Beazley is a FTSE 100 specialist insurer that covers complex, changing and emerging risks, including natural disasters, exploding rockets and cybercrime.

As an insurer of relatively unpredictable and occasionally catastrophic events, Beazley’s financial results are inherently volatile and that shows up in its share price, which has swung back and forth between £3.00 and £6.00 over the last eight years.

Although Beazley’s share price has been volatile, its intrinsic value (the value of the business based on its expected long-term dividends) has remained relatively stable, and this has thrown up several attractive buying opportunities.

For example, when the pandemic appeared in early 2020, it was obvious that Beazley was going to be hit by significant claims for things like cancelled trade events. That made investors nervous and Beazley's share price fell from £6.05 in early 2020 to about £3.00 in mid-2021.

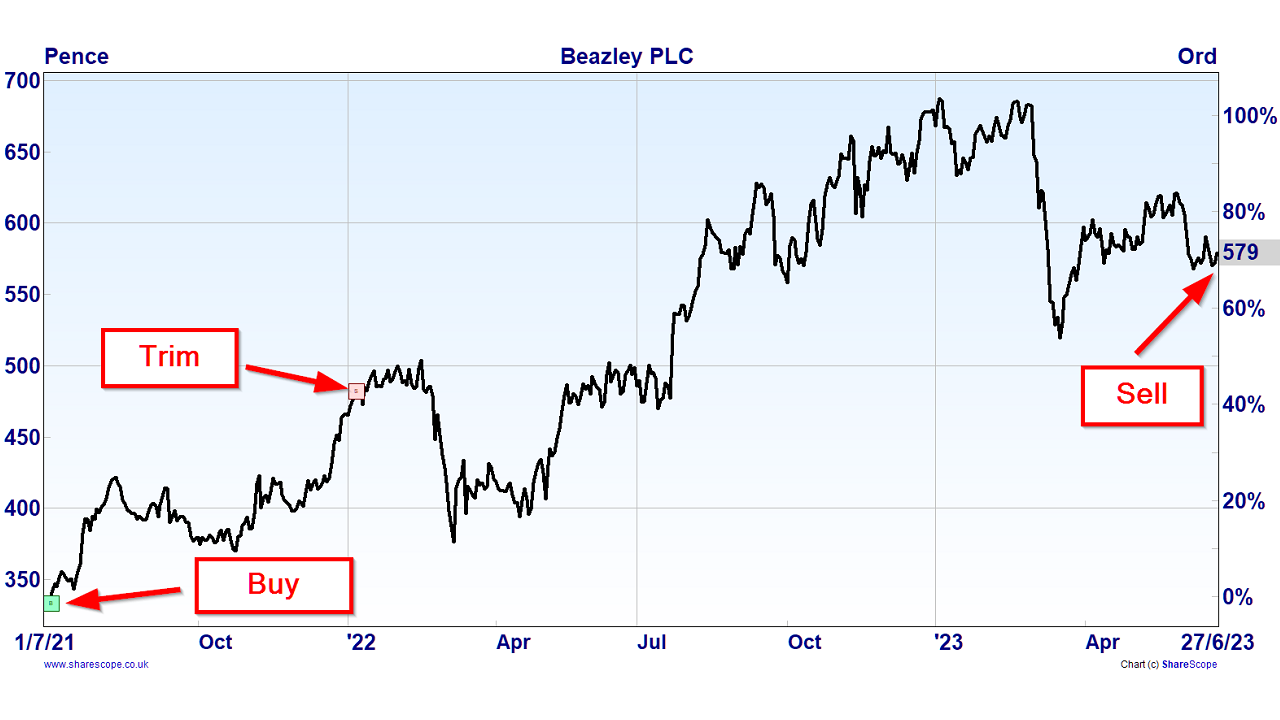

Beazley's dividend was suspended for a while, but I thought the share price decline was probably overdone, so I added Beazley to my UK dividend portfolio at £3.34 in July 2021.

As I'd hoped, the dividend was soon reinstated and pandemic-related claims weren’t nearly enough to sink the company. Investors gradually became more confident and Beazley’s share price quickly recovered to more than £6.00 by late 2022.

Although I missed the opportunity to sell at a higher share price a few months ago, I have now decided to sell my shares and the headline results from this investment are very satisfactory.

The total return after two years was 39% or 27% annualised, although of course luck is always an important factor when annualised returns are north of 20%.

