Robert Walters is a specialist recruitment firm with more than 4,000 employees operating in more than 30 countries.

It’s a FTSE Small Cap stock with a market cap of more than £300 million, a long track record of relatively steady dividend growth and a share price that has fallen almost 50% since 2021.

The result is a dividend growth stock with a 5% dividend yield, and that puts it firmly on my radar as a potential investment. In the rest of this blog post, I’ll outline why I like Robert Walters and why its shares may be attractively valued after their recent decline.

Table of contents

- A brief introduction

- A long track record of solid dividend growth

- Good profitability, but profit margins are thin (or are they?)

- A fairly robust balance sheet

- A proven and repeatable formula for success

- A competitive advantage that is hard to replicate

- Good long-term growth prospects

- Estimating a fair price for Robert Walters’ shares

- Robert Walters’ shares are trading below “fair value”

- Calculating a target position size

- A good company with good prospects and an attractive price

A brief introduction

Robert Walters is a specialist recruitment firm, which means it actively seeks out suitable job candidates from its existing network or the wider world, even if those candidates aren’t looking for a new job. If Robert Walters can successfully place a candidate into a client’s role, it will earn a fee based on a percentage of the candidate's salary.

The company operates through three main brands:

- Robert Walters is the professional and executive recruitment arm of the firm

- Walters People sources candidates for white-collar roles that pay up to £50,000 per year

- Resource Solutions helps companies outsource all their recruitment processes

Robert Walters was founded in 1985 by its eponymous founder, who had previously helped establish the better-known recruitment firm, Michael Page (now known as PageGroup).

A long track record of solid dividend growth

The first thing I look for when I’m assessing a company is a long and reasonably consistent track record of dividend growth, so let’s start there.

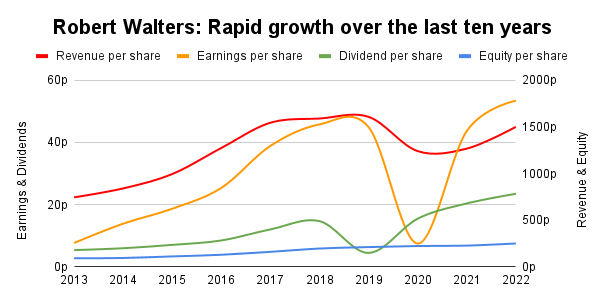

Data source: SharePad

Over the last ten years, Robert Walters produced a growth rate of about 13%, averaged across revenues, earnings, dividends and shareholder equity. Revenues per share doubled since 2013 and the dividend increased by more than 300%.

These are impressive results, but recruitment is a cyclical industry and this can materially skew a company’s medium-term growth rate.

This has indeed been the case over the last ten years, as the recruitment market gradually recovered from the post-financial crisis lows of 2013 to a surprisingly strong recruitment market in 2022.

Fortunately, we can filter out this cyclicality by measuring other aspects of the business that are less cyclical, such as the number of employees.

Robert Walters increased its headcount from 2,300 to 4,400 over the last ten years, which is a growth rate of 7% per year. I think this is a more realistic estimate of the company’s underlying growth rate over the last decade and it easily exceeds my growth rule of thumb:

- Rule of thumb: Only invest in a company if its ten-year growth rate is above 2%

One negative point is that the dividend was suspended during the pandemic, but only one dividend was missed and it was fully reinstated in late 2020. That is entirely understandable and it therefore has no negative impact on my opinion of the company.

Good profitability, but profit margins are thin (or are they?)

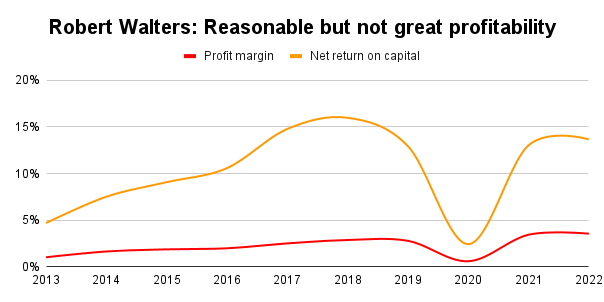

In terms of profitability, Robert Walters produced average net returns on capital of 11% over the last ten years, ranging from a relatively weak 5% in 2013 to an impressive 16% in 2019. 11% is above average and passes my profitability rule of thumb:

- Rule of thumb: Only invest in a company if its ten-year net return on capital is above 10%

This above-average net return on capital isn’t that surprising because recruitment is a relatively capital-light business. In other words, recruitment firms don’t need to invest in expensive assets such as manufacturing facilities.

