Secure Trust Bank is a specialist UK bank that has what must surely be one of the best names for a bank that anyone has ever come up with.

After recent problems at Silicon Valley Bank and other smaller US banks, Secure Trust Bank has seen its share price fall from £8 to £6.70 in the last few weeks. This share price decline has left it with a dividend yield of 6.7%, which is more than enough to get my attention.

Secure Trust Bank also has a track record of consistent profits and dividends as well as high levels of growth, but what I really want to know is, is the company's dividend as secure and trustworthy as its name suggests?

Table of contents

- A mostly impressive track record of growth

- Falling profitability and rising leverage

- Is there deep expertise in the core business?

- Conclusion: Lots of growth, lots of change, very little stability

A mostly impressive track record of growth

Let's start with the company’s financial track record. What I’m looking for, ideally, is a long and consistent track record of sustainable dividend growth.

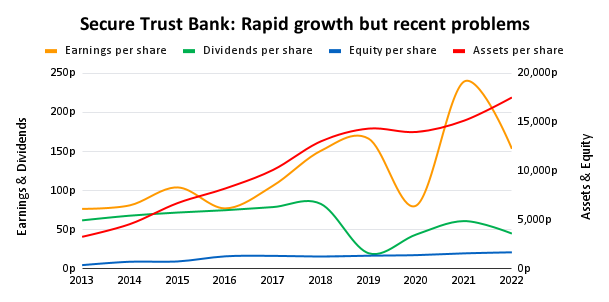

Data from SharePad

The chart above shows that Secure Trust Bank (STB) made a profit and paid a dividend in every one of the last ten years, which is good as it meets my first two rules of thumb:

- Rule of thumb: Only invest in a company if it made a profit in every one of the last ten years

- Rule of thumb: Only invest in a company if it paid a dividend in every one of the last ten years

The chart also shows that STB has grown rapidly over the last decade, but in the last few years things seem to have gone astray, perhaps because of the pandemic.

The company’s assets per share (bank assets are mostly loans to customers) have grown at an eyewatering pace of almost 18% per year over the last ten years.

Shareholder equity (a rough proxy for the break-up value of the business) has also grown very rapidly, at 14% per year.

Earnings have grown at the more pedestrian but still impressive rate of 9% per year, on average. However, the dividend has fallen in recent years, leaving Secure Trust Bank with a ten-year dividend growth rate of minus 4%.

The company’s overall ten-year growth rate (averaged across assets, equity and dividends) comes in at 9% and its ten-year growth quality (how frequently assets, equity, earnings and dividends went up) is high at 81%. These also exceed my next two rules of thumb:

- Rule of thumb: Only invest in a company if its ten-year Growth Rate exceeds 2%

- Rule of thumb: Only invest in a company if its ten-year Growth Quality exceeds 66%

Note: If you're interested in the mechanics of these Growth Rate and Growth Quality metrics, have a look at my company review spreadsheet.

The bad news is that the dividend has been cut twice in recent years and usually this would be a very large Yellow Flag (not quite a Red Flag, but still a very clear warning). However, the reality is that we have just been through a pandemic where defensive stocks like AG Barr suspended their dividends. On that basis, STB's multiple dividend cuts are not necessarily a major problem.

Falling profitability and rising leverage

Investing in companies with strong profitability is important because it's one of the best indicators of competitive strength, and a company that can produce consistently higher returns on capital than its peers may have durable competitive advantages.

Competitive advantages are important because, as a long-term dividend investor, I may own shares in a company for ten or 20 years, and without competitive advantages, few companies would even survive 20 years in the brutal battlefields of capitalism.

As well as strong profitability, I also want to see relatively little leverage (debt), because excessive debt in a severe recession can kill even the most competitively advantaged businesses.

Here’s a chart showing Secure Trusts Bank’s profitability and leverage metrics, which I’ll explain below.

The chart shows two profitability metrics (return on capital and net interest margin) and two leverage ratios (CET1 ratio and tangible equity ratio).

Return on capital tells us how much profit the company made relative to its capital, and capital is the amount of money put into the business in the form of shareholder equity and debt (mostly unsecured bonds and lease liabilities).

The chart shows that Secure Trust Bank’s return on capital has fallen from almost 20% in 2013 to 7% today, and that for much of the last decade it was somewhere between 5% and 10%. The ten-year average comes in at 9%, which is slightly lower than I'd like.

