4imprint Group PLC is a FTSE 250-listed promotional products distributor, primarily in the US and Canada with a significantly smaller UK & Ireland business on the side.

4imprint is also an excellent example of a quality dividend-paying business, with a long and consistent track record of double-digit growth, high profitability and low debts.

It was the company's quality that attracted me to it in June 2020, along with a share price of £25 and a dividend yield of 2.7%. Now, I'll be the first to admit that 2.7% isn't great as dividend yields go, but it is if you factor in the company's long track record of double-digit growth.

So, in mid-2020 I added 4imprint to my personal portfolio and the UK Dividend Stocks Portfolio, and of course that 2.7% dividend never arrived because the pandemic got in the way.

But one missed dividend isn't a big deal, and as a long-term investor I was more interested in how quickly 4imprint would recover when pandemic-related restrictions were removed.

In the end, the company recovered quickly and in August this year, its share price exceeded £40. That was above my estimate of fair value, so I decided to sell, lock in those capital gains and reinvest the proceeds into another holding with a more attractive share price and dividend yield.

My investment in 4imprint was both short and very profitable, so in the rest of this review, I want to explain why I think 4imprint is a quality dividend stock, why I bought and sold it when I did, and why I would be happy to buy it again at the right price (and I'll also tell you what that price is).

Table of Contents

- Quality:

- Defensiveness:

- Valuation:

4imprint has been a very focused business for a very long time

When I'm looking for a quality dividend-paying company, one of the first things I look for is a long and consistent history, ideally with the company operating in a relatively narrow niche for at least several decades.

In 4imprint's case, it was founded in the mid-1980s by Richard (Dick) Nelson and was originally called Nelson Marketing. Nelson started out writing direct marketing sales letters for his father's car dealership, but after a while he began writing direct marketing letters for other clients.

The company's speciality was writing direct marketing letters on behalf of banks. It would write letters to prospective customers, offering them free toasters or other gifts if they opened a new current account. Unfortunately, "bank premiums" (as these free gifts were known) were quickly banned and Nelson Marketing was effectively out of business.

But Nelson didn't give up, and in 1987 the company pivoted from writing direct marketing letters for clients to using direct marketing to sell customised promotional products, just like the toasters previously given away by banks.

In the beginning, this meant buying a list of small-business names and addresses and sending them a letter, offering them a promotional products catalogue for free. The first catalogue was 12 pages long and went out to 250,000 businesses and it was immediately successful.

In 1988, Nelson sold a chunk of the company to a catalogue business and in 1996 the business was purchased outright by Bemrose Corporation, a UK-based manufacturing and printing business with a history of printing railway timetables and, more recently, railway tickets.

Bemrose had an acquisitive history and it showed, as the business was made up of various loosely related subsidiaries with little or no meaningful synergies.

When Nelson Marketing was acquired, it already had an impressive record of growth and it soon began to outgrow the other Bemrose subsidiaries. In 2000, Nelson's founder became CEO of the overall group, changed its name from Bemrose to 4imprint and sold off the UK printing business through a management buyout.

Around the same time, the direct marketing business started to focus on internet sales and it developed the industry's first transactional website, 4imprint.com.

Over the next decade or so, the other Bemrose subsidiaries were gradually sold off and, by 2013, there was nothing left except the direct marketing business.

In terms of focus then, the remaining direct marketing promotional products business has done almost nothing but sell promotional products to small and medium-sized businesses, mostly in the US, for almost four decades.

A consistent goal and strategy for well over a decade

In addition to a long and consistent focus on a narrow core market, quality companies also tend to pursue the same goal with more or less the same strategy for many years.

4imprint’s goal is to grow its revenues and profits both organically and sustainably. It’s a nice, simple goal that the company has aimed for since at least 2013, when the last Bemrose-related business was finally offloaded.

The company’s strategy for achieving that profitable, organic revenue growth has also been extremely consistent over more than 20 years.

4imprint is, in essence, a promotional products distributor. In other words, it's a marketing and order taking machine that connects promotional product manufacturers and printers with small and medium-sized business customers.

4imprint’s strategy consists of four main components:

1. Sophisticated direct marketing to acquire leads at low cost

4imprint has driven most of its growth by marketing directly to the specific person within a small business who is responsible for ordering promotional products. For example, 4imprint might buy a list of 250,000 relevant names and addresses, send each person on the list a highly optimised, high-conversion sales letter and then wait for website visits, sales and phone orders to come flooding in.