However, it wasn't all down to luck, so in the rest of this post I’ll explain why I still think Beazley is a quality dividend stock, why I've sold and why I'd be happy to reinvest at the right price.

You can also download PDF versions of my original buy and sell reviews, taken from the UK dividend stocks newsletter:

Table of contents

- Beazley is a leading global specialist insurer

- The core business and growth strategy have been stable for decades

- Financial results in recent years have been underwhelming

- The balance sheet remains strong

- Beazley's competitive advantage is its culture

- Specialist insurance is a high-growth industry

- There are no obvious speed bumps ahead

- Estimating a fair price for Beazley’s shares

- Does Beazley’s share price have sufficient upside?

Beazley is a leading global specialist insurer

Related post: How to find quality dividend stocks with enduring core businesses

High-quality companies almost always have highly focused core businesses.

In Beazley's case, it describes itself as “a leading global specialist insurer, bringing an innovative and progressive approach to solving the challenges of the insurance market”.

Specialist insurers cover risks that are complex, changing or emerging, so unlike car insurance, these risks cannot be insured using a high-volume cookie-cutter approach. Instead, experienced underwriters with deep expertise must draw conclusions based on what limited data is available.

Beazley operates through five divisions, which I've listed below with their contribution to last year’s net premium:

- Speciality Risks (37%): Covers a wide array of complex business-related risks, including risks around company directors, mergers and acquisitions, the environment and the life sciences industry.

- Cyber Risks (22%): Provides an ecosystem of services to help organisations reduce their exposure to cyber-attacks. For example, Beazley helps clients improve their cyber security to reduce the risk of an attack and it helps them respond to security breaches more effectively, mostly through its wholly-owned cybersecurity firm, Lodestone.

- MAP Risks (21%): Covers a wide range of marine, aviation, political, personal accident and contingency risks. For example, Beazley helps insure around 20% of the world’s ocean-going tonnage and it also covers companies against terrorism and political violence.

- Property Risks (16%): Mostly insures commercial property against natural disasters such as hurricanes, tornadoes, earthquakes and floods. It also handles Beazley’s reinsurance business, where it covers excess property catastrophe risk for other insurers.

- Digital (4%): Acts as a distribution platform for the other four divisions, giving small and medium-sized businesses access to Beazley’s underwriting skills through digital platforms.

Beazley is a complicated business that writes many different types of insurance covering many different types of risk. However, underneath all of its different divisions and all of those different policies and risks is a highly focused core business that revolves around identifying and insuring complex, changing and emerging risks.

The core business and growth strategy have been stable for decades

Beazley was founded in 1986 by Andrew Beazley, Robert Hiscox and Nick Furlonge, with little more than a borrowed computer, a battered hat stand and an office that looked like a broom cupboard. All three founders were experienced specialist underwriters and Beazley has been a specialist insurer from the very beginning, almost 40 years ago.

In addition to having a stable core business, Beazley has had a very consistent and stable growth strategy for many years, with four pillars:

Growth Pillar 1 - Organic growth is preferable to acquisitive growth: Beazley is a people business and organic growth is better for attracting, retaining and developing the best people. It gives them more career opportunities and it avoids diluting Beazley’s carefully nurtured entrepreneurial culture with lesser cultures from other companies.

Growth Pillar 2 - Growth should emphasise value over volume: In other words, underwriters shouldn’t try to write more insurance by lowering profit margins. Instead, insurance should only be offered where the premium is sufficient to provide high levels of expected profitability.

The discipline to only write highly profitable insurance sometimes forces Beazley to reduce its market share in markets where premiums are unacceptably low. For example, the property insurance market was unattractively priced for much of the last decade, so Beazley stuck to its principles and shrank its property book, even though it was one of the company’s largest and most important markets.

Focusing on profitability is good, but being willing to reduce market share can make profits more volatile. To offset this risk, Beazley offers insurance across a wide range of markets which smooths out the ups and downs of any one market.

Growth Pillar 3 - Expand internationally: Beazley mostly writes insurance through international insurance hubs like Lloyd’s of London, so geographic expansion usually means dealing with new brokers and new clients in new countries, rather than setting up overseas offices. That isn’t always the case though, and Beazley does have offices in several countries, notably the US.

Geographic expansion has left Beazley with a globally diverse footprint, with 55% of its premiums covering clients in the US, 21% in Europe and 24% in the rest of the world.