- Rule of thumb: Only invest in a company if its ten-year average return on capital is above 10%

This somewhat low return on capital could be a sign that Secure Trust Bank lacks any durable competitive advantages, so this is the company's first Yellow Flag that I would need to investigate further before investing.

Net interest margin tells us the interest rate the bank generated from its loans, after deducting the interest cost of funding (i.e. the interest paid to current account and savings account customers). This is similar to gross profit margin for non-financial businesses.

As with return on capital, Secure Trust Bank’s net interest margin has declined over the last decade, although in this case the decline is more consistent and severe. Net interest margin has fallen from a very high 15% in 2013 to a less impressive 6% today, although this is still high as most mainstream UK banks usually have a net interest margin of about 3% to 5%.

Here’s my rule of thumb for net interest margin:

- Rule of thumb: Only invest in a bank if its ten-year average net interest margin is above 5%

STB does meet this standard, but the decline in net interest margin is another Yellow Flag that I would need to understand before investing. Specifically, I would want to know if its margins are likely to continue falling to the point where they're below my 5% threshold.

Turning to leverage, banks lend money, so they need to access money in order to lend it out. Shareholders provide banks with capital in the form of equity, but for most banks, the main source of funding for lending is customer deposits in the form of current accounts and savings accounts.

The key difference between capital funding (mostly shareholder equity and unsecured loans from other banks) and depositor funding is that capital is expected to absorb the cost of loan defaults while depositors are not.

For example, if a bank has £10 million of capital funding from shareholders and £90 million of deposit funding from customers, it could lend out the entire £90 million of customer deposits. If £5 million of loans were defaulted on and the bank only got back £85 million, shareholders would have to absorb that £5 million loss in order to protect customer deposits.

This is why shareholder equity and other forms of risk capital (such as "tier 2" unsecured bonds) are sometimes referred to as a capital buffer, because they absorb the shocks that come from loan defaults and other losses, giving current account and savings account customers a smoother, less risky ride.

Because this capital buffer is so important to the robustness of individual banks and the banking system as a whole, there are minimum regulatory standards that banks must abide by.

For example, the CET1 ratio (common equity tier 1 ratio) measures the size of the equity buffer relative to the risk-adjusted value of the bank's outstanding loans to customers. The regulatory minimum for this ratio depends on a number of factors, such as whether the bank is systemically important and too big to fail.

The chart above shows that Secure Trust Bank’s CET1 ratio has declined very slightly over the last decade, but it remains fairly close to 15%. What that means is that, very, very approximately, the bank has an equity buffer that could absorb as much as 15% of the loan book defaulting before customer deposits were put at risk.

Most UK banks have CET1 ratios closer to 10% and in the run-up to the 2008-2009 financial crisis it was usually much lower than that, so 15% is a relatively prudent buffer and STB comfortably exceeds my requirements.

- Rule of thumb: Only invest in a bank if its CET1 ratio has been above 10% in every one of the last ten years

In addition to CET1, I use a simpler and more demanding measure of balance sheet strength known as the tangible equity ratio (TER).

Like the CET1 ratio, the tangible equity ratio compares the equity buffer to the bank’s loans, but in this case, it excludes intangible equity like goodwill because it has a tendency to vanish when you try to turn it into cold hard cash (which is what depositors would want if they wanted their money back). It also doesn't risk-adjust the bank's loans, which also makes the ratio more demanding.

Secure Trust Bank has a ten-year average tangible equity ratio of 11%, which is good. However, over the last five years the ratio has been consistently below 10%, and that fails to meet my standard.

- Rule of thumb: Only invest in a bank if its tangible equity ratio has been above 10% in every one of the last ten years

This is another Yellow Flag that would require further analysis before I invest.

Let's pause there and do a quick recap of what we've found so far. Secure Trust Bank is:

- A fast-growing bank that seems to have run into (entirely understandable) problems during the pandemic

- As the company has grown, its profitability has decreased, although its profitability is still good

- Its tangible equity buffer has steadily decreased to the point where it is now slightly thinner than I would like

Despite several yellow flags, these results are close to what I’m looking for in terms of growth, profitability and balance sheet strength, so I'm happy to continue the analysis. The next question is:

Is there deep expertise in the core business?