At least, that was the story for most of its history, but in recent years, 4imprint has gradually increased its online advertising and, in 2018, it launched brand marketing on TV and radio.

This shift away from direct marketing and towards brand marketing has worked better than expected, with the company’s key marketing metric (revenue generated per dollar of marketing spend) increasing from less than $6 pre-pandemic to more than $8 in 2022.

This is important because it shows that 4imprint is successfully adapting to a world where fewer people are willing to interact with the traditional direct marketing tools of cold sales letters and emails.

2. An exceptional offer to convert leads into customers

To convert visitors and leads into customers, 4imprint has an impressive offer, including free samples and free help with artwork, combined with jaw-dropping guarantees around delivery (on time or your money back), value (refund of double the difference if you find the same service cheaper elsewhere) and satisfaction (100% satisfaction or get a full refund or have the order re-run for free).

Customer service is where the real magic happens, because 4imprint puts customer satisfaction at the heart of its business. Actually, that isn’t quite right. It puts employee satisfaction at the heart of the business and that leads to customer satisfaction.

Just look at the 4imprint.com website; it’s covered in pictures of staff, proudly showing their names and how long they’ve worked at the company. This is very similar to Admiral insurance (which I currently hold), where a focus on employee satisfaction reduces employee churn, which reduces recruitment costs and increases the average employee’s experience level (and therefore productivity).

3. A capital-light way to fulfil customer orders

4imprint rarely touches the products that customers buy from its website. Instead, when a customer places an order, 4imprint's staff help with design work and the order then goes off to one of 4imprint’s suppliers. The suppliers do all the manufacturing and custom printing, and they also ship the product directly to the customer, which is known as drop shipping.

This is good because, unlike Headlam (the UK's leading floorcovering distributor that has to store hundreds of tonnes of carpet in its warehouses, and which I also currently hold), 4imprint doesn’t have to spend money on warehouses, it doesn’t have to fill those warehouses with inventory and it doesn’t need vehicles to deliver products to customers.

Of course, suppliers still need those things so 4imprint still has to pay for them, but it only pays for them once a customer has already placed an order. Because of that, it has very few fixed overheads and is very cash generative, and that’s part of the reason why it was able to retain all of its highly-valued employees through the pandemic, even though orders fell by as much as 80%.

4. Blue boxes to maximise customer lifetime value

Having turned a lead into a customer, 4imprint’s next job is to turn that customer into a loyal repeat-purchase customer, and its tool of choice for that job is the Blue Box.

The Blue Box is literally a blue box that 4imprint sends out to customers on a regular basis. The box usually contains a variety of product catalogues and several free gifts. Here's a video of someone opening one of these legendary Blue Boxes...

Everyone loves free gifts, so 4imprint's Blue Boxes are an incredibly popular and effective way to maintain the relationships with customers that ultimately drive repeat purchases.

Together, these four pillars of 4imprint’s strategy have allowed it to grow both quickly and consistently.

4imprint's growth has been consistent and sustainable

Focusing on a niche market and having a consistent goal and strategy are all good signs of quality, but at the end of the day I'm after reliable, sustainable dividend growth, so let's have a look at how 4imprint has managed on that front.

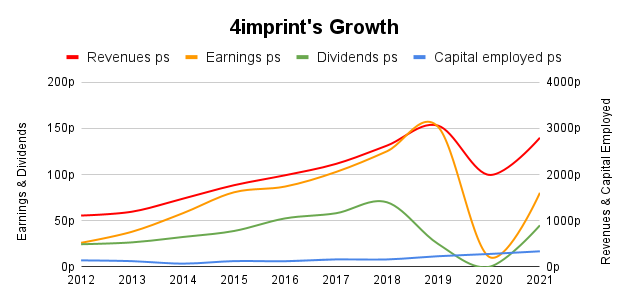

Ignoring the obviously unprecedented impact of the pandemic, if we focus on the period from 2012 to 2019, 4imprint's growth was very impressive:

- Revenues almost tripled from $297 million to $861 million

- Earnings per share increased almost five-fold from 26 to 152 cents

- Dividends more than tripled from 25 to 84 cents

- Capital employed increased by 25%

This comfortably exceeds my rule of thumb for growth:

- Rule of thumb: Only invest in companies where growth is consistently above 2%

Unfortunately, that rapid growth was produced over a seven-year period, which isn't very long. There is a risk that we're simply looking at the upswing of a business cycle, and that's true to some extent because 2012 was only a couple of years after the global financial crisis.

