soon morphed into a "virtual re-seller" of utility services supplied by other companies and it has been focused on that niche ever since.

Trading as the Utility Warehouse (UW), Telecom Plus supplies its customers with gas and electricity, telecoms services (landline, broadband and mobile) and, more recently, home insurance.

Even though it offers an industry-leading range of services, Telecom Plus’s business is far more focused than most of its larger competitors. That’s because, to varying degrees, most of the large utility companies are involved in the physical process of creating and distributing electricity, gas or telecom services.

Depending on the services they supply, they own wind farms, power stations, pipelines, telephone exchanges or mobile phone masts. On top of all that, they have customer-facing operations with websites and call centres.

In contrast, Telecom Plus is 100% focused on customer acquisition and customer support. In other words, it's a virtual re-seller that doesn’t own any of the underlying infrastructure or create any of the underlying services.

This allows it to excel at customer acquisition, service and retention while leaving its suppliers (companies like EE for mobile services or e.on for gas and electricity) to deal with all the headaches associated with operating, maintaining and upgrading complicated physical infrastructure.

A business model that is unique among UK utility companies

Telecom Plus's stated goal is somewhat unusual, as it isn’t focused on shareholders or customers. Instead, like Admiral (the car insurer, which I currently hold), it takes an employee-focused approach by saying:

“Our overall purpose as a business is to help our Partners achieve their personal goals, whatever they may be, through their involvement with UW”

The company’s "Partners" are its army of almost 50,000 mostly part-time salespeople, who turn friends, family and other people they meet into customers via word-of-mouth marketing.

These Partners are a key component of Telecom Plus’s strategy and are one of the main features that make the company highly effective. This unique strategy is best described by contrasting it with the strategy of almost all its peers.

Most utility suppliers compete first and foremost on price because utility services are commodities. In other words, there is little or no difference between the gas and electricity supplied by Utility Warehouse and the gas and electricity supplied by British Gas.

Because they compete primarily on price, most utility suppliers are on price comparison websites such as Moneysupermarket (which I currently hold).

The basic strategy is to offer unsustainably low prices to attract new customers. However, unsustainably low prices are, by definition, unsustainable, so over time, these suppliers will gradually charge these newly acquired customers more and more until they become profitable enough to offset the cost of offering unsustainably low prices in the first place.

Unfortunately, this business model has some serious downsides because it attracts customers who are (a) looking for the lowest price and (b) willing and able to switch.

Taken together, those two facts make it very hard for utility suppliers to raise prices for very long. As soon as one of these bargain-hunting customers reaches the end of their initial low-cost contract, they’ll be looking to switch to whoever is offering the lowest and most unsustainable price.

This leaves the utility suppliers with high customer acquisition costs (in the form of fees paid to price comparison websites and losses from unsustainably low pricing) and high rates of customer churn, which means they spend a lot of money acquiring customers who leave before they ever generate much in the way of profit.

Telecom Plus’s business model is the complete opposite. Instead of attracting customers by offering unsustainably low prices, it offers:

- Simplicity: The simplicity of a single supplier for gas, electricity, landline, broadband, mobile and home insurance, with a single account and a single monthly payment and bill

- Savings: Prices that are consistently below the average standard rate of the big suppliers, with no price walking and no ripping-off of loyal long-term customers

- Service: A customer service team that has won more than 70 awards over more than 25 years

These features appeal to people who don’t want to spend their valuable time and energy switching a myriad of utility services every year or two just to shave a few percent off their bills. These people are typically older and/or wealthier homeowners so that demographic is Telecom Plus’s ideal customer.

The problem is that these people are hard to reach. They don’t like going on comparison websites, and they’ll only switch suppliers if there’s a problem or if the supplier pushes the price up to ridiculous levels. This is where Telecom Plus’s army of Partners comes in.

Partners are primarily part-time people, and many of them are customers. They can earn a bit of money on the side, part-time, or they can make being a Partner into a lucrative full-time business. Telecom Plus does virtually no advertising, so Partners spread the word using word-of-mouth, promoting the company to family, friends and other people they meet.