As a long-term dividend investor, I’m looking for companies that can beat the competition and grow over time, so I’m looking for companies that are better at what they do than their peers.

A key aspect of being better is having greater expertise, and that usually requires a lot of focus and a lot of time, so I’m looking for companies that have had the same narrowly focused core business for decades.

In this case, Secure Trust Bank was originally set up in 1952 as Secure Homes, where it helped people simplify their utility bills into a single monthly payment that was smoothed out across the year, avoiding the peaks and troughs of winter and summer.

Secure Homes was acquired by Arbuthnot Banking in 1985 and in 1994, Secure Homes became Secure Trust Bank when it was merged with Peoples Bank.

The newly created Secure Trust Bank now had three parts:

- A utility bill smoothing service

- A tiny bank with customer deposits and loans to individuals and businesses of around £30 million

- An insurance broking business that sold sickness, accident and other insurance to its customers, underwritten by third-party insurers

During the 2000s credit crunch, the bank cut back its lending book so that by 2008, it was an incredibly small bank with just 40,000 customers, £13 million of loans and profits of £5 million.

In 2009, management realised that OneBill (its utility-smoothing service) had no future because fewer and fewer people wanted their utility bills smoothed out. To turn things around, management launched a used car finance business and refreshed the bank's personal loans business, with the aim of offering higher interest loans to higher risk subprime borrowers.

It also launched a retail in-store point-of-sale finance business, allowing retailers to sell expensive products (such as musical instruments and jewellery) on credit.

To scale up these new ventures, the bank acquired a portfolio of loans from other lenders. The idea was to make a profit from these loans while actively marketing its motor and personal loan services to these newly acquired customers. This dramatically increased the loan book, from £13 million to £51 million.

And then, in 2010, everything changed when Secure Trust Bank lucked into the mother of all tailwinds.

The 2008-2009 global financial crisis had brought most of the UK’s big banks to the brink of destruction, and their reputations were in tatters. This changed the UK lending market in three ways:

- Thousands of people were disgusted by the behaviour of the UK's biggest banks, so they were willing to move their savings to banks they previously hadn't heard of, as long as they sounded secure and trustworthy

- To strengthen their balance sheets, the big banks dramatically cut back on lending

- To further strengthen their balance sheets, the big banks became more selective, lending mostly to lower-risk prime borrows rather than higher-risk subprime borrowers

All of this meant that suddenly, Secure Trust Bank could attract new customers and deposits with ease, and the bank was swamped with a veritable tsunami of inflowing cash. The bank also found it very easy to lend those deposits out at much higher interest rates, because the big banks were avoiding subprime borrowers like the plague.

Thanks to this seismic shift in the UK lending market, STB’s loan book almost doubled in 2010, going from £51 million to £90 million. It then more than tripled to £298 million in 2012 and doubled again to £623 million in 2014.

In other words, over the five years from 2009 to 2014, Secure Trust Bank’s loan book grew almost 600%.

Although much of that lending went into STB’s recently set-up subprime motor and personal loans businesses, they simply couldn’t absorb the flood of cash from new deposits.

To fix that, STB acquired subprime lender Everyday Loans in 2012, expanding its existing subprime personal loans business. In 2013, it acquired V12 Finance, another point-of-sale lender. After that, STB acquired Debt Management Services, so it could handle struggling borrowers internally rather than paying an external debt collector.

Also in 2013, STB launched a real estate finance business, providing funding for small housebuilders and professional landlords.

And as if that wasn’t enough, the real estate business was joined by a business asset finance division in 2014, funding machinery, vehicles and other fixed assets for small and medium businesses. The asset funding business was soon followed by the launch of a commercial lending business, providing short-term loans that enabled companies to offer short-term credit to their customers.

There is a lot going on here, so here's a list of the bank’s operations as they were in 2015:

- The OneBill utility-smoothing service (started in 1952)

- Current accounts and savings accounts (acquired in 1994)

- Personal loans (started in 1994)

- Subprime motor finance (started in 2009)

- Retail point-of-sale finance (started in 2009)

- Debt management services (acquired in 2013)

- Real estate loans for developers and landlords (started in 2013)

- Business asset finance (started in 2014)

- Business invoice finance (started in 2014)

Now, remember that I'm looking for companies with deep expertise in niche markets that they have operated in for decades.