Growth Pillar 4 - Grow through innovation: Specialist insurers cover risks that are complex, changing and emerging, but non-specialist insurers will gradually learn more about these risks as more claims occur. This can lead to commoditisation, where general insurers can cover these risks at higher volumes with lower prices. This forces specialist insurers to look for new risks that are complex, changing or emerging, and this is where innovation comes in.

Beazley is committed to being innovative and has developed and commercialised many firsts, including the first cyber catastrophe bond, the first ESG Lloyd’s syndicate and the first commercial insurance for lunar exploration.

Financial results in recent years have been underwhelming

Related post: How to identify stocks with high-quality dividend growth

Related post: Find quality dividend stocks using these profitability ratios

Financial performance is one area where Beazley earns itself a Yellow Flag.

As an insurer and, in particular, a catastrophe insurer, Beazley exists to de-risk society by acting as a shock absorber when very bad things happen. This is noble, but it can also be costly if an unexpected number of bad things happen in a short period of time, which has been the case in recent years.

For example, in 2017 Beazley was hit by three hurricanes, major wildfires in California and an earthquake in Mexico. In 2018 there were two hurricanes, two typhoons and more wildfires in California. In 2019 there was one hurricane and two typhoons and in 2020 and 2021 we had the pandemic. There is now a war in Europe and none of this is good for insurers like Beazley who insure clients against catastrophes.

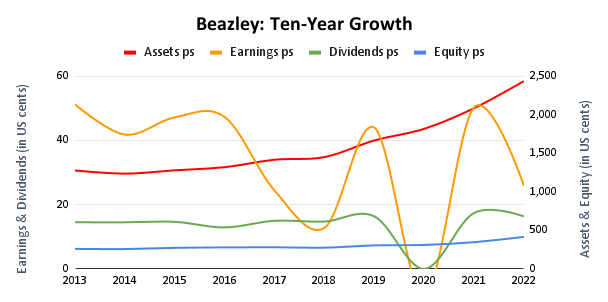

Data source: SharePad

Unsurprisingly, Beazley’s earnings have been alarmingly volatile over the last five years or so. However, the company’s assets, which are mostly claim reserves (premiums put aside to cover the cost of future claims), have grown consistently by about 7% per year, and this reflects the company’s steadily growing book of insured risks. More insured risks mean more potential earnings, at least in a quiet year, so in terms of potential earnings, Beazley has definitely made solid progress.

However, despite that underlying progress, Beazley hasn't produced consistent earnings or dividend growth over the last decade and that's why I've given it a Yellow Flag warning.

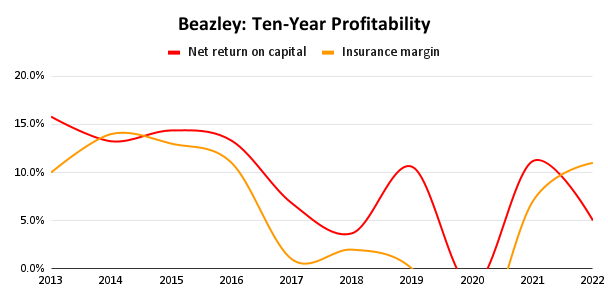

In terms of profitability, the recent string of catastrophes has also had a materially negative impact.

Data source: SharePad

Beazley's net return on capital averaged 9% over the last decade, which is below my minimum acceptable threshold of 10%. Insurance profit margins (the inverse of the combined ratio) averaged 6%, which is above my minimum threshold of 5%, but only just. Even worse, since 2017, both net returns on capital and insurance margins have been consistently below what I consider to be acceptable levels.

This is enough to earn Beazley another Yellow Flag. However, I don't think this warrants a Red Flag as these poor results were, in my opinion, caused by an unusual string of catastrophes rather than any inherent weakness in Beazley's capabilities.

However, I don’t want to view the company through rose-tinted glasses, so if Beazley fails to materially improve its profitability and growth within the next few years then I would no longer consider it a quality business.

The balance sheet remains strong

Related post: How to avoid dividend traps with excessive debts

Insurers have highly leveraged balance sheets because they have large assets (claim reserves, i.e. premiums put aside to cover future claims) and large liabilities (the expected cost of future claims) compared to a relatively small amount of shareholder equity.

Claim reserves should exceed claim liabilities and regulators insist that insurers maintain a sufficient margin of safety between the two. This margin of safety is known as regulatory capital, which is a buffer that should be able to absorb the cost of excess claims even during a one-in-two-hundred-year disaster.