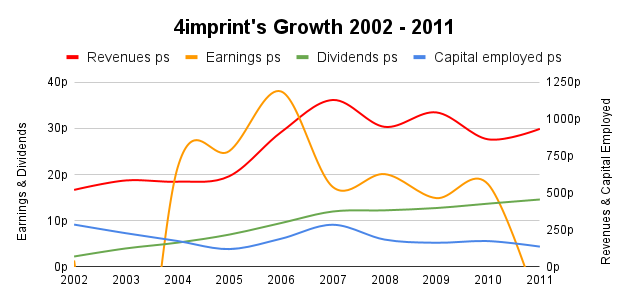

To get a better idea of the sustainability of 4imprint's growth, we need to look at its performance over the previous decade.

As the chart above shows, 4imprint's results over the previous decade were much less impressive. Revenues were mostly flat (other than a big jump from 2005 to 2007), capital employed consistently fell and earnings were all over the place (and sometimes negative).

What you're seeing here is the impact of Bemrose and its subsidiaries, which were (thankfully) all spun off by 2013. None of these are part of the current 4imprint business, so their past performance is irrelevant and misleading.

Fortunately, 4imprint did separate out the revenues and operating profits of its direct marketing business from the other Bemrose businesses, and the picture they paint is one of stunning success.

Revenues for the direct marketing business went from $49 million in 2002 to $145 million in 2008 (just before the financial crisis), while operating profits went from $3.6 million to $10 million. So, 4imprint effectively tripled in size between 2002 and 2008 and, although there was a setback during the financial crisis, by 2012 the company had more or less doubled in size again.

For context, revenues in 2022 are expected to exceed $1 billion, which is a 20-fold increase over 20 years.

That is very rapid growth, and the good news is that growth was sustainable because it was funded from operating cash flows and retained earnings rather than debt.

Consistently high returns on capital, but profit margins are thin

A consistently high return on capital is perhaps the best single piece of evidence that you're looking at a quality company with durable competitive advantages. Why? Because if there was no durable competitive advantage, those high returns on capital would be competed away by other companies offering similar products or services that are either better, cheaper or more convenient.

In addition to being a sign of durable competitive advantages, consistently high returns on capital also produce the rocket fuel that underpins sustainable above average growth.

Return on capital underpins growth because in order to generate long-term sustainable growth, a company has to serve more customers. To serve customers you need more staff, more offices, more computers, more warehouses, more machinery and so on, and all of that has to be funded either by shareholders or lenders or landlords (who effectively lend properties).

For example, if a company generates a return on capital of 5%, 5% is pretty much its maximum sustainable growth rate. To understand why, think of a savings account.

If a savings account has a 5% interest rate, the money in the account can only grow by 5% per year, and to do that you have to reinvest all of the interest.

The only way to get a 5% savings account to grow faster than 5% is to put more cash into it, either from your own pocket or by putting in money you've borrowed from someone else.

And that is precisely what a lot of low-return businesses do.

They produce low returns on capital (a low "interest rate") and they pay half of those low returns out as dividends, so their ability to reinvest earnings to fund growth is very limited. If they want to grow quickly, they'll either raise additional capital from shareholders through rights issues, or they fund growth by taking on more debt.

Personally, I would rather invest in a company with an "interest rate" of 10% or more. That way, the company can pay out half its earnings as dividends and still retain enough earnings to drive sustainable growth at 5% per year, comfortably outpacing inflation (at least most of the time).

- Rule of thumb: Only invest in companies where return on capital is consistently above 10%

Turning back to 4imprint, it has indeed produced returns on capital well above my 10% target and good enough to fund double-digit growth while paying a consistently growing dividend.

One of the key reasons why 4imprint is in a position to generate high returns on capital is its business model, where it operates as a drop-shipping distributor with little need for factories, warehouses, delivery vehicles or even inventory.

As you can see in the chart below, for a while the company was producing returns on capital in the region of 75%, which is almost too good to be true.

Unfortunately, those figures are too good to be true. Or, more accurately, they're true, but they're misleading because until recently, 4imprint had a defined benefit pension scheme with a large deficit.

What does a pension deficit have to do with return on capital?

The answer is that pension deficits are a liability. A deficit exists when a company's pension scheme doesn't have enough assets to cover its liabilities (future payments due to pensioners), and the company has a legal obligation to reduce and eventually remove the deficit by pumping additional cash into the pension.