Being capital-light also improves cash flow because it means that capital expenses (which reduce cash but not profit) are relatively small. Robert Walters has an average ratio of capex to profits of 34%, which is below average and passes my capex rule of thumb:

- Rule of thumb: Only invest in a company if its ten-year capex-to-profit ratio is below 100%

Turning to profit margins, the picture is less rosy as the ten-year average is low at 2.2%. Low profit margins are a sign of competitive weakness and Robert Walters fails my profit margin rule of thumb:

- Rule of thumb: Only invest in a company if its ten-year profit margin is above 5%

However, the company’s 2.2% profit margin doesn’t reflect the true picture. That’s because recruitment revenues usually include income that is passed directly on to third parties with zero profit margin.

These “pass-thru” costs include payments from clients that are used to cover the cost of job advertisements, and freelancer wages that are paid directly to freelancers.

Stripping those out turns revenues into net fee income and profit margin into net fee margin, which are more appropriate metrics for recruitment firms.

Robert Walters has a ten-year net fee margin of 7.3% and that does exceed my profit margin minimum of 5%.

A fairly robust balance sheet

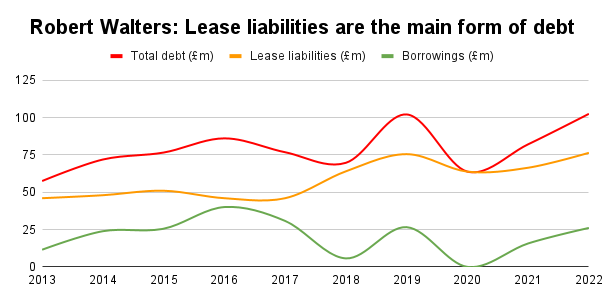

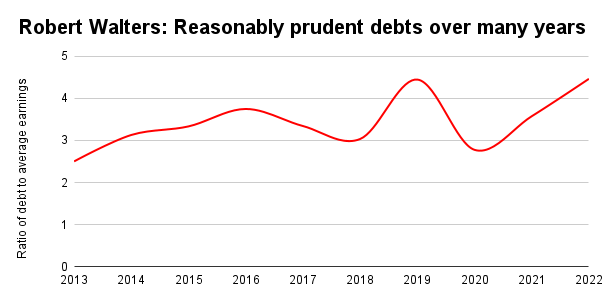

Balance sheet strength is as important as growth and profitability, and in 2022, Robert Walters had borrowings of £26 million. With ten-year average earnings of £23 million, this gives it a borrowings to average earnings ratio of just 1.1. That's very low, which is what I’d expect to see in a capital-light business.

However, recruitment firms do need to lease office space and leases are a form of debt, where companies borrow property from landlords and pay rent instead of interest.

In 2022, Robert Walters had lease liabilities of £76 million, leaving it with total debts (borrowings and leases) of £103 million. That is 4.5 times its average earnings, which breaks my debt rule of thumb:

- Rule of thumb: Only invest in a cyclical company if the ratio of total debt to average earnings is below four

This is a problem, but it doesn’t warrant a Red Flag.

That’s because the debts are mostly in the form of leases, and these tend to be less problematic than borrowings. They’re less problematic because you can easily choose to not renew a lease when it ends, but at the end of an interest-only loan, you have to find the money to repay the loan.

Because leases are less risky than borrowings, I use a more accommodating rule of thumb when leases are the main form of debt (as is often the case with retailers):

- Rule of thumb: Only invest in a lease-heavy company if the ratio of total debt to average earnings is below five

Robert Walters does scrape in below that threshold, so I’m comfortable that its current debts aren’t obviously excessive, and over the last ten years, the ratio was almost always below four.

A proven and repeatable formula for success

In addition to a long track record of strong growth, profitability and a robust balance sheet, I’m looking for companies that have developed a repeatable and sustainable formula for success, which has enabled them to grow within their core market over many decades.

In this case, over the last four decades, Robert Walters has had a remarkably simple business model, which it has stuck to with fanatical discipline:

- Maintain a culture that attracts and retains talented recruitment consultants

- Develop long-term trust-based relationships with clients and candidates

- Pay consultants based on team results rather than individual results

- Expand organically into new employment disciplines and locations

- Grow your own managers and leaders

This business model has many self-reinforcing aspects.