All well-run insurers maintain a capital buffer that is significantly thicker than the regulatory minimum. Here’s my rule of thumb:

Rule of thumb: Only invest in an insurer if its solvency ratio (the ratio of regulatory capital to the regulatory minimum) is at least 150%

In Beazley’s case, the picture is slightly more complex as it must meet a Lloyd’s-specific regulatory minimum which already includes a 35% margin of safety. Relative to that requirement, Beazley has maintained a solvency ratio of 130%, which is effectively 165% when that additional margin of safety is taken into account, so Beazley’s balance sheet appears to be well capitalised.

Beazley also carries just over £600 million of debt on its balance sheet, in the form of lease liabilities and unsecured borrowings that are used as a supplementary form of capital. This gives the company a debt to average earnings ratio of 3.4, which is below my threshold of 4.0 for cyclical businesses. On that basis, I have no issues with Beazley's balance sheet.

Rule of thumb: Only invest in a cyclical business if its debt to average earnings ratio is below 4.0

Beazley's competitive advantage is its culture

Enduring great businesses (as defined by Jim Collins, author of Good to Great) tend to be companies that are set up by genius founders who, over several decades, manage to embed their genius deep within the processes and accepted norms of their company.

I think Beazley is one of those businesses, which means its main competitive advantage is its culture.

For example, enduring great companies are built to last, so they usually grow their own leaders in order to perpetuate their all-important culture. In Beazley's case, in 40 years it has had just three CEOs: Co-founder Andrew Beazley and two long-time employees (Beazley's current CEO and CFO joined the company 22 and 17 years ago, respectively).

Enduring great companies also tend to focus on a narrow market where they can be the best in the world and they apply the same basic business model and growth strategy for decades. Both of those are true of Beazley.

These companies are also innovative, but they never put short-term profits or rapid growth ahead of sustainable long-term growth, and that applies to Beazley as well.

Most importantly, they realise that the company itself is the ultimate "product" and they focus as much on building a great company as they do on providing great products and services.

These boxes are surprisingly hard to tick on a consistent basis, but Beazley has managed to do just that throughout its near-40-year history and because of that, it has all the hallmarks of an enduringly great business.

Specialist insurance is a high-growth industry

As well as investing in high-quality companies, I also want those companies to operate in growing markets.

In this case, the specialist insurance industry is expected to grow by around 10% per year over the next decade, thanks to the global economy’s increasing size and complexity. Even better, the market for cyber insurance (where Beazley is a market leader) is expected to grow by more than 20% per year over the next decade, leaving Beazley well-placed for future growth.

That is good news, but Beazley’s ability to scale up its cyber insurance business is constrained by its need to maintain a diverse portfolio of risks, without excessive exposure to any single catastrophic event (such as a new type of ransomware that infiltrates thousands of companies at once). Fortunately, the property market has recently become much more attractive as climate change makes floods, forest fires and other risks harder to calculate, and that plays into Beazley’s hands.

The company’s current plan is to scale up both the Cyber Risks and Property Risks divisions at a similar pace, which could fuel strong growth over the next few years while allowing Beazley to maintain a sufficient degree of diversification.

There are no obvious speed bumps ahead

In the short-term, Beazley is firing on all cylinders and key markets have definitely swung in its favour over the last year or so. Net earned premiums (after reinsurance) are up 34% over the last two years and in the first quarter of 2023, net premiums were up 24% over the previous year.

Beazley also expects high growth in Cyber Risks and Property Risks over the next few years, and in the first quarter of 2023, gross premiums (before reinsurance) for these divisions were up 24% and 56% respectively.

As for the current economic downturn, I don’t think it’s likely to pose any major problems because specialist insurance only has a limited correlation with the broader economy. In other words, cyber-attacks and hurricanes happen just as often during economic busts as they do during booms.

Having said all that, the short-term future isn't entirely rosy. Beazley’s claim reserves are partially invested in bonds and there was a significant paper loss when bond prices fell last year. However, these bonds are typically held to maturity so any paper losses are expected to reverse as the market value of these bonds converges with their face value as they near maturity (known as pull to par).

Looking beyond the short-term future, Beazley is an established and very successful player in markets that are expected to grow faster than the overall global economy for at least the next decade. The company has proven over multiple decades that its finely honed approach enables it to expand market share in existing markets, expand geographically and expand through innovation into entirely new markets.