In other words, the deficit is money owed by the company to the pension scheme, which means that pension deficits are a form of debt. Debt is a form of capital and that's why pension deficits can affect return on capital.

I don’t usually include pension deficits when I’m calculating return on capital because the data isn’t easily accessible, so if a company has a large pension deficit, my figures for capital and return on capital will be too low and too high respectively. This is why 4imprint has an exceptionally high return on capital figure in the chart above.

This isn’t usually a problem because most companies don’t have large pension deficits, but when there is a large deficit, it should be taken into account.

After digging out 4imprint's pension deficit numbers for the past decade and including them in the calculation of capital, its average return on capital from 2012 to 2021 falls to 33%.

The last tweak I would make is to ignore 2012, because in 2012 4imprint still owned some of the less successful Bemrose subsidiaries and, as a result, its 2012 returns on capital are less impressive.

If we ignore 2012, 4imprint's average returns on capital jump up to a very healthy 35%, and to me that's good evidence of a durable competitive advantage.

To round off the topic of profitability, I should mention 4imprint's weak profit margins, which have averaged less than 4% over the last decade. That fails my profit margin rule of thumb:

- Rule of thumb: Only invest in companies with profit margins consistently above 5%

However, 4imprint is a distributor and distribution is an inherently low-margin business. I think its low margins are probably a reflection of its distributor business model rather than a lack of competitiveness relative to its peers.

On that basis, I would be willing to accept these thin margins as unavoidable, but only if the company doesn't have high fixed costs or high debts.

In terms of fixed costs, these are low as a result of the company's capital-light drop-shipping business model, and other than some very small lease liabilities, 4imprint has no debt.

4imprint owns a valuable, rare and hard to replicate asset

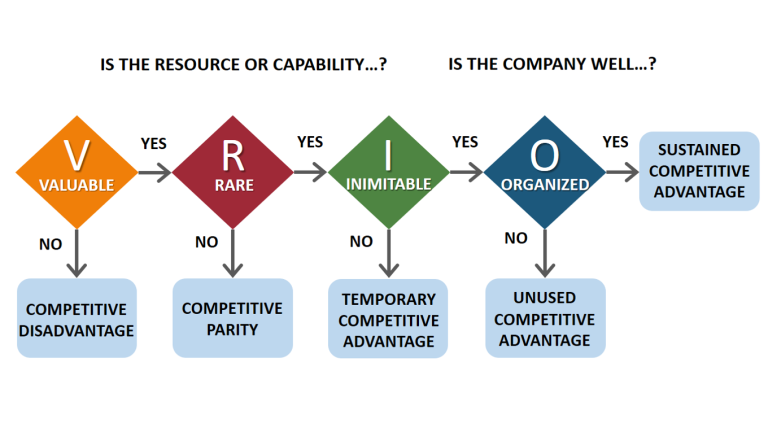

I said earlier that high returns on capital are the best indicator of a durable competitive advantage, and another way to think about durable competitive advantages is that they're valuable, rare and hard to replicate assets. This is known as the VIRO Framework.

Source: business-to-you.com: VRIO Framework

I think 4imprint has a valuable, rare and inimitable asset that it is well-organised to benefit from, and that asset is its “family business” culture.

A family business culture is something I’ve seen over and over again in high-quality companies:

- They often have founders or founding family members on the board

- They often have CEOs who have been with the company for decades and have, in many cases, worked their way up from the bottom

- They make a point of focusing on employee satisfaction as much as customer satisfaction

- They're focused on producing sustainable growth over ten or twenty years and they're far less concerned about quarterly earnings

In 4imprint’s case, Dick Nelson (the founder) ran the direct marketing business from 1984 to 2000, before becoming CEO of the whole Bemrose group.

In 2003, the other Bemrose businesses proved to be too problematic, the group recorded a significant loss and Nelson resigned.

4imprint's current CEO, Kevin Lyons-Tarr, joined the direct marketing business in 1991, has led it since 2004 and has been group CEO since 2015 (shortly after all the other subsidiaries were sold off).

So, in its near-40-year history, 4imprint's remaining direct marketing business has effectively had two CEOs, which is a similar story to other fabulously successful businesses that I currently hold, such as Admiral and Hargreaves Lansdown.

Together with other factors such as its focus on putting employees at the centre of the business and its refusal to use debt, these long-tenure leaders are a strong indicator that 4imprint has that rare and wonderful thing, a “great” culture (see Jim Collins’ Good to Great concepts for other indicators).