For example, expanding organically helps to retain the best talent as they’ll eventually have the opportunity to open their own offices from scratch. Expanding organically also helps retain the company’s culture because it avoids acquiring other companies and their cultures.

Growing your own managers and leaders helps retain talent as they know they can go as high within the company as their talents will allow. It also helps to perpetuate the company’s culture, ensuring that all leaders have deep knowledge of the firm, developed by working their way up from the bottom.

For example, Robert Walters’ current CEO joined the company as a consultant in 1999 and has just taken over from founder Robert Walters, who spent almost 40 years as CEO.

Growing your own leaders also results in strategic consistency, with internally hired CEOs being far less likely to bin the existing strategy in order to “make their mark” by pivoting the company in a “bold” new direction. Avoiding this is good because most “bold” pivots end with the company flat on its face.

This simple, repeatable growth formula has built and retained deep expertise within the business, enabling it to repeatedly expand into dozens of new employment disciplines and countries, to the point where it now has more than 4,000 employees operating in more than 30 countries, generating annual revenues of more than £1 billion.

A competitive advantage that is hard to replicate

One potential problem is that specialist recruitment firms are easy to start. All you need is a phone, a desk and the ability to fill roles for clients by head-hunting suitable candidates. Barriers to entry are therefore virtually non-existent, so competition is enormous.

High competition means low profits and a high chance of corporate death, so how has Robert Walters managed to survive and thrive for so long?

The answer is that the company has an enduring competitive advantage. There are two pillars to this competitive advantage:

- A powerful business model that builds deep recruitment expertise and enables that expertise to be repeatedly extended into new disciplines and locations.

- The discipline to stick to and refine that business model over many decades.

The result is a company that is simply more competent at specialist recruitment than the vast majority of its peers and is able to repeatedly extend that competence into new markets.

That is a very difficult advantage to overcome because that level of expertise and discipline takes years to develop and nurture, and few companies are able to sustain the necessary level of focus and consistency over that sort of timeframe.

Instead, most companies switch strategies too often, they make too many people redundant during downturns (which means they have to hire new people during upturns, which dilutes the company’s culture) and they hire external CEOs who often have no interest in sticking with the previous CEO's strategy.

Good long-term growth prospects

Enduring competitive advantages are powerful because they enable companies to maintain or grow their market share over the long term. This is important because, as long-term investors, much of our returns will come from buying good companies and holding while they grow their revenues, earnings and dividends.

A company’s long-term growth prospects are, to a large extent, dictated by three factors:

- Its ability to maintain or increase its market share

- Its ability to expand into adjacent markets

- The growth rate of each market that it operates in

Starting with the ability to maintain or grow market share, this depends on a company’s ability to maintain its competitive advantages.

My expectation is that Robert Walters should be able to maintain its existing competitive advantage for many decades to come, precisely because its advantage is its ability to follow a proven business model over many decades.

As for expanding into adjacent markets, the company has already done it dozens of times, by repeatedly expanding into new disciplines and locations. It seems very likely that this will continue long in the future.

What about the growth of the overall global recruitment market? The overall market is expected to grow broadly in line with the global economy over the longer term, which means something in the region of 2-3% per year.

Taking all of that into account, I would expect Robert Walters to grow at least in line with inflation over the next few decades, and there is the potential for significantly higher growth than that.

Estimating a fair price for Robert Walters’ shares

Having analysed the business at some length, I think Robert Walters is definitely a suitable candidate for the UK Dividend Stocks Portfolio, which is a virtual version of my real-world portfolio. The next step, therefore, is to calculate the price I would be willing to pay.

My approach to valuation is to estimate a company’s fair value (which is the price where expected returns are equal to the market average) and then to only buy its shares if there is a significant margin of safety between the current share price and fair value.

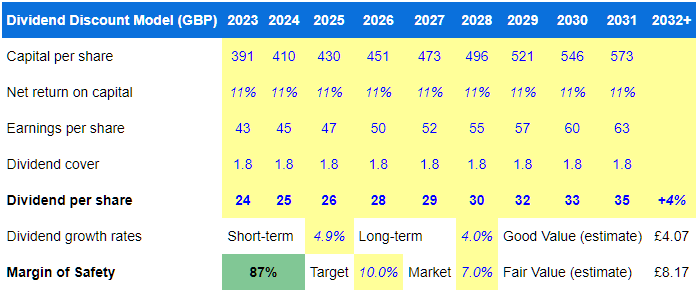

I estimate fair value by building a discounted dividend model, which means estimating the company’s likely future dividends.