All of that gives me a reasonable degree of confidence that Beazley is very likely to grow its premiums, earnings and dividend over the next ten years.

Estimating a fair price for Beazley’s shares

Related post: Estimating fair value based on future dividends

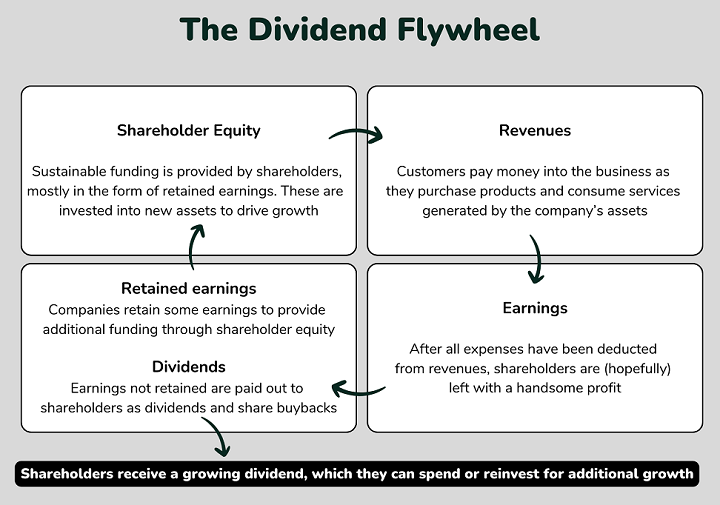

A company’s intrinsic value or fair value is equal to the sum of all the cash it will return to shareholders between now and the end of time, discounted by an annual rate that takes account of the time value of money.

In practice, we can estimate a company's fair value using a discounted dividend model, which involves estimating future earnings and dividends and choosing an appropriate discount rate (and entering all of that into an investment spreadsheet).

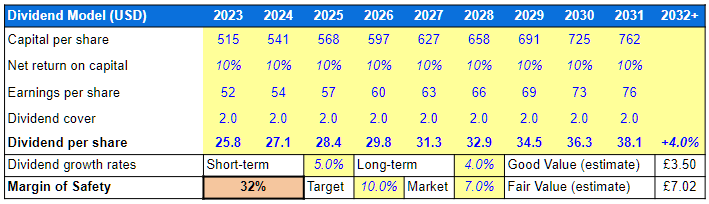

Here's my dividend model for Beazley with a detailed explanation below (note that Beazley's reporting currency is USD, so the values in the table are in US cents).

Building a dividend model using bottom-up assumptions

Dividend models are built from assumptions about the future and I always start with bottom-up assumptions that focus on the company and the financial fundamentals that drive its dividend flywheel.

The launching point is always last year's capital (debt and equity), which in this case was 515 cents per share.

I then estimated Beazley's future earnings by estimating its future return on capital at 10%, which is in line with the company's historical performance.

I then estimated Beazley's future dividends by estimating its future dividend cover at 2.0. That's slightly higher than the average dividend cover over the last decade, but that period was impacted by an unusual number of disasters that lowered Beazley's earnings and, therefore, its dividend cover. Looking at dividend cover over multiple decades shows that a dividend cover of around two has been more typical, so that's the figure I went with.

These assumptions produce an estimated 2023 dividend of 25.8 cents and a medium-term dividend growth rate of 5% per year to 2031.

At this point, there are two aspects of the model that may raise some eyebrows.

First, the model shows Beazley's earnings growing progressively each year, but in reality, Beazley has volatile earnings, so the model doesn't appear to be realistic.

That's true, but the model's earnings do not represent an estimate of what Beazley's actual earnings will be in any given year. Instead, the model shows the expected value of Beazley's future earnings, where the expected value is a probability-weighted average of all possible outcomes.

In other words, if there are no disasters in 2023 then Beazley might earn 100 cents per share, but if it sees large claims relating to yet more record wildfires, floods and heatwaves, it might only earn 20 cents. If each possible outcome is equally likely, the expected value of Beazley's earnings would be a simple average of those two outcomes, i.e. 60 cents per share.

So although Beazley's actual earnings will inevitably be volatile, I assume that the expected value of its future earnings will increase steadily as the company progressively insures more risks and writes more premiums each year.

The second issue with the model is the size of the 2023 dividend, which at 25.8 cents is significantly larger than the recently paid 2022 dividend of 16.3 cents.