4imprint operates in a cyclical industry

Some people define quality businesses as those capable of generating very reliable cash flows, typically from the sale of low-ticket, repeat-purchase branded consumer goods.

While many of those businesses are high-quality, I think it's wrong to automatically classify cyclical companies like Rio Tinto as low-quality just because they operate in highly cyclical industries.

Personally, I prefer to analyse quality and defensiveness separately, and in 4imprint's case, we have a quality business operating in a cyclical industry.

The promotional products industry is cyclical because demand for customised promotional products goes up and down with the overall economy.

When the economy is booming, companies are happy to go to live events and hand out logoed baseball caps to prospective customers, and they're happy to give logoed cups or bags to employees or customers. But when the economy slows or falls into an outright recession, budgets get cut and not buying promotional products is an easy (if perhaps short-sighted) way to save cash.

This cyclicality isn’t a major problem because 4imprint’s management have deliberately structured the business to cope with cyclical downturns.

The first line of defence for a cyclical business is to keep debts low, so 4imprint has no debt, other than some very small lease liabilities.

The second line of defence is to avoid fixed costs, and 4imprint achieves that by being a capital-light drop-shipper, with little or no fixed overheads from warehouses or factories to worry about.

The promotional product market is growing, but very slowly

If a company's core market is shrinking, it isn't defensive, no matter how stable supply and demand might be, so core market growth is (in almost all cases) an absolute necessity.

The market for promotional products is both old and mature, but it isn't in decline, and future growth is expected to be broadly in line with overall economic growth.

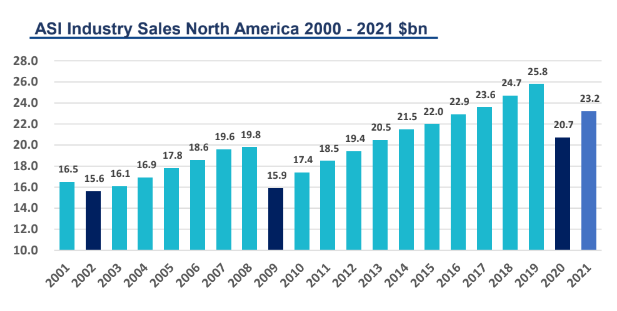

For example, the chart below shows sales volumes for the North America promotional product market.

Source: Advertising Specialty Institute

Source: Advertising Specialty Institute

Although the chart looks somewhat impressive, the industry’s annualised growth rate over the 18 years from 2001 to 2019 was only 2.5%, which is barely ahead of inflation over the same period.

Given that relatively low historical growth rate, a conservative estimate would be that the market’s future growth is likely to be similarly sluggish.

Amazon could become a threat over the longer-term

When I first reviewed 4imprint in 2020, my biggest concern was Amazon.

If you look at 4imprint.com, you’ll see a website that sells clothing, bags, stationery, drinkware, tech gadgets and other relatively small, low-cost items. That sounds a lot like Amazon.

If you drill down to a specific product category, like polo shirts, you’ll see more product details and a five-star rating system. That also sounds a lot like Amazon.

The difference, of course, is that you can add your corporate logo to all of 4imprint’s products, whether you’re buying t-shirts, notepads or USB sticks. Unfortunately for 4imprint, that is also beginning to sound a lot like Amazon. More specifically, Amazon has introduced two customisation offerings.

The first is Amazon Merch on Demand where, for example, I could sell t-shirts with the UKDividendStocks.com logo on the front. Amazon would do all the fulfilment (getting the t-shirt, doing the printing and shipping) and I would receive a (very small) profit for each t-shirt sold.

Merch on Demand is mostly aimed at YouTubers, influencers, artists or others who want to sell “merch” to their audience.

Amazon’s second offering, called Amazon Custom, is more relevant to 4imprint. It allows companies who can fulfil customised product orders to list and sell those products on Amazon. In other words, it gives 4imprint’s smaller competitors a very trusted, high-traffic route to market.

However, there are still significant differences between Amazon’s current offer and 4imprint’s:

1. Order size

Amazon is mostly a B2C business, so most orders contain just a few items. Having played around on the Amazon Custom site, it seems that (for now) 30 t-shirts is all you can order in one go, which is just about okay for a very small business.

4imprint is mostly a B2B business, so with most of its products you have to buy at least five or ten items, and 4imprint’s system seems quite happy for me to request several thousand t-shirts (with an attractive volume-based discount).

2. Product quality

Amazon has become a platform where almost anyone can sell almost anything. This has its upsides, but one big downside is that (in my experience) quality has increasingly taken a backseat.