These models can be quite complicated for some companies, but for Robert Walters, my dividend model is very simple and is based on just four assumptions:

- Net return on capital remains at a historically average 11%

- Dividend cover remains at a historically average 1.8

- Enough earnings are retained to fund a growth rate of 5% over the next decade (which is a natural consequence of the first two assumptions)

- Beyond the next decade, the company sustains a long-term growth rate of 4% (which is 1% above the global economy's expected growth rate of 3%)

The resulting scenario sees the company’s dividend grow by 5%, from 23.5p today to 35p in 2031, and then by 4% longer-term. Both of those growth rates are below the company’s historical growth rate, so I think the model and its assumptions are both realistic and conservative.

By discounting those future dividends by 7% per year (which is the long-run average return from UK stocks), the model produces a fair value estimate of £8.17 per share. This is my target sell price.

By discounting those future dividends by 10% per year (my target rate of return), the model also produces a “good value” estimate of £4.07 per share. This is my target buy price.

Robert Walters’ shares are trading below “fair value”

Today, Robert Walters’ shares are trading at £4.59, which is far below my fair value estimate.

To measure the gap between price and fair value, I also calculate a margin of safety score. This margin of safety score goes from 0% when the share price equals my fair value estimate to 100% when the share price equals my good value estimate.

Currently, the margin of safety for Robert Walters is relatively high at 87%, which passes my valuation rule of thumb:

- Rule of thumb: Only invest in a company if its margin of safety score is above 66%

And last but not least, I am a dividend investor, so I’m also looking for a healthy dividend yield. The good news is that Robert Walters has a yield of 5.1%, which is almost identical to my target yield of 5%.

On that basis, I would be more than happy to invest in Robert Walters at its current price.

Calculating a target position size

The final step is to work out how much of my portfolio I should invest in this company.

I aim to hold 15 to 20 stocks, so I have a default position size of 3% for cyclical stocks and 4% for defensives.

I then adjust those defaults based on each holding’s valuation. Cheaper stocks have wider margins of safety and higher expected returns, so they should have larger target position sizes, and vice versa.

Robert Walters is trading fairly close to my target buy price, and my investment spreadsheet tells me that at the current price, my target position size for this cyclical stock is 4.1%.

A good company with good prospects and an attractive price

In summary then, Robert Walters does have most of the features that I look for in an investment.

It has a long track record of relatively consistent inflation-beating dividend growth, it has had the same core business and business model for decades and the share price and dividend yield look attractive.

I would be more than happy to invest in this company at its current price. However, I have yet to pull the trigger because life is not that simple. My portfolio is already filled with equally attractive stocks and there are other equally attractive candidates on my watchlist.

All I can say for sure is that I would not be at all surprised to see Robert Walters in my portfolio before the end of the year.

Disclosure: PageGroup is a holding in my real-world portfolio and the UK Dividend Stocks Portfolio.

15/06/2023 Update: The day after I published this post, Robert Walters issued a somewhat negative quarterly trading update, which is understandable given the weak economic backdrop. The share price immediately fell by 12%, from around £4.60 to £4.06. I was asked for my opinion on this, so here it is:

When I invest, I'm trying to think about the next ten years because I could easily hold a company's shares for that long. One quarterly update is 1/40th of that period, which should give you an idea of how unimportant most quarterly updates are. In this case, Robert Walters is a cyclical business, so it is no surprise to see its revenues and earnings fall during a downturn. That's why this latest quarterly update has no material impact on my analysis or opinion of the company.

With the share price now almost identical to my target buy price, the company's margin of safety score is almost 100%, which means I'm more likely to invest sooner rather than later, not less likely.

The UK Dividend Stocks Newsletter

Helping UK investors build high-yield portfolios of quality dividend stocks since 2011:

- ✔ Follow along with the UK Dividend Stocks Portfolio

- ✔ Read detailed reviews of buy and sell decisions

- ✔ Quarterly, interim and annual updates for all holdings

- ✔ Quality Dividend Watchlist and Stock Screen

Subscribe now and start your 30-DAY FREE TRIAL

UK Dividend Stocks Blog & FREE Checklist

Get future blog posts in (at most) one email per week and download a FREE dividend investing checklist:

- ✔ Detailed reviews of UK dividend stocks

- ✔ Updates on the UK Dividend Stocks Portfolio

- ✔ UK stock market valuations

- ✔ Dividend investing strategy tips and more

- ✔ FREE 20+ page Company Review Checklist

No spam. Unsubscribe anytime.