That dramatic increase in the dividend reflects the fact that Beazley has historically paid occasional special dividends. As it is impossible to know when the next special dividend will appear, the model simply assumes that occasional special dividends will be replaced by a consistently larger ordinary dividend. The model's dividend cover of 2.0 has been set at a level that reflects the long-term historical norm for dividend cover, including special dividends.

To complete the model, my final assumption is that Beazley can maintain a long-term growth rate of 4% after 2031. That is above the expected 2-3% long-term growth rate of the global economy because Beazley is an internationally diverse business with plenty of room for expansion in high-growth markets.

Turning from bottom-up to top-down assumptions

Bottom-up assumptions should be complemented by top-down assumptions that focus on real-world factors outside of the company, such as the amount of market share left to go after and the core market's overall growth rate.

In Beazley's case, the specialist insurance market is extremely broad and Beazley has a relatively small share in many different markets, many of which are expected to grow relatively quickly for at least the next decade. It also has a significant footprint in the cyber insurance market, which is expected to grow at double-digit rates over the next decade. Beazley also has a long and proven track record of taking market share in existing markets and pioneering and growing into new markets.

Given all of that, I think it's unlikely that top-down factors will constrain Beazley's growth rate to less than my model's 5% growth rate, so I don't think the model needs to be tweaked to take account of top-down factors.

Estimating Beazley's fair value

With Beazley's future dividends estimated out until the end of time, the last step is to discount those future dividends in order to estimate the company's fair value.

To estimate fair value, I use a discount rate of 7% per year, which is the UK stock market’s long-term average return. That gives Beazley a fair value estimate of £7.02 per share and that is my target sell price.

To calculate my target buy price, I discount those dividends by 10% per year, which is my target rate of return. This gives Beazley a good value estimate of £3.50, and that's the price I would happily reinvest at.

Does Beazley’s share price have sufficient upside?

When I purchased Beazley in 2021, its share price was £3.34. That was comfortably below my fair value estimate at the time of £5.67.

The dividend had been suspended because of the pandemic, but based on the prior year’s dividend the yield would have been 4%. At that price, I thought investors were probably being overly pessimistic about the pandemic’s long-term effects.

At the beginning of July 2023, Beazley’s share price stood at £5.89. That was fairly close to my latest fair value estimate of £7.02, leaving Beazley with a relatively thin margin of safety between its current market value and my estimate of fair value.

In fact, the upside to my target sell price was only 19%. In other words, if Beazley’s share price increased by 19%, it would be no more attractive than an investment in the FTSE All-Share, at least according to my model.

To give you some context, I prefer my investments to have at least 50% upside and preferably more than 100%. This should produce both higher returns and a wider margin of safety in case my fair value estimate is too high.

With an estimated upside of just 19%, Beazley was far less attractively valued than many of my portfolio’s other holdings, and that’s why I decided to sell at the beginning of July.

The investment produced a total return of 39% over two years or 26.6% annualised (the annualised figure is unusually high because I trimmed the position after it gained 40% in its first six months).

There is obviously a lot of luck involved when the annualised return is north of 20% per year, but investing is hard enough, so I’ll accept whatever luck I can get. But luck aside, the low starting valuation and the quality of Beazley's business were definitely the most important factors.

I have already used the proceeds to top up three other holdings, all of which have much higher dividend yields and significantly larger upsides to my estimated fair values.

If Beazley's share price falls back towards £3.50 then I would gladly consider reinvesting, but for now, it has been moved to my Watchlist.

The UK Dividend Stocks Newsletter

Helping UK investors build high-yield portfolios of quality dividend stocks since 2011:

- ✔ Follow along with the UK Dividend Stocks Portfolio

- ✔ Read detailed reviews of buy and sell decisions

- ✔ Quarterly, interim and annual updates for all holdings

- ✔ Quality Dividend Watchlist and Stock Screen

Subscribe now and start your 30-DAY FREE TRIAL

UK Dividend Stocks Blog & FREE Checklist

Get future blog posts in (at most) one email per week and download a FREE dividend investing checklist:

- ✔ Detailed reviews of UK dividend stocks

- ✔ Updates on the UK Dividend Stocks Portfolio

- ✔ UK stock market valuations

- ✔ Dividend investing strategy tips and more

- ✔ FREE 20+ page Company Review Checklist

No spam. Unsubscribe anytime.