That may be okay if you’re buying ten t-shirts for your in-store staff, because if the t-shirts are rubbish you’ve only lost your company £100 or so. But if you order 5,000 t-shirts and they’re rubbish, you might lose your job.

This is why 4imprint has close relationships with suppliers and has merchandising staff who test every single product before it gets onto the company’s website. In contrast, I suspect that Amazon has no idea about the quality of the products on its platform in at least 99.999% of cases.

3. Customer service

Perhaps the biggest difference is the way 4imprint takes a hands-on approach to customer service. The website makes it clear that 4imprint’s customer service staff are willing and able to help out. That could mean assisting the customer with logo design, or the logo's size and position on the promotional product, or it could mean sending out free samples, followed by a redesign based on the customer’s feedback.

On top of that, 4imprint has its 360 Degree Guarantee, which guarantees on-time delivery, value-for-money and satisfaction.

This aspect of 4imprint’s offer is way outside of anything Amazon currently does or is likely to want to do within the next few years. Amazon is about three things: Volume, volume and volume, and getting hands-on and friendly with customers (other than through AI) just isn't part of its business model.

So, perhaps for the next decade and perhaps forever, I think 4imprint offers something that Amazon probably doesn’t want to replicate.

However, Amazon does have a habit of entering potentially interesting markets with a finely honed test-and-learn (or bullets then cannonballs) approach, and that could be what we’re seeing with Amazon Custom.

If Amazon did decide to go full-steam ahead into the customised promotional product market, it would probably want to be the default platform for small drop-shippers, giving them a low-cost, trusted and astonishingly powerful route to market via the ubiquitous Amazon website.

This may not completely replicate 4imprint's high-touch service, but it would definitely make it harder for 4imprint to pick up those customers where price was more important than a helping hand.

4imprint survived the pandemic with bruises, but no scars

Thanks to its zero-debt balance sheet and flexible cost base, 4imprint came through the pandemic relatively unscathed. That's extremely impressive, given that its revenues fell to less than 20% of normal levels during the initial round of lockdowns.

As the pandemic receded, 4imprint recovered quickly and its recent 2022 interim results were far ahead of pre-pandemic levels. First-half revenues are at an all-time high, the company is on track to exceed full-year revenues of $1 billion for the first time and the interim dividend has been set at 40 cents, 60% higher than the previous record interim dividend of 25 cents in 2019.

There could be a strong element of pent-up demand in those results, with everyone desperate to get back to live events in order to give out logoed pens and baseball caps to passers-by, but even so, 4imprint is definitely firing on all cylinders.

Of course, we’re staring down the barrel of a potentially severe recession in the US and, as a cyclical business, I would expect 4imprint’s short-term results to be impacted.

However, I don’t expect the impending recession (if it actually arrives) to be anywhere near as bad as the pandemic, and 4imprint came through the pandemic with virtually no impact to its long-term dividend-paying potential. In fact, the pandemic may have been a tailwind, because weaker competitors would almost certainly have suffered a lot more damage.

Looking forward, there is still room to take market share

4imprint operates in a mature market where medium-term growth is likely to be in the low-single-digit range, broadly in line with the overall North American economy.

If 4imprint is to grow faster than that, it must continue to take market share, as it has with impressive consistency over the last four decades.

Market share growth is a sensible goal, and 4imprint's goal is to be the overall market leader (which it achieved in 2019 and, after the pandemic, is currently in second place), but growth by taking market share has its limits. After all, market share can only be increased to 100%, and even that is virtually impossible.

More realistically, once a company has a 10-20% share of its core market, it will need to look new markets if long-term market-beating growth is to continue.

In 4imprint’s case, its market share is around 5%, and it's very close to being the overall market leader. 5% market share is quite low for a market leader, and there are tens of thousands of very small promotional products distributors out there, so the market is still quite fragmented.

This means 4imprint still has very strong scale and experience advantages over those small competitors, so outcompeting them and gaining additional market share still seems very doable.

On that basis, I think 4imprint might be able to double its market share to 10% and perhaps double it again to 20%.

At that point, it would probably make more sense to expand into new markets (such as selling to larger enterprises or expanding into new countries) than trying to gain more market share in its core market of small and medium-sized US businesses.

Estimating fair value using a discounted dividend model

To estimate 4imprint’s fair value we need to build a realistic but conservative discounted dividend model.