This personal approach allows Telecom Plus to reach customers other suppliers cannot reach, and it’s a proven way to convince people who don’t like switching that switching to UW is worth the effort (because it's the last switch they'll ever need to make).

A track record of consistent and sustainable growth over many years

I have several rules of thumb relating to growth:

- Only invest in companies that have grown ahead of inflation over the last decade

- Only invest in companies where growth is consistent rather than sporadic

- Only invest in companies where growth is funded primarily by retained earnings rather than debt

In terms of growth rate and consistency, Telecom Plus's differentiated strategy has allowed it to produce very consistent and sometimes extremely fast growth over almost three decades.

Focusing on the last ten years, Telecom Plus grew by around 5% per year, with that growth being consistent and broad-based across revenues, earnings, capital employed and dividends.

As for the sustainability of that growth, it was mostly funded by retained earnings rather than borrowings or lease liabilities, and Telecom Plus's debts are relatively prudent at 3.2-times the company's average earnings (my definition of "prudent" is a debt-earnings ratio of less than 5-times).

As a quick aside, you might have spotted that the dividend has been uncovered since 2016.

In most cases, this would be a serious red flag, typically indicating that the dividend is unsustainable. However, in this case, it is more a quirk of accounting than anything else.

The root cause goes back to 2014 when Telecom Plus entered into a 20-year agreement to supply its customers with gas and electricity from npower (now e.on). The deal cost Telecom Plus £220 million, paid almost entirely up-front, and that left it with a £220 million intangible asset on the balance sheet.

This intangible asset is being amortised by £11.2 million per year until 2034. Amortisation is an expense that reduces earnings, but it’s a non-cash expense, so it doesn’t affect the company’s ability to pay dividends.

If we ignore that non-cash expense, the dividend has been comfortably covered over the last decade, so as far as I’m concerned, the “uncovered” dividend isn’t a problem.

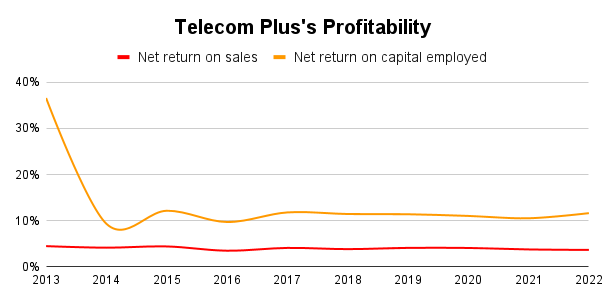

A track record of consistently good profitability

I have a couple of rules of thumb relating to profitability:

- Only invest in companies where the return on capital is consistently above 10%

- Only invest in companies where the profit margin is consistently above 5%

Telecom Plus’s capital-light, no-infrastructure approach really shows up in its return on capital, which has been consistently above 10% for at least the last two decades. For many companies, a 10% return on capital is nothing to shout about, but it really is exceptional among UK utility suppliers.

In the chart above, 2013 is a bit of an outlier because it covers the period before the npower supply deal. Return on capital was much higher because Telecom Plus’s capital didn’t include the £220 million intangible asset, and earnings weren't being reduced by the amortisation of that asset. If you ignore 2013, the rest of the chart shows Telecom Plus's consistent 10%-plus return on capital.

As for the return on sales, this comes in at a less impressive 4%. So, how did Telecom Plus make it into the portfolio with such thin profit margins? The answer is that I didn’t pay much attention to profit margins in 2015, so I didn’t have minimum standards for it.

Perhaps more importantly, my various rules are only rules of thumb, so they can be broken if it seems reasonable to do so. In this case, even if I had a 5% minimum profit margin rule in 2015, I would still have added Telecom Plus to the portfolio.

That’s because utility suppliers are low-margin by nature, so Telecom Plus’s 4% profit margin reflects industry norms rather than competitive weakness.

A valuable, rare and hard-to-replicate competitive advantage

The only way to consistently produce above-average returns in a competitive market is to have a durable and low-cost competitive advantage. In this case, I think the combination of Telecom Plus’s unique business model and the assets that underpin it is a valuable, rare and hard-to-replicate advantage.