In this case, since 2008, Secure Trust Bank has dramatically expanded its business into a wide range of new lending markets at significant scale. The pre-2008 businesses (utility bill smoothing and personal loans) were, by 2015, a small fraction of the company's overall operations. In other words, in 2015, most of Secure Trust Bank's operations had either been acquired or started up during the previous five years.

That is not what deep expertise in a narrow niche looks like to me.

Instead, this looks like a business that was desperately trying to find places where it could lend out unexpectedly huge sums of cash that were flowing in from customer deposits, and it was willing to start new businesses in entirely unfamiliar markets in order to do so.

Also, growing a business by 600% in five years is very disruptive, especially when that growth has involved starting or acquiring seven new businesses. Disruption causes strain, strain can lead to cracks and cracks can easily lead to failure at best and total destruction at worst. And by 2016, Secure Trust Bank was beginning to crack.

The first thing to go was subprime lender Everyday Loans, which was sold off in 2016. The bank then stopped making new personal loans and sold of its remaining personal loans book in 2017, because it found it impossible to write profitable loans as the market returned to normal levels of competitiveness.

In 2017, Secure Trust Bank stopped offering motor loans to subprime borrowers and began to focus on near-prime and prime borrowers. These borrowers are lower risk, but lower risk means lower interest rates, and this is move away from subprime lending in one reason why the bank's net interest margins have declined.

In 2018, the asset finance business stopped making new loans, because it was a joint venture and the other half of the venture pulled out after being acquired.

So, from 2016 to 2018, three of the seven new businesses were either closed down or pivoted to lower-risk markets.

The rapid pace of change continued in 2017 when STB entered, after much preparatory work, the residential mortgage market. This business lasted barely three years before being closed down due to “unsustainable pricing” from competitors (or, perhaps the tiny Secure Trust Bank lacked the economies of scale necessary to compete against vastly larger mortgage lenders like Lloyds, TSB and Barclays?)

And last but not least, in 2021 the bank sold its debt management business and closed down its increasingly obsolete utility bill smoothing service.

There has been so much change over the last decade that I find it impossible to believe that Secure Trust Bank has built deep expertise in its chosen niches, because it doesn't seem to have found its niche yet, let alone build deep expertise in it.

This is a huge Red Flag, so on that basis, I have decided to pull the plug on Secure Trust Bank, so here is a final summary of my thoughts.

Conclusion: Lots of growth, lots of change, very little stability

Secure Trust Bank appears to be a reasonably good business and it has produced reasonable returns on capital and very impressive growth over the last decade.

However, I am a long-term, relatively conservative dividend investor and I’m trying to invest in long-lived, durable and enduring businesses that are typically market leaders, with competitive advantages and deep expertise in their chosen niches.

None of that, really, applies to STB.

The remaining businesses (point of sale finance, motor finance, real estate finance and commercial finance) were all started or acquired after 2008, so the bank is effectively only 15 years old. I have socks older than that.

Also, STB’s break-neck growth rate over the last decade is clearly an area of risk, because so much of the business has been put together so quickly in just the last few years, and much of it subsequently closed down or sold off.

It’s a bit like building a house: If you take one year to build a house and it could last centuries, standing tall through the most ferocious of storms, but if you only take one week to build a house then it probably won’t stand up to much more than a gentle breeze.

So, although I quite like Secure Trust Bank, I have no intention of investing until it puts together five or ten years of steady, stable growth, building deep expertise in a handful of niche markets, which is why I've added it to my blacklist of uninvestable stocks, with a review date of 2028.

The UK Dividend Stocks Newsletter

Helping UK investors build high-yield portfolios of quality dividend stocks since 2011:

- ✔ Follow along with the UK Dividend Stocks Portfolio

- ✔ Read detailed reviews of buy and sell decisions

- ✔ Quarterly, interim and annual updates for all holdings

- ✔ Quality Dividend Watchlist and Stock Screen

Subscribe now and start your 30-DAY FREE TRIAL

UK Dividend Stocks Blog & FREE Checklist

Get future blog posts in (at most) one email per week and download a FREE dividend investing checklist:

- ✔ Detailed reviews of UK dividend stocks

- ✔ Updates on the UK Dividend Stocks Portfolio

- ✔ UK stock market valuations

- ✔ Dividend investing strategy tips and more

- ✔ FREE 20+ page Company Review Checklist

No spam. Unsubscribe anytime.