If you're not familiar with discounted dividend models, they're based on the idea that a company is worth the sum of all the cash it will return to shareholders (through dividends and share buybacks) over its remaining lifetime. In addition, each cash return should be discounted by your target rate of return to reflect the fact that £1,000 of income today is better than £1,000 of income ten years from now.

To build a dividend model, we first need to come up with a realistic and conservative scenario of what 4imprint's future dividends might look like.

My dividend models are built using the "savings account" analogy.

If you want to know how much interest you're going to get out of a savings account, you need to know three things:

- How much money is in the account today

- What the interest rate is going to be

- How much interest you're going to leave in the account to drive compound growth and how much you're going to withdraw as income

When you're looking at a company, this translates into three key metrics:

- Capital employed

- Return on capital

- Dividend cover

Estimating 4imprint's capital employed

This is easy because the 2021 annual report tells us all we need to know.

The company had $12 million of debt capital (from borrowings and leases), $83 million of shareholder capital (shareholder equity) and no capital from the pension scheme (the deficit reached zero in 2021, thanks to many years of large cash injections and a helping hand from recently rising interest rates).

That gave 4imprint $95 million of capital employed at the start of 2022, or $3.38 per share.

Estimating 4imprint's average future return on capital

Unfortunately, estimating future return on capital is complicated by the fact that until 2013, the direct marketing business was buried among the Bemrose businesses. The financial reports didn't break out capital employed for each subsidiary, so we only have return on capital data for the 2013-2021 period.

Average return on capital (including the pension deficit) for that period was 35%. That period includes the pandemic, which hopefully we won't be seeing again, so I think it's reasonable to alter the historical results to see what returns on capital would have looked like if the pandemic was instead merely a normal recession.

If I assume that 2020's earnings fell by 50% rather than their actual decline of 93%, and that 2021's earnings were similarly less depressed, 4imprint's average return on capital from 2012 to 2021 improves to 40%.

I think 40% is probably a reasonable assumption for 4imprint's future returns on capital, averaged over a full business cycle, although this is based on somewhat limited data.

One final adjustment is that earnings in 2022 are expected to be abnormally high, probably as a result of pent-up demand. Based on management guidance, return on capital could be as high as 60% in 2022, but after that I will assume it reverts to 40%.

Estimating 4imprint's average future dividend cover

Historically, 4imprint's dividend cover was usually between 1.5 and 2.0, which is a fairly normal healthy level. However, this fails to take into account all the cash the business was funnelling into its pension scheme. If we include pension deficit reduction payments, average dividend cover from 2012 to 2021 falls to 1.2.

That's low, but that's to be expected from a company generating returns on capital north of 35%. Retaining most of those earnings and growing the "savings account" at close to 35% just isn't feasible, so instead, 4imprint pays out most of its earnings as a dividend and still retains enough earnings to grow at a good pace.

The pension scheme causes further complications, because it's due to be sold to a life insurer or pensions consolidator in 2024, and with the pension and its deficit gone, 4imprint will have much more free cash available to return to shareholders as dividends.

Given that the deficit has already been reduced to zero, I will assume that 4imprint's dividend cover falls to 1.2 in 2023, and this implies a step-change in the size of its dividend.

So, we now have assumptions for each of the three key metrics:

- Capital employed starts at $3.38 per share in 2022

- Return on capital peaks at 60% in 2022 and then averages 40% over the medium-term

- Dividend cover falls to 1.2 as dividends increase after the removal of the pension scheme

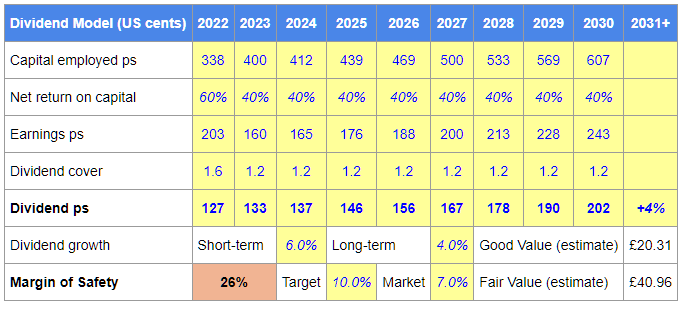

If I plug those values into my investment spreadsheet it produces the following dividend model.