The army of almost 50,000 Partners is its business model's main asset. Using the VRIO framework for assessing assets, Telecom Plus’s army of Partners is:

- Valuable: They are valuable because they enable the company to reach extremely loyal, non-switching, high-value customers that other suppliers cannot reach.

- Rare: They are rare because Telecom Plus is the only UK supplier of any meaningful scale (and it may be the only supplier) that has an army of 50,000 word-of-mouth salespeople.

- Inimitable: Telecom Plus has taken more than 25 years to build its army of Partners. This is replicable by other companies, but it would take years, by which point Telecom Plus’s army would likely have grown even further in scale and effectiveness.

- Organised (to capture value): An army of network marketing Partners isn’t enough to generate outsize profits and growth. The company has to be well-organised and effectively run to benefit from that army, and I think Telecom Plus’s long history of success is strong evidence that it fits that description.

Switching costs are both a benefit and an obstacle

Switching costs are things that stop customers from leaving, such as the hassle associated with switching investment platforms or bank accounts.

When it comes to utilities, finding a new supplier takes time and effort, and the switching process can take weeks. In many cases, there is a legal barrier to exit in the form of a long contract, which you can only get out of by paying all of the remaining monthly payments up-front.

This is a benefit to Telecom Plus, especially as it most of its customers take multiple services. In other words, a customer who gets their gas, electricity, landline, broadband, mobile services and home insurance through Utility Warehouse has a lot of work to do if they want to switch all of that to other suppliers ("other suppliers" being plural as no other single supplier offers all of those services).

This switching cost helps the company retain customers for longer, especially as it focuses on customers who don’t want to switch in the first place.

Unfortunately, those switching costs also act as a barrier when Telecom Plus is trying to get prospective customers to switch from their existing suppliers to Utility Warehouse. They already have contracts with multiple suppliers and don’t want to switch anyway, so persuading them to do so isn't easy.

This is precisely why Telecom Plus uses a face-to-face (in-person or online) selling process. Partners can walk prospective customers through the switching process, explaining the details of what’s going to happen and helping them decide which services to switch based on the switching costs (if any) of their various existing suppliers.

Surprisingly little impact from commodity prices

We've just been through a significant energy supplier crisis in the UK, where dozens of suppliers went bust because energy prices skyrocketed, but the UK's energy price cap meant they couldn't pass those input cost increases onto customers.

Telecom Plus sidestepped that fate because it had already experienced its own energy crisis in 2006.

Back then, it bought gas and electricity on the wholesale market. It entered the market when prices were high, so competitors who had been in the market for years had been able to buy at much lower prices. This enabled them to sell gas and electricity at prices that were unprofitable for Telecom Plus, so the company was consistently losing money in its energy business.

In 2006, Telecom Plus's energy business caused a loss for the overall business, so management set up the energy deal with npower. The deal was that Telecom Plus's customers would get all their gas and electricity from npower at a discount to the average standard price of major suppliers like British Gas.

That small discount gave Telecom Plus enough room to cover the cost of its overheads while making a small profit margin on the overall energy business. More importantly, all of the risks and complexities of commodity hedging were passed over to npower, who had much more experience in that side of the energy business.

Thanks to that deal, Telecom Plus is better insulated from energy price volatility than any of its peers, and that's why it came through the recent energy supplier crisis without a scratch.

The core market is expected to continue growing...

We've already looked at Telecom Plus's past growth, but what income investors really want is dividend growth long into the future.

On that front, the UK's energy, telecoms and home insurance markets are all relatively mature and stable. Having looked at various forecasts, the general consensus is that these markets are expected to grow broadly in line with UK population growth (about 0.2% per year) and inflation (hopefully 2% per year) for the foreseeable future.

The company’s share of the combined UK energy, telecoms and home insurance markets is just 2%, so there is plenty of room to grow faster than the overall market for many years to come.

...but that core market is at risk of disruption

Despite the mature and stable nature of Telecom Plus's core markets, the future isn't entirely rosy.

The UK's energy regulator (Ofgem) thought the relatively small number of major UK energy suppliers allowed those suppliers to generate excess profits by operating as an informal cartel. To fix that, it spent much of the last decade introducing new rules to increase competition and reduce profits.

Unfortunately, this regulation was poorly thought through and, in my opinion, was driven more by short-term political considerations (showing that the government is on the side of the people versus "evil" corporations) rather than considerations of what was likely to improve the energy market (assuming it even needed improving).

The regulator made it easier for new competitors to enter the market and introduced a price cap to limit profits. The net outcome was the recent collapse of dozens of those new energy suppliers.

This is a good reminder that heavily regulated markets will occasionally see abrupt, unexpected and disruptive regulatory change.

Given the debacle of the last few years, I have no faith that the UK's energy regulator won’t make similarly ill-judged changes in the future.

This is clearly a risk that defensive dividend investors need to be aware of because they often invest in utilities. The key, as always, is to focus on companies that have decades of experience, high profitability and low debts and to diversify wisely in case regulators do something daft.

There is also some risk from supplier concentration

Another risk that crops up now and again is concentration risk, where one supplier, customer, employee or product disappears, taking most of the business with it.

In this case, Telecom Plus uses a single supplier for each of the utility services it supplies to customers. This is a significant risk, so Telecom Plus tries to reduce that risk in various ways:

- Large suppliers: These suppliers are all large and well-established companies like e.on, TalkTalk and EE.

- Long contracts: Like the 20-year energy deal with e.on, these contracts typically last well over a decade, giving Telecom Plus plenty of time to find a new supplier

- Attractive proposition: These contracts are in high demand because they give suppliers access to parts of the market they cannot usually reach.

Given these attributes, I think it's very unlikely that a supplier would (a) go bust, (b) try to get out of a contract early or (c) that a replacement supplier or suppliers couldn't be found.

The UK energy market crisis is a big opportunity for Telecom Plus

Although the UK energy market is in a mess right now, with the price cap still forcing suppliers to sell energy far below cost, Telecom Plus’s differentiated business model and prudent approach have turned this crisis into a significant opportunity.

Most of the hard-discounting suppliers have gone bust, and almost all of the suppliers have set their prices equal to the price cap. As the only supplier with such a broad range of utility services, Telecom Plus is uniquely positioned to cross-subsidise its energy business with telecoms and home insurance profits.

For a while (it may or may not still be true), Telecom Plus was the cheapest energy supplier in the UK, as MoneySavingExpert has pointed out.

This leaves Telecom Plus in an exceptionally strong position, and management is hopeful that the company can grow very quickly over the next five years, which is how long it could take for new upstart competitors to scale up to the point where they are once again a nuisance.

In addition, the cost-of-living crisis is expected to be a strong tailwind because (a) people are looking to save money on their utilities (and UW is currently the cheapest energy supplier) and (b) people are looking for an additional part-time income, such as promoting UW as one of its Partners.

This expected medium-term growth is already coming through, with total customers growing by 10% in just the second half of FY 2022. Management expects that to continue and hopes to more than double the business's size over the next four or five years.

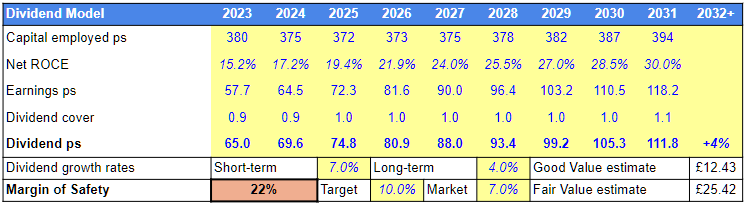

Estimating fair value by estimating future dividends

So far, we've looked at the business of Telecom Plus, and as I said at the beginning, I still think this is very much a quality defensive dividend stock.

However, quality and defensiveness aren't the only factors that make a good investment. If we overpay for an investment, our expected returns will be poor, so in addition to quality and defensiveness, we also need to think about valuation.

In theory, a company is worth the present value of all its future dividends, discounted by your target rate of return, so if we want to estimate a company's fair or intrinsic value, we need to build a model of its future dividends.