That's a bit of a wall of numbers, so here's the narrative version of this scenario:

- 4imprint recovers well in 2022 and posts record earnings per share of 203 cents (the previous record was 152 cents in 2019)

- The 2022 dividend is 127 cents, well-above the pre-pandemic record of 85 cents

- In 2023, the economy slows and 4imprint's return on capital falls to historically average levels, reducing EPS to 160 cents (still above the pre-pandemic record because the company has grown over the four years from 2019 to 2023). The dividend is still increased as dividend cover falls to 1.2

- Return on capital and dividend cover remain stable over the medium-term, generating growth of 6% per year to 2030, more than doubling the size of the business relative to its pre-pandemic peak

- Over the longer-term (beyond 2030), growth settles down to 4% as 4imprint's high market share forces it to look for growth in new markets

Of course, this is simply a scenario based on some hopefully realistic and conservative estimates, but I also think it's very plausible, so on that basis I'm comfortable using this dividend model.

To estimate fair value, we simply discount (reduce) those estimated future dividends by a fair rate of return. In my case, I like to use the UK market's long-term average total return of 7% per year.

I also like to estimate a "good value" price, which discounts future dividends by my target rate of return of 10%.

This gives the following result:

- My "fair value" estimate for 4imprint is £40.96 per share

- My "good value" estimate for 4imprint is £20.31 per share

Is there a sufficient margin of safety between price and fair price?

Now that we have estimates for good and fair value, the last thing to do is compare the company's current share price to those estimates of good and fair value.

If the share price is above fair value, I should expect future returns to be below average, and if the price is below my good value estimate, I should expect returns to be above my target of 10% per year.

Another way to say this is that when the share price is above my fair value estimate the margin of safety is zero and when the share price is below my good value estimate, the margin of safety is 100%.

When I looked at 4imprint in mid-August, its share price was going up like a rocket ship, having increased from a low of around £23 in July to more than £40 in August.

At £23, the share price looked quite attractive, it was close to my good value estimate and the margin of safety was close to 100%.

But at more than £40, the share price was almost exactly equal to my estimate of fair value and the margin of safety had vanished.

At £40, and with little or no margin of safety, it didn't make sense to hold onto 4imprint when I could lock in some good profits and reinvest the proceeds into other holdings that were still attractively valued.

Here's a snapshot of the overall investment from beginning to end.

Unfortunately, by the time I got round to writing up the pre-sale review in the September issue of my monthly newsletter, 4imprint's share price had fallen to £35.55.

But that was still close to my fair value estimate and the margin of safety was still only 26%, so for me, it still made sense to lock in those profits.

In the end, the investment produced annualised returns of almost 18% over two and-a-bit years, which is well-above my 10% target. Having said that, it was quite an unusual dividend investment because almost all of the returns came from capital gains and almost none from dividends.

Even so, I would say the investment worked out well. 4imprint is a quality company, the pandemic gave investors an excellent buying opportunity (although my timing was far from perfect) and the company's recovery has led to a rapid recovery in the share price back, more or less, to my estimate of fair value.

To me, this is a good example of sensible dividend investing:

- Own quality dividend growth companies

- Buy them when there is a wide margin of safety between price and fair value

- Sell when the company's quality or its share price are no longer attractive

Would I reinvest in 4imprint and at what price?

I would be happy to reinvest in 4imprint. I still think it's a great business with a great culture and lots of room for growth over the next decade or two, although I do think Amazon could be a problem over the longer-term (but you could say that for almost any retailer or even wholesaler).

The only thing I really don't like is the near-£40 share price.

However, if the next recession causes the share price to fall to my good value estimate of £20, and if the dividend comes in at anything like my $1.27 estimate (about £1.09), the dividend yield would be 5.4%.

That's slightly above my target dividend yield of 5% and, at that point, I would gladly add 4imprint to my portfolio for a second time.

The UK Dividend Stocks Newsletter

Helping UK investors build high-yield portfolios of quality dividend stocks since 2011:

- ✔ Follow along with the UK Dividend Stocks Portfolio

- ✔ Read detailed reviews of buy and sell decisions

- ✔ Quarterly, interim and annual updates for all holdings

- ✔ Quality Dividend Watchlist and Stock Screen

Subscribe now and start your 30-DAY FREE TRIAL

UK Dividend Stocks Blog & FREE Checklist

Get future blog posts in (at most) one email per week and download a FREE dividend investing checklist:

- ✔ Detailed reviews of UK dividend stocks

- ✔ Updates on the UK Dividend Stocks Portfolio

- ✔ UK stock market valuations

- ✔ Dividend investing strategy tips and more

- ✔ FREE 20+ page Company Review Checklist

No spam. Unsubscribe anytime.