My models are centred around a company's return on capital employed and its ability to retain earnings to fund future growth.

For Telecom Plus, my model uses the following assumptions:

- Return on capital gradually improves over the next decade as the £220 million intangible asset is amortised away to almost nothing

- The company pays a progressive dividend, starting at 65p for 2023, as per management guidance

- Growth is funded purely with retained earnings

- Telecom Plus's long-term growth rate caps out at 4%, slightly above the expected long-term UK growth rate of 3% or so

Taken together, those assumptions produce the following dividend model:

(If you'd like to try your hand at building a discounted dividend model like this one, feel free to use my Dividend Stocks Spreadsheet.)

The model includes three important numbers:

- Fair value is the present value of those estimated future dividends, discounted by 7% per year. In other words, if the dividend model was 100% accurate (which, of course, it won't be) and you paid the fair value price, then you would receive a return of 7% annualised over the remaining life of the company. 7% is assumed to be "fair" as it's equal to the UK market's long-term rate of return.

- Good value is the same as fair value but uses a 10% discount rate (my target return rate).

- Margin of Safety tells you where the share price is relative to both good and fair value (the margin of safety is 100% when the share price equals the good value price and zero when it equals the fair value price)

As you can see from the table above, my estimate of Telecom Plus's fair value is £25.42.

At the time of writing, the share price was £22.50. That's only slightly below the fair value estimate, and that's why the margin of safety is just 22% (my preferred margin of safety is 100%).

On that basis, Telecom Plus didn't seem to be overvalued at £22.50, but it didn't seem to be especially good value either.

Or, looking at it in a more conventional way, at £22.50, Telecom Plus had a dividend yield of 2.5% and an expected growth rate of between 4% and 7%. If we use the simple yield-plus-growth estimate for expected returns (total returns are the sum of income yield plus capital growth), that gives an expected annual return of about 8% (2.5% from income plus about 5.5% from growth).

That's only slightly above the FTSE 100's 7% expected long-term return, which again suggests that Telecom Plus wasn't especially attractive at £22.50.

Selling Telecom Plus after rapid gains brought the share price close to fair value

Almost exactly a year ago, Telecom Plus was trading at £10.50, comfortably below my "good value" estimate. The UK’s energy supply crisis was unfolding, and investors were treating energy suppliers like hot potatoes, desperate to offload them in case they got burned.

But if you looked at Telecom Plus in detail, it was clear that this business was completely different to all of the now-failed suppliers.

Since then, the shares have gone up more than 100% as Telecom Plus repeatedly surprised investors with good news.

At the beginning of August, the price had almost reached my estimate of fair value, so on that basis, I decided to sell up and reinvest the proceeds into some of my other holdings that seemed to be far more attractively valued, with significantly higher dividend yields.

More specifically, I sold Telecom Plus on August 5th at £21.80.

Over the seven-year holding period, the investment produced capital gains of 71.8% and a total dividend income of 15.4%, for a total return of 87.2%. On an annualised basis, that came to 23.5%.

In summary, this was a very successful investment, and I would be more than happy to have Telecom Plus back in the portfolio, but only at a more attractive price.

Ideally, that price would be my good value price of £12.43. However, I'm a pragmatist, so I might be tempted to reinvest at something slightly above that level, but only slightly above.

The UK Dividend Stocks Newsletter

Helping UK investors build high-yield portfolios of quality dividend stocks since 2011:

- ✔ Follow along with the UK Dividend Stocks Portfolio

- ✔ Read detailed reviews of buy and sell decisions

- ✔ Quarterly, interim and annual updates for all holdings

- ✔ Quality Dividend Watchlist and Stock Screen

Subscribe now and start your 30-DAY FREE TRIAL

UK Dividend Stocks Blog & FREE Checklist

Get future blog posts in (at most) one email per week and download a FREE dividend investing checklist:

- ✔ Detailed reviews of UK dividend stocks

- ✔ Updates on the UK Dividend Stocks Portfolio

- ✔ UK stock market valuations

- ✔ Dividend investing strategy tips and more

- ✔ FREE 20+ page Company Review Checklist

No spam. Unsubscribe anytime.